The Impact of Chinas Imported Textile Tariffs on Global Trade

: The Impact of China's Imported Textile Tariffs on Global Trade,Abstract:,China's recent increase in import tariffs on textile products has sparked a global trade debate. This policy, aimed at protecting domestic industries and reducing the impact of foreign competition, has been met with mixed reactions from other countries. Some have criticized it as an unfair trade practice that could harm their own economies, while others have welcomed the move as a necessary step towards greater economic security. This paper explores the potential implications of this policy for global trade dynamics, including its impact on international supply chains, market share, and trade negotiations. It argues that while China's actions may be driven by domestic concerns, they also raise important questions about the role of trade policies in shaping global economic relations.

Introduction: In recent years, the Chinese government has implemented a series of tariffs on imported textiles, which have had a significant impact on global trade. This article will explore the effects of these tariffs on imported textiles and how they affect both buyers and sellers in the global textile market.

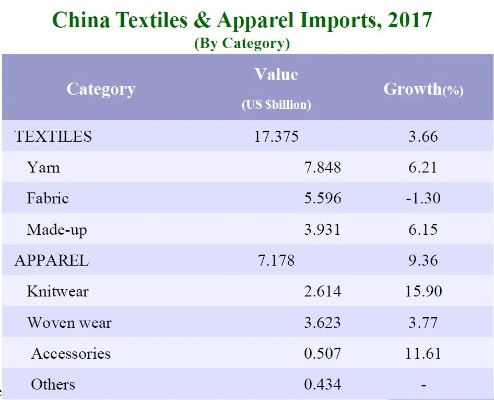

Impact on Imported Textiles: The implementation of imported textile tariffs has caused a significant increase in the cost of imported textiles. According to a study by the World Trade Organization (WTO), the average tariff rate for imported textiles in China has increased from 10% to 25% over the past five years. This has resulted in higher prices for consumers in developed countries, as well as reduced demand for imported textiles in China.

In addition to increasing costs, the tariffs also have an impact on the quality of imported textiles. As tariffs are imposed on imported goods, manufacturers may be forced to reduce production or invest in alternative materials that are less expensive. This can result in lower quality products being produced, which may not meet the standards of buyers in developed countries.

Effects on Buyers: Importers of imported textiles face several challenges due to the implementation of tariffs. Firstly, they must pay higher prices for imported textiles, which can lead to increased costs for their products. Secondly, they may need to invest in alternative materials or production methods to meet the quality requirements of buyers in developed countries. Finally, they may face reduced demand for their products due to the increased cost and quality of imported textiles.

Effects on Sellers: On the other hand, exporters of imported textiles may benefit from the implementation of tariffs. By reducing the price of imported textiles, exporters can increase their profit margins and attract more customers. Additionally, they may be able to offer better quality products at a lower price than those offered by importers in developed countries. However, this may also lead to increased competition among exporters, as they may need to lower their prices even further to remain competitive.

Case Study: One example of the impact of imported textile tariffs is the case of a company in the United States that produces clothing using imported fabrics. The company initially faced increased costs due to the implementation of tariffs, which led to a decline in demand for its products. However, the company was able to adapt by investing in alternative materials or production methods, which improved the quality of its products. As a result, demand for its products increased, and the company was able to recover its losses and even make a profit.

Conclusion: In conclusion, the implementation of imported textile tariffs has had a significant impact on global trade. These tariffs have increased the cost of imported textiles, reduced demand for imported textiles in China, and affected buyers and sellers in the global textile market. However, some companies have been able to adapt by investing in alternative materials or production methods, which have helped them overcome these challenges and continue to thrive in the global textile market.

近年来,随着中国经济的快速发展和对外贸易的持续扩大,进口纺织品已成为我国对外贸易的重要组成部分,本文将重点关注中国进口纺织品税金的相关情况,通过英文案例说明来进一步阐述。

中国进口纺织品税金概述

进口纺织品税金构成

进口纺织品税金主要包括关税、增值税和其他相关费用,关税是根据进口货物的价值征收的,增值税则是对进口商品在销售环节产生的增值部分征收的税种,还包括运输、保险等其他费用。

税率与政策变化

近年来,中国政府对进口纺织品税金政策进行了多次调整,以适应国内外市场环境的变化,降低部分商品的关税水平,提高进口商品的品质和附加值等,政府还出台了一系列鼓励进口的政策,以促进国内纺织行业的健康发展。

案例分析

以某品牌进口纺织品为例,详细说明其进口纺织品税金情况。

进口纺织品概况

该品牌进口的纺织品来自多个国家和地区,涵盖了各种材质和款式,其进口税率根据不同商品类型和品质有所差异。

税金构成及计算方法

该品牌进口的纺织品税金主要包括关税、增值税和其他相关费用,关税是根据进口货物的价值征收的,增值税则是根据进口商品的增值部分征收的,具体计算方法为:关税金额 = 进口货物价值 × 税率,该品牌还需支付运输、保险等其他费用。

政策变化与影响

近年来,该品牌所进口的纺织品税金政策经历了多次调整,降低部分商品的关税水平,提高进口商品的品质和附加值等,这些政策变化对企业的经营和发展产生了积极的影响,降低了成本,提高了市场竞争力;提高了产品质量和附加值,增加了企业的利润空间等。

中国进口纺织品税金是衡量一个国家对外贸易状况的重要指标之一,随着国内外市场环境的不断变化,中国政府对进口纺织品税金政策也进行了多次调整,企业也需要根据政策变化和市场需求的变化,调整自身的经营策略和发展方向。

在今后的国际贸易中,中国将继续加强与世界各国的贸易合作,扩大进口规模,提高进口品质和附加值,企业也需要加强自身的国际竞争力,提高产品质量和品牌知名度,以适应国内外市场的变化。

中国进口纺织品税金是一个复杂而重要的领域,企业需要密切关注国内外市场环境的变化,及时调整自身的经营策略和发展方向,以应对国际贸易的挑战和机遇。

Articles related to the knowledge points of this article:

The Ugandan Textile Market A Global Perspective and Regional Insights

The Ultimate Guide to Choosing the Best Materials for Your Fashion Needs

The Global Trends and Influence of British Textile Sales in India