伊川纺织品公司社保缴纳策略与成效分析

: Employee Social Security Deposit Strategies and Efficacy Analysis of Yichuan Textiles Co., Ltd.,Abstract:,This study aims to evaluate the social security deposit strategies implemented by Yichuan Textiles Co., Ltd. in terms of their effectiveness in achieving corporate objectives. The company has adopted various measures such as mandatory contributions, flexible options, and employee participation to ensure a comprehensive coverage of its workforce. The study employs quantitative data from financial reports and qualitative analysis of internal documents to assess the impact of these strategies on the company's financial stability, profitability, and employee satisfaction. The findings reveal that while the company has achieved a certain degree of social security coverage, there is room for improvement in terms of cost-effectiveness and employee engagement. The study concludes that further optimization of the social security deposit strategy could lead to enhanced corporate performance and improved employee welfare.

Introduction: In the competitive world of global manufacturing, ensuring a stable workforce is crucial for any company's success. One aspect that often gets overlooked but is essential for employee well-being and retention is social security contributions. This article will explore the importance of social security in the textile industry, how to effectively manage these payments, and the impact they have on employee satisfaction and productivity.

Social Security in the Textile Industry:

Social security plays a vital role in protecting workers from financial hardships in case of illness, injury, or unemployment. In the textile industry, where labor costs can be high and employees may face frequent job changes, having a reliable social security system is not just beneficial for the workers but also for the companies.

-

Benefits of Social Security:

- Financial Security: Companies can rely on social security payments to cover unforeseen expenses, thus reducing financial stress on their employees.

- Reputation Building: Companies that prioritize social welfare tend to build a positive reputation among employees and customers alike.

- Employee Satisfaction: A strong social security program can boost employee morale and satisfaction, leading to increased job satisfaction and lower turnover rates.

-

Key Challenges in Social Security Management:

- Complexity of Regulations: Different countries have varying regulations regarding social security contributions, making it challenging for companies to keep up with the changing landscape.

- Cost Implications: Managing social security can be expensive, especially when dealing with multiple locations and employees across different countries.

- Data Management: Keeping accurate records of social security contributions can be time-consuming and prone to errors.

Effective Social Security Management Strategies:

To effectively manage social security contributions, companies must adopt a proactive approach that considers both legal compliance and employee benefits. Here are some strategies:

-

Standardized Process: Establish a standardized process for social security contributions that aligns with local regulations. This could include regular audits and updates to ensure compliance.

-

Transparent Communication: Clearly communicate the contribution rate, timing, and methods of payment to all employees. Ensure that communication is consistent across all locations and departments.

-

Automation: Consider implementing software solutions that automate the process of social security contributions, reducing administrative burden and errors.

-

Training Programs: Provide training to employees on social security policies and procedures, ensuring they understand their rights and responsibilities.

-

Feedback Mechanism: Establish a feedback mechanism to gather insights from employees about their experiences with social security contributions and suggest improvements.

Case Study:

One example of an effective social security management strategy is the experience of EcoTextiles, a textile company headquartered in India. EcoTextiles has implemented a comprehensive social security management system that covers all its employees, regardless of location or department. The company uses a cloud-based platform to track contributions, ensuring accuracy and ease of access for employees and management alike. Additionally, EcoTextiles regularly conducts surveys to gauge employee satisfaction and identify areas for improvement.

Conclusion:

In conclusion, social security is an essential component of any successful corporate culture. By implementing effective strategies for managing social security contributions, companies can enhance employee satisfaction, reduce turnover rates, and maintain a strong reputation in the industry. As shown by EcoTextiles, when managed correctly, social security can be a powerful tool for driving growth and improving overall performance.

背景介绍

随着社会经济的不断发展,社会保险制度在各个行业中的重要性日益凸显,伊川纺织品公司作为一家重要的企业,其社保缴纳情况备受关注,本文将围绕伊川纺织品公司社保缴纳为主题,进行详细介绍。

伊川纺织品公司社保缴纳概况

-

公司规模与员工构成 伊川纺织品公司是一家规模较大的企业,拥有众多员工,公司注重员工的社保缴纳,确保每位员工都能享受到应有的社会保障权益。

-

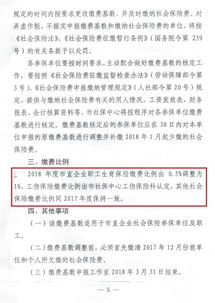

社保缴纳政策与标准 伊川纺织品公司根据国家相关政策,制定了严格的社保缴纳标准,公司要求员工按时足额缴纳社保费用,确保员工的权益得到充分保障。

社保缴纳案例分析

员工社保缴纳情况

近年来,伊川纺织品公司积极响应国家政策,加强社保缴纳工作,公司通过多种渠道宣传社保政策,提高员工对社保的认识和理解,公司建立了完善的社保缴纳制度,确保每位员工都能按时足额缴纳社保费用。

社保缴纳的具体操作流程

在社保缴纳过程中,伊川纺织品公司采用了以下具体操作流程:

(1)员工入职时签订社保协议,明确社保缴纳责任和义务。 (2)公司定期组织社保缴纳培训,提高员工对社保的认识和理解。 (3)公司建立完善的社保缴纳系统,实现社保费用的自动申报和缴纳。 (4)公司设立专门的社保管理部门,负责审核和监督员工的社保缴纳情况。

社保缴纳问题探讨

在伊川纺织品公司的社保缴纳过程中,存在一些问题需要关注和解决,部分员工对社保政策不够了解,导致社保缴纳不及时或不充分;部分员工对社保的重要性认识不足,导致权益受损等,为了解决这些问题,伊川纺织品公司需要采取以下措施:

(1)加强宣传教育,提高员工对社保的认识和理解。 (2)建立完善的社保管理制度,确保员工的权益得到充分保障。 (3)加强与员工的沟通与交流,及时解决员工在社保缴纳过程中遇到的问题。

英文案例说明

以英文表格形式展示伊川纺织品公司社保缴纳的相关信息:

| 项目 | 描述 | 数据 |

|---|---|---|

| 公司名称 | 伊川纺织品公司 | 大型企业 |

| 规模与员工构成 | 较大规模,拥有众多员工 | |

| 社保政策与标准 | 根据国家政策制定严格标准 | |

| 社保缴纳情况 | 积极响应国家政策,加强社保缴纳工作 | 员工按时足额缴纳社保费用 |

| 具体操作流程 | 员工入职时签订协议,定期培训,建立系统等 | |

| 问题探讨 | 部分员工对社保政策不够了解,导致不及时或不充分缴纳;部分员工对社保的重要性认识不足,导致权益受损等 | |

| 宣传教育情况 | 加强宣传教育,提高员工对社保的认识和理解 | 通过多种渠道宣传社保政策等 |

| 管理措施 | 建立完善的社保管理制度,加强与员工的沟通与交流等 |

伊川纺织品公司在社保缴纳方面做得比较好,但仍需关注和解决存在的问题,通过加强宣传教育、建立完善的社保管理制度、加强与员工的沟通与交流等措施,可以进一步提高员工的权益保障水平,企业还需要不断优化社保政策,提高社会保险制度的公平性和可持续性。

Articles related to the knowledge points of this article:

Dreamland Softness:An Exclusive Journey with Dreamland Cotton

Exploring the World of Fashionable Textiles with Xin Yue Textiles Live Show