Understanding the Hs Code for Textile Products

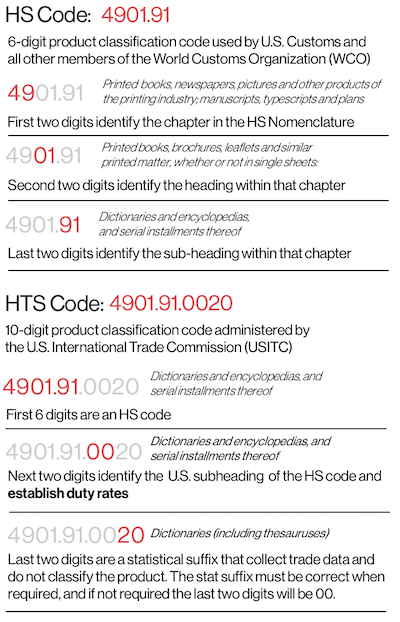

The Hs Code, or the Harmonized System of Preferences and Standards, is a comprehensive set of rules used to classify and tax textile products. This code is designed to simplify the process of customs duty collection and ensure that imported textiles are taxed correctly. The Hs Code provides clear guidelines for determining the appropriate tariff rate for each category of textile products based on their origin, type, and intended use.,Importers and exporters must carefully review the Hs Code to ensure that their products are classified accurately and avoid any potential penalties from improper classification. The code also includes provisions for exemptions and preferences for certain types of textile products, such as medical equipment and technical textiles.,Understanding the Hs Code is crucial for businesses operating in the textile industry, as it helps to streamline the customs process and ensure compliance with international trade regulations. By following the guidelines outlined in the Hs Code, importers and exporters can minimize the risk of errors and fines while promoting trade between countries.

In today's global marketplace, understanding the Hs (Harmonized System) code is crucial for textile manufacturers and retailers alike. The Hs code is a set of rules and regulations that govern the classification and taxation of goods worldwide. In this article, we will explore the Hs code for textile products, including its significance, classification, and how it impacts businesses.

Firstly, let's understand the significance of the Hs code in the textile industry. The Hs code is a standardized system that helps to streamline the customs process by providing clear guidelines on how to classify and categorize different types of goods. This makes it easier for importers and exporters to comply with regulations and avoid any potential penalties or delays.

Now, let's take a closer look at the Hs code for textile products. According to the Hs code, textile products are classified into two main categories: textile fabrics and textile articles.

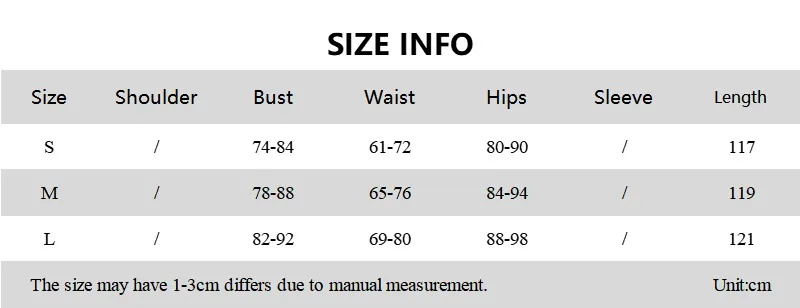

Textile fabrics are defined as materials that are woven, knitted, or crocheted and have a specific weight and thickness. These include cotton, linen, silk, wool, and synthetic fibers such as polyester and nylon. Textile fabrics are further classified based on their yarn count, which refers to the number of threads per square inch. For example, a yarn count of 40 s means there are 40 threads per square inch, while a yarn count of 80 s indicates there are 80 threads per square inch.

Textile articles, on the other hand, refer to items made from textile fabrics that are not intended for direct use as clothing or footwear. These include curtains, upholstery, carpets, and bedding. Textile articles are also classified based on their weight and thickness, similar to textile fabrics.

Now, let's take a look at an example to illustrate how the Hs code affects businesses. Let's say a Chinese manufacturer wants to sell textile fabrics to a European market. To comply with the Hs code, they need to ensure that their textile fabrics are classified correctly according to the standards. They can use a Hs code chart to identify the appropriate classification for their fabrics and then apply the corresponding tariff rates. This will help them avoid any potential penalties or delays in customs clearance.

