Understanding Taxes on Exporting Textiles:A Comprehensive Guide

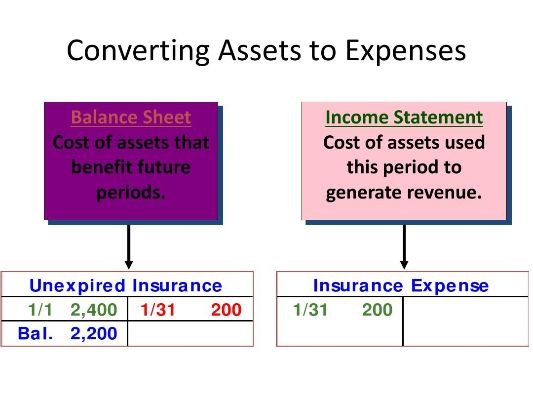

: An Overview of Taxes on Textile Exports,Introduction:,Textile exports are a significant part of many countries' economies, contributing to their foreign exchange earnings and job creation. However, the process of exporting textiles is not without its challenges, particularly regarding taxation. This comprehensive guide aims to provide an understanding of the taxes applicable to textile exports, including tariffs, value-added tax (VAT), and other relevant taxes.,Tariffs:,Tariffs are taxes imposed by customs authorities on imported goods. The imposition of tariffs can significantly impact the cost of textile exports, as they are often subject to higher tariff rates than domestically produced goods. This can result in increased prices for consumers, which may affect market demand and competitiveness.,Value-Added Tax (VAT):,VAT is a consumption tax that is typically levied on the price of goods and services. In the case of textile exports, VAT is applied at the point of entry into the destination country. The amount of VAT charged depends on the tariff rate and the specific legislation of the importing country. It is important for exporters to be aware of the VAT rates and regulations in their target markets to avoid unexpected costs.,Other Taxes:,In addition to tariffs and VAT, there may be additional taxes such as excise duties, environmental taxes, and local content requirements. These taxes can also have a significant impact on the overall cost of textile exports. For example, environmental taxes may be imposed on certain textile products to discourage the use of hazardous chemicals or excessive water usage. Local content requirements may require exporters to source materials from domestic producers to meet certain standards.,Conclusion:,Understanding the taxes applicable to textile exports is crucial for successful international trade. Exporters need to be familiar with the tariff and VAT rates in their target markets, as well as any additional taxes or requirements. By doing so, they can effectively manage their tax obligations and ensure compliance with international trade regulations.

Hello everyone, today I will be discussing a crucial topic for any business owner exporting textiles - the need to pay taxes when exporting goods. This is an important aspect of international trade that affects both the profitability of your business and compliance with local and international regulations. Let's dive into the intricacies of this topic.

Firstly, it's essential to understand what constitutes "exporting" textiles. In simple terms, exporting refers to the process of sending goods from one country to another, usually for sale or use abroad. For textiles, this could mean sending fabrics, clothing, or other textile products to markets in countries like the United States, Europe, or Asia.

Now let's talk about the taxes involved. When exporting textiles, you are required to register as a foreign-trader with your local government. This registration process is typically done through the International Trade Administration (ITA) or similar agencies in your country. Once registered, you can then start exporting goods legally.

One common tax that businesses exporting textiles face is tariffs. Tariffs are taxes imposed by governments on imported goods, designed to protect domestic industries and promote domestic production. If you're exporting textiles to a country with a tariff, you may have to pay these additional taxes before they can enter the market.

Another tax consideration is customs duties. Customs duties are taxes levied at the border of a country by customs authorities upon the entry of goods into their territory. These duties can vary widely depending on the type of textiles you're exporting, the value of the goods, and the destination country's customs regulations.

To illustrate this point, consider the case of a company exporting high-end silk scarves to the United States. The US has a complex set of tariffs and customs duties for textiles, which can add up quickly. For example, if the cost of the scarves is $50 each, and the company has to pay a 10% tariff, the final price for the American consumer would be $55 per scarf. That's just for the tariff alone!

