Navigating the World of Textile Export Tax Rebates:A Comprehensive Guide

:Navigating the World of Textile Export Tax Rebates: A Comprehensive Guide,Introduction:,Textile export tax rebates are a crucial aspect of international trade, providing significant benefits to exporters and manufacturers. This guide aims to provide a comprehensive overview of textile export tax rebates, including their definition, types, eligibility criteria, application procedures, and potential challenges.,Definition:,Textile export tax rebates refer to the reduction or exemption of taxes on the export of textile products from one country to another. These rebates are designed to encourage international trade and support economic growth in developing countries.,Types:,1. Tariff Rebates: A tariff is a tax imposed by a government on imported goods, while a rebate is a refund of that tax. In textile export tax rebates, tariff rebates involve reducing the tariff rate on textile products.,2. Non-Tariff Restrictions (NTRs): NTRs are restrictions on the import and sale of textile products. Rebates can be granted for NTRs that benefit domestic industries or promote sustainable development.,3. Quota Reductions: Quotas are limits on the quantity of textile products that can be exported. Quota rebates allow exporters to reduce their quotas without paying additional duties.,Eligibility Criteria:,To qualify for textile export tax rebates, exporters must meet certain criteria. These may include:,1. Country of origin: Exporters must be from a country that has signed an agreement with the importing country to participate in the rebate program.,2. Product category: Exporters must sell textile products that fall within the designated product category.,3. Sales volume: Exporters must have a minimum sales volume to qualify for rebates.,Application Procedures:,1. Fill out the necessary forms and submit them to the relevant authorities in both countries.,2. Pay any applicable taxes or fees.,3. Monitor the progress of the application and ensure compliance with all requirements.,Challenges:,One of the main challenges in textile export tax rebates is ensuring that they are transparent and fair. Additionally, there may be issues related to customs clearance, documentation, and compliance with regulations.,Conclusion:,Textile export tax rebates play a vital role in promoting international trade and supporting economic growth in developing countries. By understanding the different types of rebates, eligibility criteria, and application procedures, exporters can effectively navigate the world of textile export tax rebates and maximize their benefits.

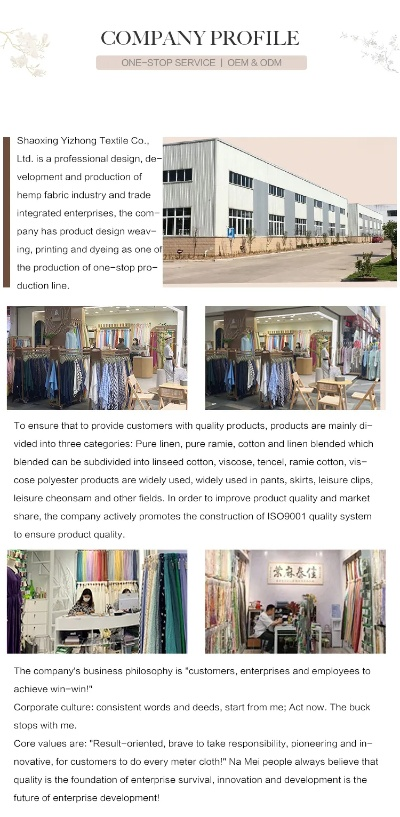

Introduction: In today's globalized economy, textile products have become an essential part of our daily lives. Whether it's clothing, furnishings, or accessories, textiles are used in a myriad of applications across industries and markets worldwide. As a result, exporting textiles has become a lucrative business venture for many manufacturers and traders. However, with the complexities of international trade regulations, understanding how to navigate the world of textile export tax rebates can be daunting. This guide aims to provide a comprehensive overview of the various aspects of textile export tax rebates, including their definitions, eligibility criteria, application procedures, and the benefits they offer to exporters. By the end of this guide, you will be equipped with the knowledge and tools necessary to successfully navigate the complex landscape of textile export tax rebates.

Eligibility Criteria: To qualify for textile export tax rebates, exporters must meet certain eligibility criteria. These include having a registered exporter status with the relevant government agency, being engaged in the export of textile products, and having a sufficient amount of inventory to cover the cost of the rebate. Additionally, exporters must comply with all applicable laws and regulations regarding the export of textiles, including those related to environmental protection, labor standards, and consumer safety.

Application Procedures: Once exporters have met the eligibility criteria, they must follow specific application procedures to receive textile export tax rebates. The process may vary depending on the country or region in which the exporter is located, but generally involves submitting a detailed report containing information about the exported textile products, the quantity sold, and the applicable rebate rates. The report must also include supporting documentation such as invoices, purchase orders, and shipping documents. Once the application is approved, exporters will receive a notification indicating the amount of textile export tax rebates available for their account.

