纺织品税率抵税政策详解

This article provides a detailed analysis of the textile tariff credit policy, which is an important measure to reduce the cost of imported textile products. The textile tariff credit policy allows importers to deduct the value of imported textiles from their taxes, effectively reducing the overall cost of imported textiles. This policy has been widely adopted in many countries, including China, Japan, and the United States.,The textile tariff credit policy is based on the principle of "importing goods, paying taxes, but receiving credits". When importers purchase textiles from abroad, they are required to pay customs duties and other related taxes. However, these taxes can be offset by the value of imported textiles, resulting in a reduction in the overall cost of imported textiles.,The implementation of the textile tariff credit policy requires strict compliance with relevant regulations and procedures. Importers must provide accurate information about the quantity and value of imported textiles, as well as the source of the textiles. They must also comply with all tax payment obligations and ensure that the imported textiles meet certain quality standards before being eligible for the tariff credit.,Overall, the textile tariff credit policy plays an important role in promoting trade and reducing costs for importers. By allowing importers to deduct the value of imported textiles from their taxes, it helps to balance the trade balance and promote economic growth.

In today's global economy, understanding the complexities of tax laws can be a daunting task for businesses operating in various industries. However, for textile manufacturers, understanding and effectively applying the textiles tax rate deduction policy is crucial to ensuring compliance with tax regulations and maximizing profits. This guide aims to provide an overview of the textiles tax rate deduction policy, its benefits, and how it can be utilized by textile manufacturers worldwide.

The textiles tax rate deduction policy is designed to encourage the production and consumption of textile products, particularly those that have a positive impact on the environment or promote sustainable development. The policy allows certain types of textiles to be deducted from the manufacturer's taxable income, based on specific criteria such as the amount of waste generated during production, the energy efficiency of the manufacturing process, and the environmental impact of the product.

To understand the textiles tax rate deduction policy better, let's take a closer look at some key aspects:

-

Types of Textiles Allowed for Deduction: The textiles tax rate deduction policy allows manufacturers to deduct certain types of textiles, including but not limited to:

-

Recycled Textiles: Manufacturers that produce recycled textiles are eligible for a deduction based on the amount of waste generated during their production process. For example, if a manufacturer generates 10 tons of waste during the production of 100,000 square meters of recycled fabric, they may be able to deduct $50,000 from their taxable income.

-

Energy-Efficient Textiles: Manufacturers that produce energy-efficient textiles are also eligible for a deduction based on the amount of energy used during their production process. For example, if a manufacturer uses 20% less energy during the production of 100,000 square meters of energy-efficient fabric, they may be able to deduct $20,000 from their taxable income.

-

Environmentally Friendly Textiles: Manufacturers that produce textiles that have a positive impact on the environment, such as organic cotton or bamboo fiber, are also eligible for a deduction based on the environmental impact of their product. For example, if a manufacturer produces 100,000 square meters of organic cotton fabric that reduces greenhouse gas emissions by 30%, they may be able to deduct $30,000 from their taxable income.

-

-

Deduction Amount: The amount of the textiles tax rate deduction varies depending on the type of textile and the amount of waste or energy used during production. For example, a manufacturer that generates 10 tons of waste during the production of 100,000 square meters of recycled fabric may be able to deduct $50,000 from their taxable income. Similarly, a manufacturer that uses 20% less energy during the production of 100,000 square meters of energy-efficient fabric may be able to deduct $20,000 from their taxable income.

-

Tax Credits and Other Benefits: In addition to the textiles tax rate deduction, manufacturers may also receive tax credits and other benefits under the textiles tax rate deduction policy. For example, a manufacturer that produces 100,000 square meters of recycled fabric may be eligible for a tax credit of up to $10,000 based on the amount of waste generated during production.

-

Compliance Requirements: To qualify for the textiles tax rate deduction, manufacturers must meet certain compliance requirements, such as maintaining accurate records of waste and energy use during production and reporting these details to the relevant tax authorities.

Now, let's take a closer look at an example to illustrate how this policy can be applied by a textile manufacturer:

Example: A Textile Manufacturer Applying for the Textiles Tax Rate Deduction

Suppose a textile manufacturer named "GreenTextiles" has been producing recycled fabric for several years and generating significant amounts of waste during the process. To apply for the textiles tax rate deduction, GreenTextiles must first determine the amount of waste generated during their production process and then report this information to the relevant tax authorities. Based on their findings, GreenTextiles may be eligible for a deduction of $50,000 for the amount of waste generated during the production of 100,000 square meters of recycled fabric.

Once GreenTextiles has received approval for the textiles tax rate deduction and has reported their findings to the relevant tax authorities, they can now deduct this amount from their taxable income for the current year. This will help reduce their tax liability and increase their profitability.

In conclusion, the textiles tax rate deduction policy is a powerful tool that can significantly benefit textile manufacturers worldwide. By understanding and effectively applying this policy, manufacturers can reduce their tax burden, increase their profitability, and promote sustainable development.

随着经济的快速发展,税收政策在促进产业发展中发挥着越来越重要的作用,针对纺织品行业的税率抵税政策引起了广泛关注,本篇文章将详细介绍这一政策的主要内容、适用范围以及具体操作方式,并结合案例进行说明。

纺织品税率抵税政策概述

政策背景

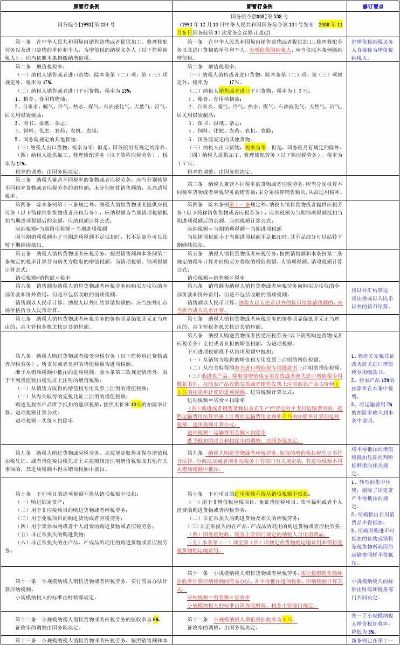

纺织品税率抵税政策是国家为了鼓励纺织品行业的发展,减轻企业税收负担而推出的一项重要政策,该政策规定在一定范围内,纺织品出口可以享受一定的税收减免。

适用范围

该政策适用于所有从事纺织品生产和出口的企业,包括但不限于纺织品生产企业、纺织品出口企业等,对于符合条件的纺织品出口,可以享受相应的税收减免。

具体操作方式

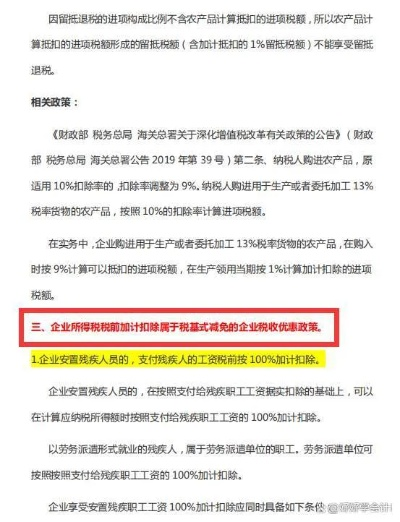

(1)申报流程:企业需要按照规定的流程向税务部门申报享受税率抵税政策,具体流程包括填写相关申报表格、提供相关证明材料等。

(2)减免额度:根据不同类型和规模的纺织品企业,享受的税率抵税政策额度有所不同,具体减免幅度根据企业出口额、产品类型等因素确定。

案例分析

以某纺织品生产企业为例,该企业在实施纺织品税率抵税政策后,取得了显著的成效。

企业概况 该企业主要从事纺织品生产与出口,拥有一定的生产规模和市场份额,在实施税率抵税政策前,该企业在税收方面存在一定的压力。

申报过程 该企业在税务部门申报享受税率抵税政策时,需要提供相关的出口合同、发票、产品检测报告等证明材料,经过税务部门的审核,该企业成功获得了相应的税收减免。

具体减免情况如下:该企业出口的纺织品在税率抵税政策的支持下,享受到了不同程度的税收减免,对于部分高价值纺织品,可以享受更高的退税比例;对于特定产品类型,还可以享受更优惠的税收减免期限。

政策优势与影响分析

政策优势

(1)减轻企业税收负担:通过实施纺织品税率抵税政策,可以有效地减轻企业的税收负担,提高企业的经济效益。

(2)促进纺织品行业发展:税率抵税政策的实施有利于促进纺织品行业的健康发展,提高行业的竞争力和市场占有率。

影响分析

(1)促进出口贸易:税率抵税政策的实施将进一步促进纺织品出口贸易的发展,提高出口产品的竞争力。

(2)优化产业结构:通过鼓励纺织品行业的发展,可以优化产业结构,提高产业的整体效益和竞争力。

纺织品税率抵税政策是国家为了促进纺织品行业发展而推出的一项重要政策,该政策在减轻企业税收负担、促进出口贸易等方面发挥了重要作用,该政策的实施也将进一步优化产业结构,提高产业的整体效益和竞争力,对于符合条件的纺织品企业来说,应该积极了解和掌握这一政策,充分利用其优势,提高企业的经济效益和市场竞争力。

Articles related to the knowledge points of this article:

How to Identify Textiles for Authenticity

The Dynamic Landscape of the Jiading Textile Manufacturers