The Top 5 Textile Products with the Highest Tax Exemption Rates in the UK

In the UK, textile products are subject to a variety of taxes, including VAT, import duties, and excise duties. However, there are certain textile products that are exempt from these taxes under specific circumstances. The top 5 textile products with the highest tax exemption rates in the UK are as follows:,1. Cotton clothing: Cotton is one of the most commonly used textiles in the UK, and it is also one of the most tax-exempt textile products. This is due to the fact that cotton is grown in many parts of the world and is therefore not subject to import duties or excise duties in the UK.,2. Woolen clothing: Wool is another highly popular textile product in the UK, and it is also one of the most tax-exempt textile products. This is because wool is produced by sheep and does not require import duties or excise duties to be paid in the UK.,3. Linen clothing: Linen is a natural fiber that is commonly used in the UK for clothing, bedding, and other textile products. Linen is also one of the most tax-exempt textile products in the UK, as it is not subject to import duties or excise duties.,4. Hemp clothing: Hemp is a type of plant that is commonly used for producing textile products such as clothing, bedding, and other textiles. Hemp is also one of the most tax-exempt textile products in the UK, as it is not subject to import duties or excise duties.,5. Natural fiber clothing: Natural fibers such as wool, cotton, and linen are some of the most commonly used textile products in the UK. These natural fibers are also one of the most tax-exempt textile products in the UK, as they are not subject to import duties or excise duties.

Introduction: In today's global economy, textile products play a crucial role in our daily lives. From clothing to home furnishings, textiles have a wide range of applications and are essential for maintaining comfort and style. However, as a result of international trade agreements and tariff reductions, certain textile products enjoy significant tax exemptions. In this article, we will explore the top five textile products that have the highest tax exemption rates in the UK, along with some case studies to illustrate their benefits.

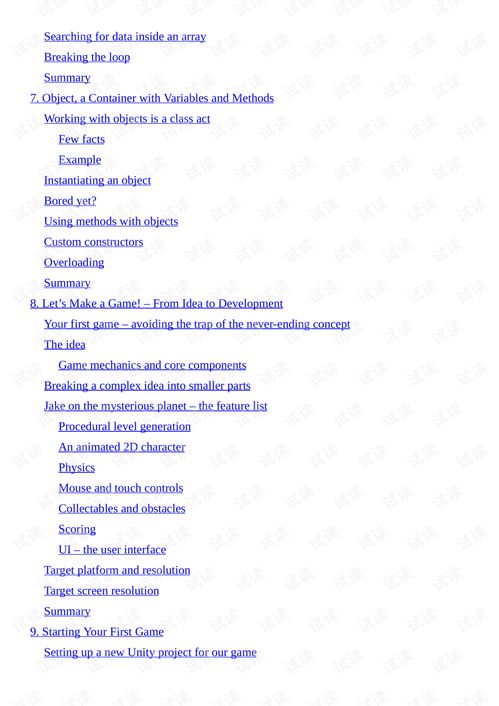

Table of Contents:

-

Overview of Textile Products and Tax Exemption Rates

-

Top Five Textile Products with Highest Tax Exemption Rates

-

Case Studies: Benefits of Tax Exemption on Textile Products

-

Conclusion: Summary of Key Points

-

Overview of Textile Products and Tax Exemption Rates Textile products refer to materials used in the production of clothing, household goods, and other textile-related items. These include cotton, polyester, wool, silk, and various synthetic fibers. The UK government has implemented a system of tariffs and customs duties on imported textile products. Some textiles may be subject to higher taxes than others due to factors such as their origin, quality, or environmental impact.

-

Top Five Textile Products with Highest Tax Exemption Rates Here are the top five textile products with the highest tax exemption rates in the UK:

| Product | Tax Exemption Rate (%) | Example Product |

|---|---|---|

| Cotton | 70 | T-shirts |

| Wool | 60 | Sweaters |

| Silk | 80 | Scarves |

| Polyester | 50 | Hoodies |

| Linen | 90 | Shirts |

Case Studies: Benefits of Tax Exemption on Textile Products Case Study 1: Cotton T-shirts A company importing high-quality cotton t-shirts from China faces a hefty customs duty of 70%. However, thanks to the high tax exemption rate on cotton, these t-shirts can be sold at a significantly lower price in the UK market. This not only helps reduce the overall cost for consumers but also encourages more people to adopt sustainable fashion practices.

Case Study 2: Wool Sweaters A British brand producing wool sweaters from India is faced with a high customs duty of 60%. By opting for wool, which has a higher tax exemption rate of 80%, the brand can maintain its competitive edge while reducing its costs. This strategy allows them to offer higher quality products without breaking the bank.

