The Basics of Textile Insurance Coverage

Textile insurance, also known as textiles insurance or textile goods insurance, is a type of property insurance that covers the loss, damage, or theft of textile products such as clothing, carpets, and other fabric items. This coverage is essential for businesses that rely heavily on textiles, as it can help them recover from losses caused by natural disasters, fires, theft, or other events.,The basics of textile insurance coverage include:,1. Definition of Coverage: Textile insurance typically covers all forms of damage to textiles, including physical damage caused by fire, flood, or other hazards, as well as damage due to wear and tear.,2. Limitations: While textile insurance may cover many types of damage, there may be limitations on coverage based on factors such as the value of the textiles in question, the amount of coverage purchased, and the specific terms of the policy.,3. Claims Process: Claims for textile insurance should be filed within a certain time frame, and the claimant must provide evidence of the damage or loss in order to receive compensation.,4. Deductibles: Many policies come with an deductible, which is the amount of money the insured must pay out of pocket before receiving any coverage.,5. Replacement Cost: In some cases, textile insurance may cover the cost of replacing damaged textiles with new ones.,Overall, textile insurance is an important tool for protecting businesses from the financial impact of unexpected losses caused by natural disasters or other events.

Introduction Textiles are an essential part of our lives, from everyday wear to luxurious fabrics for clothing and home decor. However, like any other commodity, textiles can be subject to theft, damage, or loss due to various reasons. To protect your investment in textiles, it's important to understand the basics of textile insurance coverage. In this article, we will explore the different types of textile insurance policies, their benefits, and how to choose the right one for your needs.

Types of Textile Insurance Policies There are several types of textile insurance policies available, each designed to cover different risks associated with textiles. Here are some of the most common types:

-

Physical Loss Insurance: This policy covers losses caused by physical damage to textiles such as tearing, fraying, and shrinkage. It also includes coverage for damage caused by fire, smoke, or explosion.

-

Contents Insurance: This policy is designed to protect your textiles against theft or damage while they are in storage or on display. It may include coverage for items that are lost or stolen, as well as replacement costs if the item cannot be replaced.

-

General Liability Insurance: This policy provides coverage for legal claims arising from incidents related to your textile business. It may include coverage for property damage, personal injury, or advertising-related claims.

-

Extended Warranty Insurance: This policy offers additional protection beyond what is provided by the manufacturer's warranty. It may include coverage for defects in materials, workmanship, or performance during the warranty period.

Benefits of Textile Insurance Insurance can provide several benefits for textile businesses, including:

-

Compensation for Damage or Loss: If your textiles are damaged or lost due to an insured event, you can receive compensation for the cost of repairing or replacing them.

-

Legal Protection: Insurance can provide legal protection against legal claims arising from incidents related to your textile business.

-

Peace of Mind: Knowing that your textiles are covered in case of an accident or disaster can give you peace of mind knowing that you have financial security in case of unexpected events.

Choosing the Right Textile Insurance Policy When choosing a textile insurance policy, it's important to consider the following factors:

-

Risk Level: Determine the level of risk associated with your textile inventory. High-risk items may require more comprehensive coverage than lower-risk items.

-

Budget: Set a budget based on your finances and determine which coverage fits within that limit.

-

Needs: Consider your specific needs and choose a policy that meets those needs. For example, if you frequently ship textiles internationally, you may need additional coverage for international shipments.

-

Comparison: Compare different policies from different insurers to find the best fit for your needs and budget.

Case Study: The Importance of Textile Insurance in a Fashion Company Let's take a look at a real-life example of the importance of textile insurance in a fashion company. Imagine a fashion company that specializes in high-quality fabrics for clothing and accessories. The company has a large inventory of fabrics that are used in its products, which can be subject to theft or damage.

To protect their investment in textiles, the company decided to purchase a textile insurance policy. The policy covered losses caused by physical damage, content insurance for stolen or damaged items, general liability insurance for legal claims related to its business operations, and extended warranty insurance for defects in materials or workmanship during the warranty period.

By taking out a textile insurance policy, the fashion company was able to receive compensation for any losses caused by accidents or natural disasters. They also felt confident that they had financial security in case of unexpected events, such as theft or damage to their inventory. Additionally, the company was able to minimize its exposure to legal claims related to its business operations by having a policy that covered all necessary aspects of its operation.

Conclusion Textile insurance is an essential tool for protecting your investment in textiles. By understanding the different types of policies available and their benefits, you can make an informed decision about which policy is right for your business. Remember that investing in textile insurance can provide peace of mind, financial security, and legal protection for your business. So don't hesitate to explore your options and choose the right policy for your needs today!

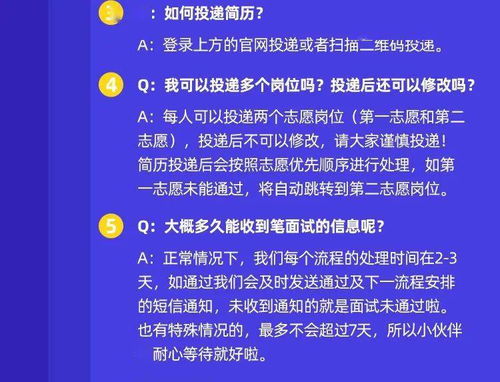

大家好,今天我们来谈谈纺织品的一般投保,投保是保障纺织品质量、风险和权益的重要手段,在购买纺织品时,了解投保的相关知识非常重要,下面我们将通过一个英文案例和表格来详细说明。

纺织品投保概述

纺织品投保是指购买纺织品时,为保障自身权益和风险,向保险公司购买相关保险的行为,投保的目的是为了在纺织品在使用过程中出现质量问题或意外情况时,能够得到相应的赔偿和保障。

纺织品投保流程

- 选择保险公司:在选择保险公司时,需要根据自己的需求和风险承受能力进行选择,可以选择知名品牌保险公司或者专业第三方保险公司。

- 准备投保资料:准备投保资料时,需要提供纺织品的基本信息、使用情况、质量问题等相关资料。

- 填写投保单:填写投保单时,需要详细填写纺织品的基本信息、保险条款、保险金额等。

- 提交投保申请:提交投保申请后,等待保险公司的审核。

- 审核通过:如果投保申请通过审核,保险公司将与投保人签订保险合同。

纺织品投保案例分析

以某纺织品公司为例,该公司购买了纺织品保险,该公司主要经营各种类型的纺织品销售,包括床上用品、服装等,在购买纺织品保险时,该公司选择了知名品牌保险公司,提供了详细的纺织品信息、使用情况等相关资料,保险公司经过审核后,与该公司签订了保险合同。

纺织品投保注意事项

在纺织品投保过程中,需要注意以下几点:

- 选择合适的保险公司:在选择保险公司时,需要选择有良好信誉和专业能力的保险公司。

- 了解保险条款:在购买纺织品保险时,需要仔细阅读保险条款,了解保险范围、理赔流程等相关内容。

- 提供真实资料:在提供投保资料时,需要提供真实、准确的资料,避免虚假申报。

- 注意风险控制:在购买纺织品保险时,需要注意风险控制,避免出现质量问题或意外情况时无法得到相应的赔偿和保障。

纺织品投保表格说明

以下是纺织品投保表格的说明:

| 项目 | 描述 |

|---|---|

| 投保人信息 | 姓名、身份证号码、联系方式等 |

| 纺织品信息 | 类型、规格、数量、质量等级等 |

| 使用情况 | 使用场所、使用时间等 |

| 保险需求 | 保险金额、保险期限等 |

| 保险公司信息 | 保险公司名称、联系方式等 |

| 保险条款 | 保险范围、理赔流程等 |

纺织品投保是保障纺织品质量、风险和权益的重要手段,在购买纺织品时,应该了解投保的相关知识,选择合适的保险公司和保险产品,提供真实、准确的投保资料,需要注意风险控制,避免出现质量问题或意外情况时无法得到相应的赔偿和保障,希望本文能够帮助大家更好地了解纺织品投保的相关知识。

Articles related to the knowledge points of this article:

Introduction to the北京清新针纺织品批发市场地址