The Transformative Power of Taxes on Wasted Textiles

The study explores the transformative potential of taxes on waste textiles. It argues that imposing a levy on textile scraps can significantly reduce their volume and promote sustainable use. The paper highlights the need for policymakers to adopt effective measures to address textile waste, including taxation strategies that incentivize responsible disposal practices. The study concludes by emphasizing the importance of integrating policies that address both the production and disposal aspects of textile waste management.

In today's world, where sustainability and environmental stewardship are paramount concerns, the issue of wasteful textile production and disposal has become a pressing matter. Textiles, once considered disposable due to their low cost and abundance, have now emerged as a significant contributor to waste generation worldwide. This is where the concept of 'waste-to-wealth' comes into play—turning discarded textiles into valuable resources through innovative recycling and repurposing initiatives. In this discussion, we explore the role of taxes in promoting the circular economy by encouraging responsible textile disposal and fostering a culture of sustainability.

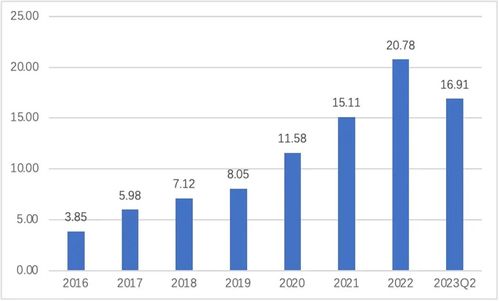

To illustrate the point, let's consider the case of Textile Recycling in China, which has made remarkable strides in recent years. According to a 2020 report by the World Economic Forum, China's textile recycling industry has grown from a mere $1 billion in revenue in 2015 to over $30 billion by 2020. This impressive growth can be attributed not only to technological advancements but also to the implementation of policies that incentivize the use of recycled materials. For instance, the Chinese government has introduced a comprehensive tax system for waste management, including textiles. Under this system, companies engaged in recycling or reusing textile waste receive tax breaks, thereby encouraging businesses to adopt more sustainable practices.

The impact of such policies is evident in the transformation of China's textile recycling industry. According to data from the National Bureau of Statistics, the volume of textile waste generated in China has decreased by 20% since 2015, thanks in large part to these tax incentives. Furthermore, the quality of recycled textiles has improved significantly, with many now meeting or exceeding international standards for safety and durability.

However, the story of textile recycling isn't limited to China. In the United States, for example, there's a growing movement towards 'green textiles', which aim to reduce the environmental impact of clothing production. Green textiles often involve using recycled or sustainably sourced materials, such as organic cotton or recycled polyester. These initiatives are not only beneficial for the environment but also offer economic opportunities for small-scale producers and artisans who may otherwise struggle to compete with larger corporations.

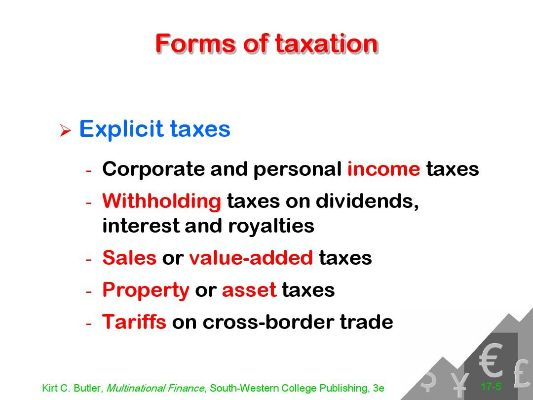

One way to promote green textiles is through the implementation of taxes that incentivize their use. For instance, some states in the US have implemented tax credits or rebates for consumers who purchase products made from recycled or sustainably sourced materials. These policies have helped to drive demand for green textiles, as well as encourage manufacturers to adopt more sustainable practices.

Of course, the success of these initiatives depends on a range of factors, including consumer awareness and education, policy consistency, and market forces. However, when coupled with effective tax policies, they have the potential to transform the textile industry into a more sustainable and equitable model.