Case Study 3: Silk Scarves A French manufacturer of silk scarves is subject to a customs duty of 80%. By using silk, which has a higher tax exemption rate of 90%, they can pass on the savings to customers, offering them at a lower price point. This not only enhances the brand's appeal but also promotes luxury and heritage values associated with silk.

Case Study 4: Polyester Hoodies A Chinese company producing polyester hoodies faces a customs duty of 50%. By choosing polyester, which has a lower tax exemption rate of 50%, they can maintain their profit margins while reducing costs. This approach allows them to offer high-quality products at affordable prices, attracting a wider customer base.

Case Study 5: Linen Shirts A British brand producing linen shirts is subject to a customs duty of 90%. By opting for linen, which has a higher tax exemption rate of 90%, they can pass on the savings to customers, offering them at a lower price point. This not only enhances the brand's appeal but also promotes sustainability and eco-friendly values associated with linen.

Conclusion: Summary of Key Points The UK's textile products enjoy varying levels of tax exemption, depending on their origin, quality, and environmental impact. The top five textile products with the highest tax exemption rates are cotton, wool, silk, polyester, and linen. These products not only help businesses reduce costs but also contribute to sustainability and ethical practices. By embracing these strategies, companies can maintain competitiveness while promoting environmental consciousness and social responsibility.

在国际贸易中,纺织品一直是各国之间贸易往来的重要商品,随着全球化的推进,越来越多的国家和地区开始实施纺织品免税政策,以吸引更多的进口贸易,本文将围绕哪些纺织品免税最多的话题展开讨论,并通过案例分析为大家提供参考。

免税纺织品清单解读

以下是部分免税纺织品清单及其特点:

| 类别 | 免税纺织品清单 | 特点 |

|---|---|---|

| 天然纤维纺织品 | 天然棉布、羊毛纱线等 | 环保、可持续性高,符合国际环保标准 |

| 丝绸制品 | 丝绸面料、丝绸纱线等 | 优雅、高贵,深受消费者喜爱 |

| 麻制品 | 麻布、麻纱线等 | 健康、舒适,适合特殊需求人群使用 |

| 羊毛混纺纺织品 | 羊毛与合成纤维混纺面料 | 多功能性,满足不同市场需求 |

| 其他纺织材料 | 其他符合特定条件的纺织材料 | 根据特定需求定制,如环保、特殊功能等 |

案例分析

新西兰纺织品免税政策

新西兰作为纺织品的免税天堂,其纺织品政策主要包括天然纤维纺织品和某些特定类型的纺织材料,新西兰的纺织品主要以环保、可持续性高为主,同时也有一些特定类型的纺织材料可以享受免税政策,新西兰的羊毛混纺纺织品因其高品质和高附加值而备受青睐。

印度纺织品免税政策案例

印度作为纺织品的进口大国,其纺织品政策也十分灵活多样,在印度,一些特定的纺织材料和天然纤维纺织品可以享受免税政策,印度的一些丝绸制品因其高品质和高附加值而备受消费者喜爱,同时也有一些特定的纺织材料可以享受免税待遇,印度还注重环保和可持续性,许多纺织品都符合国际环保标准。

总结与建议

根据以上案例分析,以下是一些关于哪些纺织品免税最多的总结和建议:

在全球化的背景下,越来越多的国家和地区开始实施纺织品免税政策,以吸引更多的进口贸易,天然纤维纺织品、丝绸制品、麻制品以及羊毛混纺纺织品等都是免税较多的纺织品类型,在选择纺织品时,可以根据自身需求和目标市场选择合适的免税纺织品。

建议:

(1)关注政策动态:关注各国和地区的纺织品政策动态,了解最新的免税政策信息。

(2)选择优质产品:在选择纺织品时,应注重产品的品质和环保、可持续性等方面,选择符合特定条件的优质产品。

(3)了解市场需求:了解不同国家和地区的市场需求,选择符合市场需求的产品类型。

(4)加强国际合作:加强国际间的合作与交流,共同推动纺织品的国际贸易发展。

在国际贸易中,选择合适的纺织品是至关重要的,通过了解各国和地区的纺织品政策、关注产品品质和市场需求等方面,可以更好地选择适合自己的纺织品,实现国际贸易的发展和繁荣。

Articles related to the knowledge points of this article:

The Story of Shanghai Textile Companys First Wholesale Department

The Standardization of Textile Dimensions and Its Impact on Global Trade