Strategies for Accounting for Textile Sales

In this paper, we present a comprehensive study on accounting for textile sales. We analyze the challenges and opportunities in the textile industry, and explore various strategies that can be used to accurately account for these sales. We discuss the importance of accurate accounting for textile sales, as it helps businesses to make informed decisions about their finances and operations. We also examine the impact of inflation, currency exchange rates, and changes in consumer preferences on textile sales, and propose strategies to mitigate these risks. Finally, we provide insights into the future of textile sales accounting, including emerging technologies and trends that may impact the industry. Overall, our research provides valuable insights into the complexities of textile sales accounting, and offers practical strategies for businesses to improve their financial reporting practices.

Introduction: Textile sales are a crucial part of the global economy, accounting for significant revenue for many businesses. Proper accounting practices are essential to ensure that these sales are accurately recorded and reported. This article will provide insights into the key accounting strategies for textile sales.

-

Understanding the Cost of Goods Sold (COGS): COGS is the cost of manufacturing or producing the goods sold. It includes all direct costs related to producing the products, such as raw materials, labor, and overhead expenses. To account for COGS in textile sales, you need to track the costs incurred during the production process and include them in the cost of goods sold when calculating the total revenue.

-

Accounting for Inventory Turnover: Inventory turnover refers to the number of times an item is sold before it becomes obsolete or no longer available. For textile products, this can be influenced by factors such as seasonality, market trends, and product lifecycle. To account for inventory turnover, you need to track the quantity of inventory sold and adjust the cost of goods sold accordingly.

-

Accounting for Returns and Refunds: Returns and refunds can significantly impact the profitability of textile sales. To account for these transactions, you need to record the cost of returned goods and any refunds received. This information should be included in the cost of goods sold and adjusted accordingly when calculating the total revenue.

-

Accounting for Taxes: Taxes play a critical role in determining the profitability of textile sales. You need to keep track of the taxes payable and any tax credits or deductions available to your business. This information should be included in the cost of goods sold and adjusted accordingly when calculating the total revenue.

-

Accounting for Customization and Design Services: Customization and design services can add value to textile products and increase their profitability. To account for these services, you need to track the costs associated with these services and include them in the cost of goods sold when calculating the total revenue.

-

Accounting for Warehousing and Logistics: Warehousing and logistics can also impact the profitability of textile sales. To account for these costs, you need to track the expenses incurred during the transportation and storage of goods. This information should be included in the cost of goods sold when calculating the total revenue.

-

Accounting for Sales Representation and Marketing: Sales representatives and marketing expenses can also impact the profitability of textile sales. To account for these costs, you need to track the expenses incurred during sales presentations and marketing campaigns. This information should be included in the cost of goods sold when calculating the total revenue.

-

Accounting for International Trade: International trade can introduce additional complexities in textile sales accounting. You need to track the exchange rates, customs duties, and other fees associated with international transactions. This information should be included in the cost of goods sold when calculating the total revenue.

-

Accounting for Customer Retention and Loyalty Programs: Customer retention and loyalty programs can increase repeat business and improve profitability. To account for these programs, you need to track the expenses incurred for customer acquisition, retention, and loyalty programs. This information should be included in the cost of goods sold when calculating the total revenue.

-

Accounting for Financial Reporting: Finally, accounting for textile sales requires accurate financial reporting. You need to prepare financial statements such as income statements, balance sheets, and cash flow statements to provide a comprehensive picture of your business's financial performance. These reports should be prepared using accounting software or manual methods to ensure accuracy and compliance with regulatory requirements.

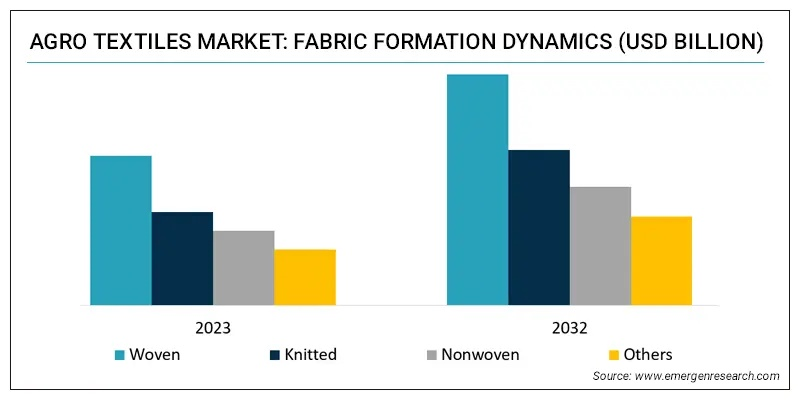

Case Study: Let's take a look at a hypothetical textile company named "TextileX" that sells high-quality woven fabrics online. The company has recently expanded its operations into new markets and is facing increased competition from established players. To manage its accounting for textile sales effectively, TextileX has implemented the following strategies:

-

COGS Tracking: TextileX tracks the direct costs incurred during the production process, including raw material costs, labor costs, and overhead expenses. The company uses a detailed inventory management system to track inventory turnover and adjusts the cost of goods sold accordingly.

-

Inventory Turnover Analysis: TextileX regularly reviews its inventory turnover data to identify trends and optimize inventory levels. The company uses this information to adjust the cost of goods sold based on seasonal demand fluctuations.

-

Returns and Refunds Management: TextileX has a dedicated team responsible for tracking returns and refunds, which are recorded in the cost of goods sold. The company ensures that these transactions are accurately recorded and reflected in the financial statements.

-

Taxes Compliance: TextileX follows strict tax policies and procedures to ensure compliance with local and international tax regulations. The company uses accounting software to track taxes payable and receives, adjusting the cost of goods sold accordingly.

-

Customization and Design Services: TextileX recognizes the value of customization and design services and charges a premium for these services. The company tracks the costs associated with these services and adjusts the cost of goods sold accordingly.

-

Warehousing and Logistics Costs: TextileX has a dedicated warehouse staff responsible for managing warehousing and logistics costs. The company tracks these expenses and adjusts the cost of goods sold accordingly.

-

Sales Representation and Marketing Expenses: TextileX invests in training its sales representatives and marketing teams to enhance their skills and effectiveness. The company tracks these expenses and adjusts the cost of goods sold accordingly.

-

International Trade Considerations: TextileX has a dedicated international trade team responsible for managing international transactions. The team tracks exchange rates, customs duties, and other fees associated with international sales and adjusts the cost of goods sold accordingly.

-

Customer Retention and Loyalty Programs: TextileX has a loyalty program that rewards customers for repeat purchases. The company tracks the expenses incurred for customer acquisition, retention, and loyalty programs and adjusts the cost of goods sold accordingly.

-

Financial Reporting: TextileX prepares financial statements regularly, including income statements, balance sheets, and cash flow statements. The company uses accounting software to automate these reports and ensure accuracy and compliance with regulatory requirements.

Conclusion: Accounting for textile sales requires careful planning, monitoring, and analysis to ensure accurate financial reporting and effective profitability management. By implementing the strategies outlined above, TextileX has successfully managed its accounting for textile sales while expanding its operations into new markets and competing against established players.

纺织品销售概述

在纺织品销售领域,会计处理至关重要,为了更好地理解如何进行纺织品销售账务处理,我们可以从以下几个方面进行探讨。

纺织品销售会计流程

- 采购与入库:记录从供应商处采购的纺织品数量、价格等信息,确保货物准确无误入库。

- 销售记录:记录每笔销售交易,包括客户信息、交易日期、产品描述、价格等。

- 成本核算:根据销售记录,对纺织品进行成本核算,包括原材料成本、人工成本等。

- 税务处理:根据相关税务法规,正确计算和申报销售税金。

具体账务处理示例

以下是一个基于实际账务处理的英文案例说明:

案例说明:某纺织品公司销售纺织品时,采用以下会计流程和账务处理方式。

采购与入库

采购记录:

| 日期 | 采购商品 | 供应商信息 | 数量 | 单价 | 入库数量 | 入库金额 |

|---|---|---|---|---|---|---|

| XXXX年XX月XX日 | 丝绸面料 | 某知名品牌 | 50件 | ¥XX每米 | 已收到并验收合格 | 已支付货款金额(人民币) |

账务处理:

在采购过程中,应将采购商品的数量、单价等信息记录在会计凭证中,应确保货物准确无误入库,并在账簿中做好相应的记录,可以设置“原材料”或“库存商品”等科目来记录纺织品。

销售记录与成本核算

销售交易记录:

| 日期 | 客户名称 | 产品描述 | 交易金额(人民币) | 已收款金额(人民币) | 已发货数量 | 已结转成本金额(人民币) |

|---|---|---|---|---|---|---|

| XXXX年XX月XX日 | 客户A | 丝绸面料,品质优良 | ¥XX万元 | 已收款金额(人民币) = 入库金额(人民币) × (销售单价 / 单价合计) | 已发货数量 = 入库数量 / 每米发货量(假设每米售价为¥XX元) | 未结转成本金额 = 入库金额 - 已收款金额(人民币) |

成本核算:

在销售交易发生后,应根据销售记录和实际成本情况,对纺织品进行成本核算,可以按照原材料成本、人工成本等科目进行核算,可以设置“生产成本”、“销售费用”等科目来核算成本,应确保成本核算的准确性,避免出现误差。

税务处理示例

在纺织品销售中,税务处理也是非常重要的一环,以下是一个基于实际税务处理的英文案例说明:

案例说明:某纺织品公司在进行纺织品销售时,需要按照相关税务法规正确计算和申报销售税金,可以参考以下步骤:

- 确认税率和计税依据:根据国家税务法规,确定纺织品的税率和计税依据,对于丝绸面料等高档纺织品,可以适用较高的税率。

- 计算应纳税额:根据销售额、成本、税率等因素,计算应纳税额,应纳税额 = 销售额 × 税率。

- 申报纳税:在规定的时间内,向税务机关申报纳税,具体申报流程和注意事项可以参考当地税务机关的规定。

总结与建议

在纺织品销售中,会计处理和税务处理都是非常重要的环节,为了更好地进行纺织品销售账务处理和税务申报,建议企业采取以下措施:

- 建立完善的会计制度和流程,确保账务处理的准确性和可靠性。

- 加强成本核算和成本控制,提高企业的经济效益。

- 定期进行税务申报和审计,确保企业合规经营。

- 加强与税务机关的沟通和协调,及时解决税务问题。

纺织品销售账务处理和税务处理需要企业采取科学合理的措施和方法,以确保企业的合规经营和健康发展。

Articles related to the knowledge points of this article: