Understanding the Costs of Importing Textile Goods:An English Guide

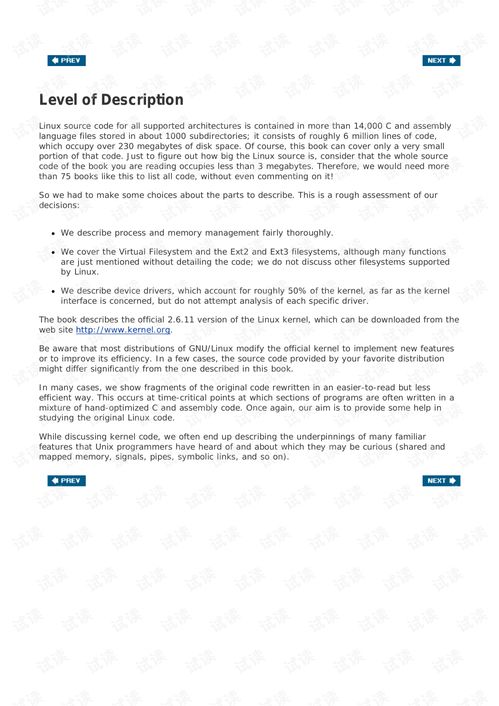

: Understanding the Costs of Importing Textile Goods: An English Guide,Introduction:,Textile imports are a significant part of the global economy, with many countries relying on foreign textiles for their domestic markets. However, importing these goods comes with costs that must be understood to ensure sustainable and profitable business practices. This guide aims to provide an English-language overview of the key costs associated with importing textiles, including tariffs, customs duties, transportation, storage, and more.,Tariffs:,Tariffs are taxes imposed by importing countries on goods entering their territory. These can vary widely depending on the country's trade policies and the type of textile being imported. Tariffs can significantly increase the cost of importing textiles, especially when compared to domestically produced goods.,Customs Duties:,Customs duties are taxes collected by customs officials upon the entry of goods into a country's borders. They can be calculated based on the value of the goods or on a percentage of the value of the goods. Customs duties can add to the overall cost of importing textiles, making them more expensive than similar products from other countries.,Transportation:,Transportation costs can also be significant when importing textiles. This includes both the cost of shipping the goods from the manufacturer to the importer's warehouse and the cost of transporting the goods from the warehouse to the final destination. The choice of transportation method (e.g. sea freight, air freight, or road transport) can also impact these costs.,Storage:,Once the textiles have been imported, they need to be stored until they are sold or used in production. Storage costs depend on factors such as the size and weight of the goods, as well as the availability of secure storage facilities. These costs can add up quickly, especially if the textiles are not immediately needed or sold.,Conclusion:,Importing textiles is a complex process that involves several costs. By understanding these costs, importers can make informed decisions about their purchasing strategies and budgets, ensuring that their operations are both economically and environmentally sustainable.

Introduction: Textile goods are an essential part of our daily lives, from clothing to furnishings. As importers and exporters, understanding the costs associated with textile imports is crucial for ensuring a profitable business. This guide will provide you with an overview of the key costs involved in importing textiles, including customs duties, taxes, handling fees, and more. We'll also cover some common scenarios and offer practical tips to help you navigate these costs effectively.

Customs Duties and Taxes: Customs duties and taxes are the most significant costs when importing textiles. These fees depend on the country of origin, value of the goods, and other factors such as the type of goods being imported. Here's a table that summarizes the typical customs duties and taxes for textile imports:

| Country | Value of Goods | Customs Duty Rate (%) | Tax Rate (%) |

|---|---|---|---|

| United States | $1000 | 5% | 7% |

| China | $500 | 10% | 13% |

| Mexico | $200 | 12% | 14% |

| Brazil | $150 | 15% | 18% |

It's important to note that these rates can vary depending on specific regulations and negotiations with customs authorities. For example, if you're importing high-value textiles from China, you may need to pay additional tariffs or be subject to stricter inspection procedures.

Handling Fees: Handling fees refer to the costs associated with moving the goods from the port of entry to their final destination location. These fees can include transportation charges, storage fees, and any other related expenses. Here's a rough estimate of the handling fees for different types of textile goods:

| Type of Goods | Estimated Handling Fee ($) |

|---|---|

| Cotton T-shirts | $100 |

| Woolen sweaters | $200 |

| Denim jeans | $300 |

It's essential to factor these handling fees into your overall budget when planning your textile imports.

Other Expenses: In addition to customs duties and taxes, there may be other costs to consider when importing textiles, such as insurance, freight charges, and local taxes. Insurance is particularly important if your shipment is damaged during transit, while freight charges can vary depending on the size and weight of your shipment. Local taxes may also apply, especially if you're importing into a country with different tax regulations than your home country.

Practical Tips: To minimize import costs, it's essential to do your research and negotiate with your shipping provider. You should also consider purchasing insurance to protect your investment against potential damage or loss during transit. Additionally, you can save money by selecting the right packaging materials and shipping method to reduce the risk of damage or delays. Finally, be prepared to pay customs clearance fees, which can vary significantly depending on the country and the type of goods you're importing.

Conclusion: Importing textile goods can be a complex process with many hidden costs. By understanding the customs duties and taxes, handling fees, and other expenses associated with importing textiles, you can better manage your budget and ensure a successful import operation. Remember to negotiate with your shipping provider, purchase insurance, select appropriate packaging materials, and plan ahead to avoid costly delays. With these strategies in place, you can confidently navigate the import process and enjoy the benefits of importing textiles into your business.

大家好,今天我们来聊聊纺织品进口清关的收费问题,进口清关涉及到一系列的费用,包括但不限于关税、增值税、清关费用等,这些费用因不同的进口渠道、货物类型、进口国家等因素而异,下面我们将详细介绍纺织品进口清关的相关收费情况。

纺织品进口清关收费概述

收费项目

纺织品进口清关的收费主要包括以下几个项目:

(1)关税:根据货物的种类和价值,按照相应的税率计算。

(2)增值税:根据货物类型和进口国家规定,按照规定的税率计算。

(3)清关费用:包括但不限于报关费、检验费、仓储费等。

收费标准

收费标准因多种因素而异,包括进口渠道、货物类型、进口国家等,进口渠道不同,收费标准也会有所不同,不同国家和地区的政策也会对收费标准产生影响。

在一些发达国家,纺织品进口清关的收费相对较高,主要原因是这些国家对进出口商品有一定的监管和税收政策,而在一些发展中国家或地区,由于政策相对较为宽松,纺织品进口清关的收费可能会相对较低。

案例分析

下面我们通过一个具体的案例来详细说明纺织品进口清关的收费情况。

某纺织品进口公司进口一批价值较高的纺织品,经过多个国家的清关程序,根据不同的进口渠道和货物类型,该公司的清关费用有所不同,关税和增值税按照相应的税率计算,而清关费用包括报关费、检验费、仓储费等,根据该公司的实际情况,该批货物的清关费用预计在人民币XX万元左右。

英文表格说明

以下是英文版本的表格,用于详细说明纺织品进口清关的相关收费情况:

| 收费项目 | 具体金额(人民币) | 说明 |

|---|---|---|

| 关税 | 根据货物的种类和价值 | 根据不同的进口渠道和货物类型而定 |

| 增值税 | 根据货物类型和进口国家规定 | 根据不同的进口国家和地区的政策而定 |

| 清关费用 | 报关费、检验费、仓储费等 | 根据具体的清关程序和实际情况而定 |

| 平均收费标准 | 根据具体情况而定 | 由于多种因素影响,具体金额可能有所不同 |

纺织品进口清关的收费情况因多种因素而异,包括进口渠道、货物类型、进口国家等,在具体操作中,建议进出口企业根据实际情况进行咨询和了解,以便更好地掌握清关费用情况,进出口企业也应该注意遵守相关法律法规,确保清关过程的顺利进行。

Articles related to the knowledge points of this article:

The Story of Wuxi Yingfeng Textiles

The Journey of Exquisite Durable Textiles an Insight into 秀力达纺织品