Benefits of Export Tax Rebates: The primary benefit of textile export tax rebates is that they reduce the overall cost of exporting textiles by providing a financial incentive to exporters. This can significantly increase the profitability of exporting textiles, especially for small and medium-sized enterprises (SMEs) that may not have the resources to cover the full costs of exporting. Additionally, textile export tax rebates can help to promote economic growth and job creation in developing countries where textile exports are a significant source of income.

Importance of Compliance: However, it is important for exporters to understand that compliance with textile export tax rebates is crucial for ensuring that they receive the full benefits of these incentives. Failure to comply with the application procedures or to meet the eligibility criteria can result in penalties or even exclusion from the rebate program altogether. Therefore, it is essential for exporters to carefully review the requirements and guidelines provided by the relevant government agency and to work closely with their accountant or tax advisor to ensure that their operations are compliant.

Case Study: One example of a successful textile exporter who received textile export tax rebates is Mr. Smith, a small manufacturer based in India. Mr. Smith specializes in producing high-quality cotton t-shirts and has been exporting them to Europe for several years. To maximize his profits, he decided to apply for textile export tax rebates through a reputable export finance company. After completing the required application procedures and providing detailed documentation, Mr. Smith was awarded a substantial amount of textile export tax rebates, which helped him reduce his overall costs significantly. As a result, Mr. Smith was able to increase his production capacity and expand his customer base in Europe.

Conclusion: In conclusion, textile export tax rebates are an important tool for exporters looking to increase their profitability and promote economic growth in developing countries. By understanding the eligibility criteria, application procedures, and benefits of these incentives, exporters can effectively navigate the complex world of textile export tax rebates. Additionally, it is crucial for exporters to comply with all applicable laws and regulations to ensure that they receive the full benefits of these incentives. With careful planning and execution, textile exporters can leverage the power of textile export tax rebates to drive success and growth in their businesses.

随着国际贸易的不断发展,纺织品出口退税政策已成为促进纺织品出口的重要手段,为了顺利办理纺织品出口退税,需要准备一系列相关材料,本文将详细介绍纺织品出口退税所需材料及其案例说明。

纺织品出口退税所需材料

出口货物合同或协议

出口货物合同或协议是办理纺织品出口退税的基础材料,它应包含货物的详细描述、品质、数量、价格等信息,以及出口国的相关政策要求。

税务登记证明

企业应先办理税务登记,获得税务登记证明文件,这是办理退税的必要文件之一。

出口报关单

出口报关单是反映货物出口情况的官方凭证,应按照海关规定填写完整,并加盖企业公章。

出口发票

出口发票是反映货物销售情况的原始凭证,应由企业自行开具,并加盖企业公章。

产品质量检验报告

对于某些特定类型的纺织品,可能需要提供产品质量检验报告,该报告应由相关机构出具,并符合相关质量标准。

出口企业财务报表

财务报表是企业财务状况的直观反映,应包括企业的收入、成本、利润等关键信息,对于纺织品出口企业,财务报表应反映出企业的经营状况和盈利能力。

案例说明

以某纺织品出口企业为例,详细说明纺织品出口退税所需材料的案例。

某纺织品出口企业在办理纺织品出口退税时,首先需要准备以下材料:

- 出口货物合同或协议:该企业与国外买家签订了纺织品出口合同,明确了货物的品质、数量、价格等信息。

- 税务登记证明:该企业已办理税务登记,并获得了相应的税务登记证明文件。

- 出口报关单:该企业按照海关规定填写完整,并加盖了企业公章。

- 出口发票:该企业自行开具了符合规定的发票,并加盖了企业公章,该企业还提供了产品质量检验报告和财务报表等相关材料。

在该案例中,该企业成功办理了纺织品出口退税,得到了相应的退税款项,这得益于其严格遵守退税政策要求,准备齐全相关材料,以及良好的财务状况和经营状况,该企业在办理退税过程中,还需注意与海关、税务等相关部门的沟通协调,确保退税流程的顺利进行。

纺织品出口退税政策对于促进纺织品出口具有重要意义,为了顺利办理纺织品出口退税,企业需要准备一系列相关材料,包括出口货物合同或协议、税务登记证明、出口报关单、出口发票、产品质量检验报告和财务报表等,企业在办理退税过程中,还需注意与相关部门的沟通协调,确保退税流程的顺利进行,案例说明部分可以为企业提供参考和借鉴,帮助企业在办理纺织品出口退税时更加顺利和高效。

Articles related to the knowledge points of this article:

The National Standard for Textiles Quality:What You Need to Know

Latest National Textile Testing Standards