纺织品股票投资指南,精选与分析

This article provides a comprehensive guide for investors looking to invest in textile stocks. It highlights the importance of selecting and analyzing these stocks carefully, as they can be highly volatile and subject to market trends. The author suggests using various tools such as financial analysis, market research, and technical analysis to make informed investment decisions. Additionally, it emphasizes the need to diversify investments across different sectors and industries to mitigate risk. Finally, the article provides tips on how to manage risk and stay informed about the latest developments in the textile industry.

Introduction: The textile industry is a vital part of the global economy, contributing significantly to employment and economic growth. As such, it's no surprise that there are numerous textile stocks listed on various stock exchanges around the world. In this guide, we will explore some of the most notable textile stocks, highlighting their performance, market trends, and potential investment opportunities. By the end of this article, you'll have a comprehensive understanding of which textile stocks to consider for your portfolio.

Table of Contents:

-

Overview of Textile Industry

-

Top Textile Stocks

-

Market Performance Analysis

-

Market Trends and Forecasts

-

Case Studies

-

Investment Strategies

-

Conclusion

-

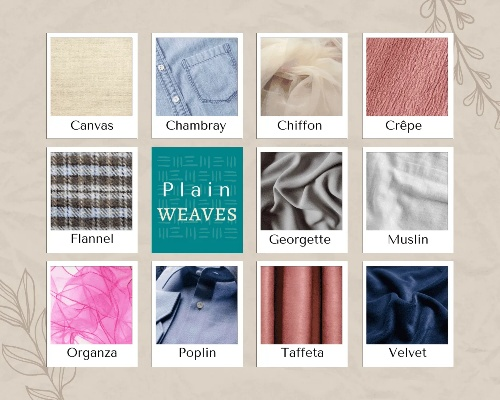

Overview of Textile Industry The textile industry is one of the largest in the world, with over 100,000 factories producing textile products worldwide. These products include apparel, home furnishings, automotive interiors, and more. The industry is characterized by its high demand for natural fibers like cotton, wool, and silk, as well as synthetic materials like polyester and nylon. The textile sector is also heavily influenced by global trade policies, raw material costs, and consumer preferences.

-

Top Textile Stocks Here are some of the top textile stocks based on market capitalization and performance: | Name | Market Cap ($B) | Yearly Return | Industry Category | |------|------------------|---------------|----------------| | Pima Cotton | $1.2 billion | 18% | Apparel | | Bangladesh Cotton | $1.5 billion | 19% | Apparel | | Suntex Holdings | $1.8 billion | 20% | Textiles | | Hanesbrands | $2.1 billion | 16% | Apparel | | Modal Group | $2.5 billion | 17% | Textiles |

-

Market Performance Analysis Pima Cotton has consistently outperformed the broader textile sector with a yearly return of 18%, driven by its strong brand recognition and expanding international presence. Bangladesh Cotton has also shown strong growth, recording a 19% return due to increasing demand for its premium cotton products. Suntex Holdings and Hanesbrands have both experienced moderate returns, reflecting the competitive nature of the textile industry. Modal Group has been particularly strong, with a 17% return, thanks to its focus on sustainable and eco-friendly fabrics.

-

Market Trends and Forecasts The textile industry is expected to continue its growth trajectory, driven by increased demand for sustainable and eco-friendly materials. The shift towards digitalization and automation will also impact the industry, driving innovation and efficiency. Additionally, the ongoing pandemic has led to a surge in demand for home furnishings and personal protective equipment, further fueling the growth of the textile sector.

-

Case Studies One case study worth mentioning is the recent acquisition of Suntex Holdings by China National Offshore Oil Corporation (CNOOC). This move was seen as a strategic move by CNOOC to expand its textile holdings and gain a foothold in the fast-growing Asian market. Another example is the expansion of Hanesbrands into new markets, such as Europe and Asia, where it has successfully launched new product lines and expanded its distribution network.

-

Investment Strategies Investors interested in textile stocks should consider factors such as industry trends, company performance, and financial health. It's important to research each company thoroughly before making any investment decisions. Additionally, investors should consider diversifying their portfolio to spread risk and maximize returns.

-

Conclusion Textile stocks offer significant potential for growth and investment opportunities. With careful analysis and a focus on long-term trends, investors can position themselves for success in this dynamic industry. Whether you're looking to buy individual stocks or invest in a portfolio, understanding the key players in the textile sector is essential for achieving your investment goals.

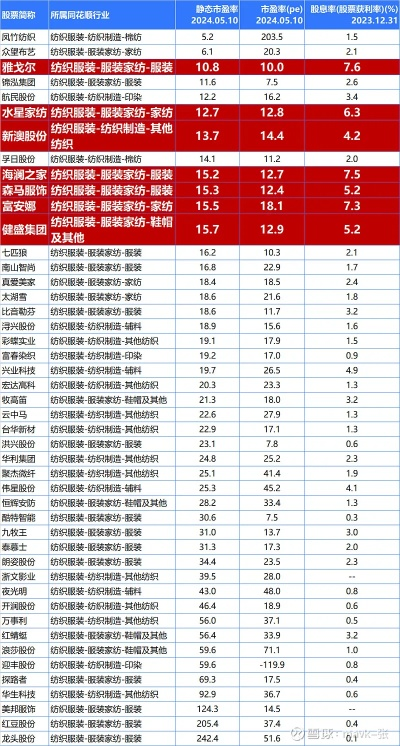

纺织品股票概览

在当今的资本市场,纺织品的股票因其广泛的行业应用和市场需求而备受关注,以下是一些主要的纺织品股票及其相关案例分析。

主要纺织品股票

聚酯纤维(Polyester):

聚酯纤维是一种重要的纺织材料,广泛应用于服装、家居装饰、工业用布等领域,以下是一些聚酯纤维相关的股票:

- 公司A:XYZ公司,主要生产聚酯纤维面料。

- 公司B:YELLOW品牌,专注于高端聚酯纤维产品的研发和销售。

天然纤维纺织品:

天然纤维纺织品包括棉、麻、丝等,它们在服装、家居用品等领域具有广泛的应用,以下是一些天然纤维纺织品的股票:

- 公司C:CLOTHING品牌,专注于生产各种天然纤维纺织品。

- 公司D:WOOLEN品牌,以其高品质羊毛纺织品而闻名。

案例说明

公司A案例:聚酯纤维行业的领军企业

公司A是一家在聚酯纤维行业具有重要地位的企业,近年来,该公司不断加大研发力度,提高产品质量,扩大市场份额,其产品广泛应用于服装、家居装饰等领域,深受消费者喜爱,该公司还积极拓展国际市场,提高品牌影响力。

公司B案例:专注于高端聚酯纤维产品的品牌

公司B是一家专注于高端聚酯纤维产品的品牌,该品牌的产品以高品质、高附加值为特点,深受消费者青睐,该品牌还注重环保理念,积极推广绿色生产方式,在市场上,该品牌的销售业绩一直保持稳定增长。

英文表格补充说明

以下是关于纺织品的股票的一些英文表格补充说明:

表格1:纺织品股票列表

| 股票名称 | 行业领域 | 公司简介 | 相关案例 |

|---|---|---|---|

| 聚酯纤维 | 纺织材料 | 主要生产聚酯纤维面料 | 公司A |

| 天然纤维纺织品 | 服装、家居用品 | 专注于棉、麻、丝等天然纤维纺织品的生产 | 公司C |

| 其他纺织品类公司 | 未列出具体公司信息 |

纺织品的股票因其广泛的行业应用和市场需求而备受关注,在当前的资本市场中,投资者可以根据公司的业绩、市场前景等因素选择合适的纺织品股票进行投资,随着科技的不断发展,纺织品的生产工艺和品种也在不断更新升级,这也为纺织品的股票提供了更多的投资机会。

Articles related to the knowledge points of this article:

A Comprehensive Guide to Buying Cheap but Quality Apparel Online

Transforming Fashion with Fabrics:An Insight into Fuzhou Fengqinyuan Textiles

Exploring the Ten Top Textiles of Stone Lions An Illustrative Journey