In addition to tariffs and customs duties, there are also other taxes and fees that can apply when exporting textiles, such as value-added tax (VAT), which is a consumption tax typically levied by European Union member states. Some countries may also impose environmental taxes or fees for certain types of textiles, depending on their environmental policies and regulations.

It's important to note that these taxes can significantly impact your bottom line, so it's essential to stay informed about changes in tax laws and regulations. You should also consult with a tax expert or accountant who specializes in international trade to ensure that you are complying with all applicable laws and regulations.

In conclusion, exporting textiles is not only a significant part of many businesses but also involves paying taxes. It's crucial to understand the different types of taxes that apply and how they affect your business operations. By staying informed and complying with all relevant laws and regulations, you can ensure a smooth and profitable exporting experience. Thank you for listening, and I hope this guide was helpful!

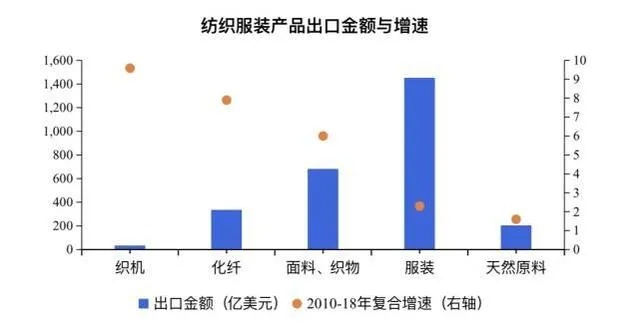

背景介绍

大家好!今天我们来探讨一下出口纺织品是否需要交税的问题,在国际贸易中,税收是一个重要的环节,对于出口纺织品来说也不例外。

出口纺织品税收概述

出口纺织品税收主要涉及到关税和增值税两个方面的规定,根据相关法律法规,出口纺织品需要按照一定的税率缴纳相应的税费,具体税率可能因国家和地区而异,出口纺织品都需要按照一定的比例缴纳税费。

出口纺织品税收案例说明

以一个具体的案例来说明出口纺织品税收的情况,假设某国家对出口纺织品征收的税率较高,那么出口纺织品就需要按照更高的税率缴纳税费,如果出口纺织品涉及到进口环节的增值税,那么还需要额外缴纳增值税税款。

出口纺织品是否需要交税的具体情况分析

- 出口纺织品是否需要交税取决于出口地和进口地的税收政策,不同国家和地区对于出口纺织品税收的规定可能存在差异,需要根据具体情况来判断。

- 对于一般出口纺织品来说,需要按照规定的税率缴纳税费,但具体的税率可能因产品类型、质量、品牌等因素而有所不同。

- 在实际操作中,出口纺织品需要提供相关的税务证明文件,如出口报关单、税务登记证等,以便税务部门进行核实和征收税费。

出口纺织品是否需要交税取决于出口地和进口地的税收政策以及具体情况,在国际贸易中,出口纺织品需要遵守相关法律法规,按照规定的税率缴纳税费,出口纺织品还需要提供相关的税务证明文件,以便税务部门进行核实和征收税费。

为了更好地了解出口纺织品税收情况,我们可以参考一些相关的税务政策文件和案例,一些国家和地区对于出口纺织品的税收规定可能会在官方网站上发布,我们可以查阅相关文件了解具体规定,我们也可以参考一些成功的出口纺织品案例,了解不同国家和地区的税收政策和实际操作情况。

我们还可以通过一些渠道了解最新的税收政策和法规变化情况,以便更好地了解出口纺织品税收情况,我们可以关注一些国际贸易论坛、海关官网等渠道获取最新的税收政策和法规信息。

出口纺织品需要交税是一个普遍存在的现象,我们需要遵守相关法律法规,按照规定的税率缴纳税费,我们也需要了解最新的税收政策和法规变化情况,以便更好地进行国际贸易活动。

Articles related to the knowledge points of this article:

Underwater Lint Removal:The Process of Textile Processing

Unlocking the Benefits of EPR Compliance for French Textile Exporters

Textile Waterproof Testing Standards and Recommended Practices

Understanding the Differences between Textile Industry and Textile Products