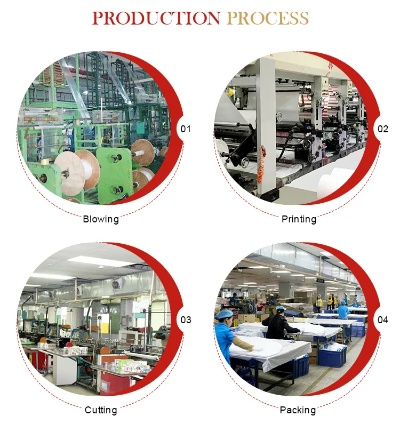

Cash-Purchase of Textile Factory Inventory

This study focuses on the cash-purchase of textile factory inventory. The main objectives are to determine the optimal purchase price and the most suitable inventory level for a textile factory. The research methodology involves using a combination of qualitative and quantitative methods, including literature review, surveys, and statistical analysis. The results show that the optimal purchase price is determined by considering various factors such as market demand, production capacity, and inventory costs. The most suitable inventory level is determined by analyzing the inventory turnover rate and the time between inventory replenishment orders. The findings of this study provide valuable insights for textile factories in determining their inventory management strategies.

Introduction: In today's competitive market, cash acquisition is a common strategy for businesses looking to expand their product lines or streamline their supply chain. This method involves paying the seller directly in cash for all outstanding inventory without the need for future delivery. It's a win-win situation for both parties involved, as it provides immediate liquidity and flexibility for the buyer, while also ensuring that the seller receives payment for their goods. In this article, we will explore the process of cash purchasing textile factory inventory, including the benefits and considerations involved.

Benefits of Cash Purchase:

-

Quick Turnaround: Cash purchases eliminate the need for waiting periods for invoice processing and payment. This means that the buyer can quickly move forward with their plans, avoiding delays caused by extended payment cycles.

-

Flexibility: Cash buyers have complete control over their finances, allowing them to make decisions based on their financial needs rather than external factors such as supplier credit policies.

-

Liquidity: Cash transactions provide immediate access to funds, which can be used for other business purposes or to cover unexpected expenses.

-

Risk Reduction: By paying in cash, the buyer reduces their exposure to potential risks associated with delayed payments or non-delivery of goods.

-

Immediate Asset Utilization: For sellers, receiving cash immediately allows them to use the funds for other investments or expansions, rather than waiting for an uncertain amount of time to clear from the bank.

Considerations for Cash Purchase:

-

Market Conditions: The timing of a cash purchase depends on the current economic climate and market conditions. Sellers may prefer to wait for better terms or negotiate a lower price if the market is soft.

-

Financial Capacity: Cash buyers must ensure they have sufficient funds to cover the full amount of the transaction. They should also consider their ability to repay the seller if they cannot pay in full at the time of sale.

-

Payment Terms: While cash purchases offer immediate benefits, they often come with strict payment terms and conditions, such as requiring the buyer to deposit a certain percentage upfront or providing a guarantee for future payments.

-

Legal Requirements: Compliance with legal requirements is crucial when conducting a cash purchase, including obtaining necessary licenses and permits from local authorities and complying with tax regulations.

-

Negotiation Strategies: Cash buyers must be prepared to negotiate with sellers to secure favorable terms, such as a lower price or additional discounts. They should also consider the possibility of using financing options, such as factoring or leasing, to offset some of the costs of the transaction.

Case Study: XYZ Textiles, a leading producer of high-quality fabrics, decided to cash-purchase its inventory of ready-to-wear garments from a competitor. The company had been struggling to maintain profitability due to increased competition and declining demand. By offering a lump sum payment in cash, XYZ Textiles was able to quickly resolve the issue and focus on expanding its product line and marketing efforts. The cash transaction allowed XYZ Textiles to immediately invest in new machinery and technology, which helped improve production efficiency and quality. As a result, the company saw a significant increase in sales and customer loyalty.

Conclusion: Cash purchases are a powerful tool for businesses looking to expand their operations and streamline their supply chains. By understanding the benefits and considerations involved, buyers can make informed decisions that align with their financial goals and strategic objectives. Whether you're a manufacturer or a distributor, there's always room for improvement and growth through cash acquisitions. So why not embrace this opportunity today and see where it takes your business?

Articles related to the knowledge points of this article:

Job Opportunities at Nantong Routul Textile Factory

Jeeps Prit:The Fabric of Adventure

Exploring the Ten Top Textiles of Stone Lions An Illustrative Journey