The Impact of Textile Export Rebates on Global Trade

The impact of textile export rebates on global trade has been significant. These rebates have helped to reduce the cost of importing textiles, which in turn has led to increased competition and lower prices for consumers. This has had a positive effect on global trade, as countries with cheaper textiles are able to compete more effectively in the market. However, it is important to note that these rebates may also lead to increased competition among producers, as they may be forced to lower their prices in order to remain competitive. Additionally, some countries may benefit from these rebates more than others, as they may have a larger domestic textile industry or be more dependent on exports for their economy. Overall, the impact of textile export rebates on global trade is complex and multifaceted, but they have undoubtedly played a role in shaping the global textile industry over the past few decades.

Introduction: The textile industry is a crucial sector in the global economy, contributing significantly to employment and economic growth. As global trade continues to evolve, understanding the implications of export rebates for this industry becomes increasingly important. This discussion will explore the role of export rebates in boosting textile exports and their impact on the global textile market. We will also present an example case study to illustrate the practical application of export rebates in the textile industry.

Export Rebates: What Are They? Export rebates are tax incentives provided by governments to encourage the export of goods or services. These rebates can be in the form of reduced taxes on imported goods, subsidies for exporters, or other forms of financial assistance. The purpose of these rebates is to reduce the cost of doing business for exporters and stimulate international trade.

Importance of Export Rebates for Textile Industry: The textile industry is heavily dependent on international markets, with many countries relying on imports from other regions for raw materials and finished products. Export rebates play a crucial role in reducing the cost of producing and exporting textile products. For instance, if a country offers a rebate on imported yarn or fabric, it can significantly lower the production costs for domestic textile manufacturers, making them more competitive in the global market.

Impact of Export Rebates on Global Trade: Export rebates have a significant impact on the global textile market. By lowering the cost of production and exporting, textile manufacturers can expand their reach into new markets, increasing their sales and revenue. Additionally, export rebates can help to diversify the textile industry's supply chains, reducing dependence on specific regions or countries.

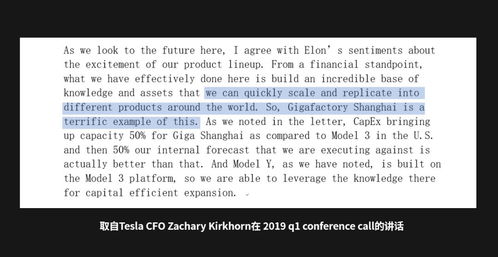

Example Case Study: China's Textile Export Rebate Program In recent years, China has implemented several export rebate programs to support its textile industry. One such program, known as the "China-ASEAN Free Trade Agreement (CAFTA)", provides exporters from China with a rebate on certain textile products when they ship to ASEAN countries. This rebate reduces the cost of transportation and customs duties for Chinese textile manufacturers, enabling them to sell their products at a competitive price in ASEAN countries.

As a result, Chinese textile companies have seen a significant increase in their market share in ASEAN countries. For example, a leading Chinese textile manufacturer reported an increase in sales of its garments in Vietnam after implementing the CAFTA rebate program. The company was able to pass on the savings from reduced transport costs and customs duties to customers, resulting in higher profit margins and stronger brand recognition.

Conclusion: Export rebates are essential tools for boosting textile exports and stimulating global trade. By offering tax incentives to exporters, governments can encourage the growth of their industries and create opportunities for foreign investment. In the case of China's textile industry, export rebate programs have played a crucial role in expanding its market presence and strengthening its position in the global textile market. As the global economy continues to evolve, we can expect to see more countries implement export rebate policies to support their textile industries and promote sustainable trade practices.

大家好,今天我们来聊聊纺织品出口退税的话题。

纺织品出口退税概述

纺织品出口退税是指国家为了鼓励出口,对出口到国外市场的纺织品给予一定的退税政策,这一政策对于促进纺织品出口、增加国际市场份额具有重要意义。

纺织品出口退税政策的具体内容

退税条件

出口纺织品需要满足一定的条件才能享受退税政策,需要满足以下条件:

(1)产品符合国家产业政策; (2)产品质量符合国际标准; (3)提供相应的出口凭证和报关单等文件。

退税流程

出口纺织品的企业可以按照以下流程申请退税:

(1)准备相关材料:包括产品说明书、质量检测报告、出口合同等; (2)向当地税务部门提交申请材料; (3)税务部门审核通过后,进行退税操作; (4)退税款项最终到达企业账户。

案例分析:纺织品出口退税的实际操作

以某纺织品出口企业为例,该企业在出口纺织品时,积极响应国家出口退税政策,取得了显著的成效。

产品符合政策要求 该企业生产的纺织品符合国家产业政策,产品质量也符合国际标准,在申请退税时,提供了相应的出口凭证和报关单等文件,满足了退税条件,经过税务部门的审核,成功获得了出口退税款项。

成功申请退税 该企业在申请退税时,提供了详细的材料和证明,包括产品照片、质量检测报告等,税务部门在审核过程中,对企业的材料进行了严格的审查,最终批准了退税申请,退税款项迅速到达企业账户,为企业的发展注入了新的活力。

纺织品出口退税的优势与影响

纺织品出口退税政策具有以下优势和影响:

优势:

(1)促进纺织品出口,增加国际市场份额; (2)减轻企业出口成本,提高市场竞争力; (3)促进国际贸易合作,推动经济发展。

影响:

(1)增加企业利润空间,提高经济效益; (2)促进企业技术创新,提高产品质量和附加值; (3)优化产业结构,推动产业升级。

结论与建议

纺织品出口退税政策对于促进纺织品出口、增加国际市场份额具有重要意义,企业在出口纺织品时,应该积极响应政策要求,准备好相关材料,按照流程申请退税,企业也应该加强自身管理,提高产品质量和附加值,以适应国际贸易市场的变化,政府也应该继续完善出口退税政策,为企业提供更好的支持和服务。

Articles related to the knowledge points of this article:

Top Ten Recommendations for Sports Textiles from Zitong

Introduction to the北京清新针纺织品批发市场地址

Exploring the Beauty and Intricacies of Jianhua Butterflies Textiles