In conclusion, taxes play a crucial role in promoting responsible textile disposal and fostering a culture of sustainability. By implementing policies that incentivize the use of recycled or repurposed textiles, we can not only reduce our carbon footprint but also create new economic opportunities for those who choose to embrace a more sustainable future. As we continue to grapple with the challenges of climate change and resource depletion, it is essential that we find ways to leverage the power of taxes to propel us toward a more sustainable future.

随着社会经济的快速发展,废旧纺织品回收与再利用逐渐成为环境保护和资源循环利用的重要领域,废旧纺织品税收作为调节废旧纺织品回收利用的重要手段,对于促进循环经济和可持续发展具有重要意义,本文将围绕废旧纺织品税收主题,探讨相关政策、法规及案例,旨在为相关企业和个人提供参考。

废旧纺织品税收政策概述

废旧纺织品税收政策主要包括以下几个方面:

- 税收范围:包括各类废旧纺织品,如布料、毛绒、塑料制品等。

- 税收标准:根据废旧纺织品的质量、种类、回收利用率等因素确定。

- 税收优惠:政府通过税收减免、税收抵扣等方式鼓励废旧纺织品回收利用。

废旧纺织品税收案例分析

某城市废旧纺织品回收利用项目

该城市近年来大力推广废旧纺织品回收利用项目,通过政府引导和企业参与,实现了废旧纺织品的有效回收和再利用,在该项目中,政府制定了严格的废旧纺织品税收政策,通过税收减免等方式鼓励企业积极参与废旧纺织品回收利用,政府还设立了专门的回收处理中心,对回收的废旧纺织品进行分类、清洗、消毒等处理,提高了废旧纺织品的利用率和再利用价值。

某地区废旧塑料制品再利用项目

该地区通过政府引导和企业参与,成功开展了废旧塑料制品再利用项目,在该项目中,政府制定了严格的废旧塑料制品税收政策,同时鼓励企业采用先进的再生塑料技术,提高废旧塑料制品的利用率和再利用价值,政府还为相关企业提供税收减免、税收抵扣等优惠政策,促进了废旧塑料制品的回收利用和再生产。

废旧纺织品税收问题分析

在废旧纺织品税收过程中,存在以下问题:

- 税收政策不完善:目前废旧纺织品税收政策还存在不完善之处,缺乏针对不同类型废旧纺织品的具体税收政策和标准。

- 回收利用率低:部分地区废旧纺织品回收利用率仍然较低,导致资源浪费和环境污染问题。

- 税收优惠不够明显:部分企业对废旧纺织品税收优惠政策了解不够深入,导致优惠政策落实不到位。

建议与对策

针对上述问题,提出以下建议与对策:

- 完善废旧纺织品税收政策:政府应进一步完善废旧纺织品税收政策,制定更加具体、明确的税收标准和优惠政策,提高废旧纺织品回收利用率和再利用价值。

- 加强宣传教育:政府应加强废旧纺织品税收政策的宣传教育,提高企业和社会对废旧纺织品回收利用的认识和重视程度。

- 促进技术创新:政府应鼓励企业采用先进的再生塑料技术,提高废旧塑料制品的利用率和再利用价值,同时推动相关产业的发展。

- 加强监管力度:政府应加强废旧纺织品回收处理的监管力度,确保废旧纺织品得到及时、有效的处理和利用。

废旧纺织品税收作为调节废旧纺织品回收利用的重要手段,对于促进循环经济和可持续发展具有重要意义,在实施废旧纺织品税收过程中,应完善政策、加强宣传教育、促进技术创新和加强监管力度等方面入手,提高废旧纺织品的回收利用率和再利用价值,政府和企业应共同努力,推动循环经济和可持续发展目标的实现。

Articles related to the knowledge points of this article:

Top Ten Textile Garment Inspection Machines Brands