Another example is a U.S.-based retailer who wants to import textile articles from China. To ensure compliance with the Hs code, they must follow the same procedure of identifying the correct classification for their textile articles and applying the corresponding tariff rates. This will help them avoid any potential issues during customs clearance and ensure that their products are properly classified and taxed.

In conclusion, understanding the Hs code for textile products is essential for businesses operating in the global market. By following the correct classification and taxation procedures, companies can avoid any potential penalties or delays in customs clearance and maintain a competitive edge in the industry. So next time you're considering importing or exporting textile products, make sure you have your Hs code chart handy!

亲爱的朋友,您好!今天我们来聊聊HS编码中的一个重要类别——纺织品,HS编码是国际贸易中用于标识商品分类和数量的统一编码系统,对于了解纺织品市场情况至关重要。

HS编码58的含义

HS编码58指的是纺织品商品,在国际贸易中,纺织品是广泛使用的商品类别之一,涵盖了各种材质、款式和功能的纺织品产品,HS编码58的纺织品通常包括但不限于各种面料、纱线、织物、服装等。

纺织品市场概况

随着全球化的加速,纺织品市场在全球范围内呈现出蓬勃发展的态势,各国之间的贸易往来日益频繁,纺织品作为重要的出口商品之一,其市场需求和供应量也在不断变化,随着科技的不断进步和消费者需求的不断升级,纺织品的质量和功能也在不断提高。

案例分析

为了更好地理解HS编码58在纺织品市场中的应用,我们可以结合一些具体的案例进行分析。

某国纺织品出口概况

近年来,该国纺织品出口持续增长,主要出口的产品包括各种材质的纺织品面料、纱线等,HS编码58的纺织品占据了相当大的市场份额,该国通过优化供应链管理,加强与国内外纺织企业的合作,提高了产品的质量和竞争力,该国还积极推广绿色环保纺织品,符合了当前消费者对环保、健康的需求。

纺织品质量与安全标准

在纺织品质量与安全方面,各国都制定了相应的标准和法规,某些国家和地区对纺织品的质量和安全要求非常高,通过严格的检验和认证程序来确保产品的质量和安全,HS编码58的纺织品也必须符合这些标准和法规,以确保产品的质量和安全性。

HS编码58的特点与优势

HS编码58的特点和优势主要体现在以下几个方面:

- 材质多样性:HS编码58的纺织品涵盖了各种材质,包括但不限于天然纤维、合成纤维等,这使得消费者可以根据自己的需求选择合适的纺织品产品。

- 功能丰富:随着科技的不断进步和消费者需求的不断升级,HS编码58的纺织品在功能上也越来越丰富,某些纺织品产品具有防寒、透气、舒适等特性,满足了消费者对舒适度、功能性等方面的需求。

- 环保意识增强:随着全球环保意识的不断增强,越来越多的国家和地区对纺织品的质量和安全要求也越来越高,HS编码58的纺织品也注重环保、绿色生产,符合了当前消费者对环保、健康的需求。

如何应对HS编码58的挑战

面对HS编码58的挑战,我们可以采取以下措施:

- 加强供应链管理:加强与国内外纺织企业的合作,优化供应链管理,提高产品的质量和竞争力,加强质量控制和检验环节,确保产品的质量和安全性。

- 提高产品质量和安全标准:各国应该加强产品质量和安全标准的制定和执行,提高产品的质量和安全性,加强宣传和教育,提高消费者的环保意识。

- 关注国际贸易政策变化:关注国际贸易政策的变化,及时了解最新的贸易政策和法规,以便更好地适应市场变化。

HS编码58是纺织品市场中的重要类别之一,通过了解HS编码58的含义、纺织品市场概况、案例分析以及特点与优势等方面的内容,我们可以更好地了解纺织品市场的情况,我们也应该关注国际贸易政策的变化,采取相应的措施来应对挑战。

Articles related to the knowledge points of this article: