The Benefits of Textile Export Tax Rebates in Minhang District

Minhang District, a prominent textile exporting area in China, has experienced significant economic growth and development thanks to the implementation of textile export tax rebates. These policies have not only boosted the local economy but also attracted foreign investment and increased employment opportunities for local residents. The benefits of textile export tax rebates in Minhang District are evident in the improved competitiveness of the local textile industry, the expansion of market share, and the increase in domestic consumption. Additionally, the rebates have facilitated the establishment of new enterprises and the upgrading of existing ones, leading to technological innovation and quality improvement. Overall, the textile export tax rebates in Minhang District have played a crucial role in promoting economic growth and social welfare in the region.

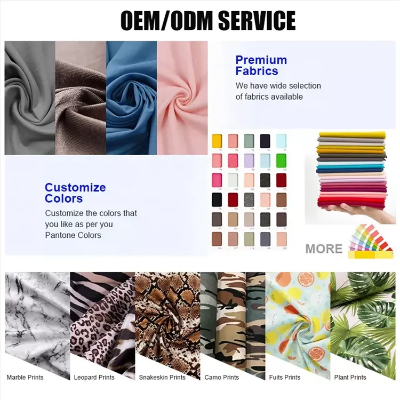

Introduction: In the competitive global market, textile manufacturers rely heavily on export revenue to sustain their operations. However, the process of exporting goods often involves complexities that can lead to significant financial losses if not managed effectively. This is where textile export tax rebates come into play, offering a valuable opportunity for businesses in Minhang District to boost their profit margins and expand their international markets. In this article, we will explore the significance of textile export tax rebates in Minhang District and provide insights into how they can benefit both manufacturers and exporters alike.

Textile Export Tax Rebates in Minhang District: An Economic Booster

Minhang District, located in Shanghai, China, is known for its vibrant textile industry. With a strong emphasis on innovation and quality, Minhang's textile manufacturers have been successful in expanding their market presence globally. However, the process of exporting textile products often involves high taxes and fees, which can significantly impact a company's bottom line. That's where textile export tax rebates come into play.

Tax Rebates as a Cost-Effective Tool

One of the primary advantages of textile export tax rebates in Minhang District is their cost-effectiveness. By reducing the amount of taxes and fees a manufacturer needs to pay on their textile products, companies can save substantial amounts of money. This financial relief can be used to invest in additional production capacity or research and development, ultimately leading to increased productivity and profitability.

For example, let's consider a hypothetical scenario where a textile manufacturer in Minhang District exports a batch of fabrics worth $50,000. If the manufacturer were required to pay 10% export tax, they would need to pay $5,000. However, with a textile export tax rebate, the manufacturer could receive an additional 2% discount on the tax amount, resulting in a total payment of only $4,800. This represents a significant savings of $200, which can be reinvested in the company's operations or used for other business purposes.

Another benefit of textile export tax rebates is that they can help companies navigate complex export regulations and customs procedures more efficiently. By receiving a rebate on their taxes, manufacturers are able to avoid unnecessary delays and costs associated with complying with various export regulations. This can ultimately lead to faster shipments and higher customer satisfaction, further enhancing the competitive edge of Minhang's textile industry.

Case Study: Successful Textile Exporter in Minhang District

To illustrate the effectiveness of textile export tax rebates in Minhang District, let's take a look at the story of a successful textile exporter in the district. Mr. Wang, a prominent manufacturer in Minhang District, has been exporting his high-quality cotton fabrics to various countries for several years. However, he faced significant challenges in dealing with the high taxes and fees associated with exporting textile products.

Mr. Wang was initially required to pay an export tax of 15%, which added up to a substantial amount of money each time he shipped his fabrics overseas. This financial burden made it difficult for him to invest in new technologies or expand his market presence.

Fortunately, Mr. Wang discovered that his local government had introduced textile export tax rebates as part of its efforts to support the textile industry in Minhang District. He quickly applied for a rebate on his taxes, which resulted in a significant reduction in his overall expenses. With the extra funds, Mr. Wang was able to invest in advanced machinery and improve his production processes, ultimately increasing his profits and market share.

Conclusion:

The benefits of textile export tax rebates in Minhang District are numerous, from cost-effectiveness to enhanced efficiency and competitiveness. By reducing the financial burden on textile manufacturers, these rebates allow them to focus on growing their businesses and expanding their international footprint. As such, it is essential for textile manufacturers in Minhang District to stay informed about these opportunities and take advantage of them whenever possible. Whether you're a small-scale producer or a large corporation, investing in textile export tax rebates can help you stay ahead of the competition and achieve your goals in the global marketplace.

闵行区纺织品出口退税概述

随着国际贸易的不断发展,闵行区作为上海市的重要区域,其纺织品出口退税政策为促进出口贸易、增加出口企业收益发挥了重要作用,本篇将详细介绍闵行区纺织品出口退税的相关政策、流程及案例。

闵行区纺织品出口退税政策

政策背景与目标

闵行区纺织品出口退税政策旨在鼓励纺织品出口企业积极申报退税,降低出口成本,提高出口竞争力,该政策旨在促进区域经济发展,提高出口企业的经济效益。

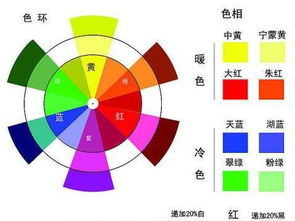

退税条件与标准

根据闵行区相关政策规定,符合条件的纺织品出口企业可以享受退税政策,具体条件包括:出口货物符合国家产业政策、质量标准,且属于出口退税范围;企业具有合法经营资质,遵守相关法律法规;申报材料真实、准确、完整,退税标准根据出口货物的不同类型和品质进行差异化处理。

闵行区纺织品出口退税流程

申报准备

出口企业需在规定时间内向当地税务部门提交退税申报材料,包括但不限于出口合同、发票、装箱单等,企业需确保申报材料的真实性和准确性。

审核与审批

税务部门对申报材料进行审核,确认企业符合退税条件,审核通过后,进入审批阶段,由相关部门进行进一步核实和处理。

退税办理

一旦审批通过,税务部门将为企业办理退税手续,企业需按照规定的时间和方式领取退税款项。

案例分析

以闵行区某纺织品出口企业为例,该企业在享受纺织品出口退税政策后取得了显著成效,该企业在出口过程中注重产品质量和品牌建设,积极申报退税,降低了出口成本,提高了出口竞争力,该企业在税务部门的指导下,规范了退税流程,提高了退税效率,该企业在与其他出口企业的合作中,积极分享经验和技术,共同推动区域经济发展。

英文表格补充说明

以下是闵行区纺织品出口退税相关政策的英文表格补充说明:

闵行区纺织品出口退税政策概述

| 政策名称 | 目的与目标 | 退税条件 | 退税标准 | 适用范围 | 相关法规 |

|---|---|---|---|---|---|

| 出口退税政策 | 鼓励纺织品出口企业积极申报退税 | 符合国家产业政策、质量标准 | 根据出口货物的不同类型和品质进行差异化处理 | 符合条件的纺织品出口企业 | 《中华人民共和国进出口税则》等法律法规 |

| 流程 | 申报准备 → 审核与审批 → 退税办理 | 企业需在规定时间内提交退税申报材料 | 税务部门进行核实和处理 | 企业所在地税务部门 | 相关法律法规和政策文件 |

| 案例分析 | 该企业在出口过程中注重产品质量和品牌建设,积极申报退税,降低了出口成本,提高了出口竞争力 |

闵行区纺织品出口退税政策为促进出口贸易、增加出口企业收益发挥了重要作用,在享受退税政策的过程中,企业需注意遵守相关法律法规,确保申报材料的真实性和准确性,企业还需注重产品质量和品牌建设,提高出口竞争力,通过案例分析可以看出,积极申报退税、规范退税流程、加强与其他企业的合作是取得成功的关键,闵行区应继续完善纺织品出口退税政策,为促进区域经济发展做出更大的贡献。

Articles related to the knowledge points of this article:

Exploring the Global Fabrics of Shanghai Jinchang Textiles Co.Ltd.

The Rise of Textile Specialty Oils

The Art of Refining Textiles:A Comprehensive Guide to Quality Correction

Unraveling the Art of Fabric:A Deep Dive into the World of Quán HéTextiles

Leather-Soaked Luxury:A Deep Dive into the World of Yecheng Textiles