Invoicing for Textile Products:A Comprehensive Guide

Introduction: Textile products, such as clothing, home textiles, and industrial fabrics, are an integral part of our daily lives. When it comes to invoicing these products, it's essential to understand the different factors that can affect the process. In this guide, we will explore the intricacies of textile product invoicing, including the basics, common challenges, and practical solutions. By the end of this guide, you will have a clear understanding of how to invoice textile products effectively.

I. Basics of Textile Product Invoicing

A. What is an Invoice? An invoice is a document that outlines the details of a sale or purchase, including the product(s) sold, quantity, price, and any other relevant information. It serves as proof of payment and is essential for both the seller and the buyer.

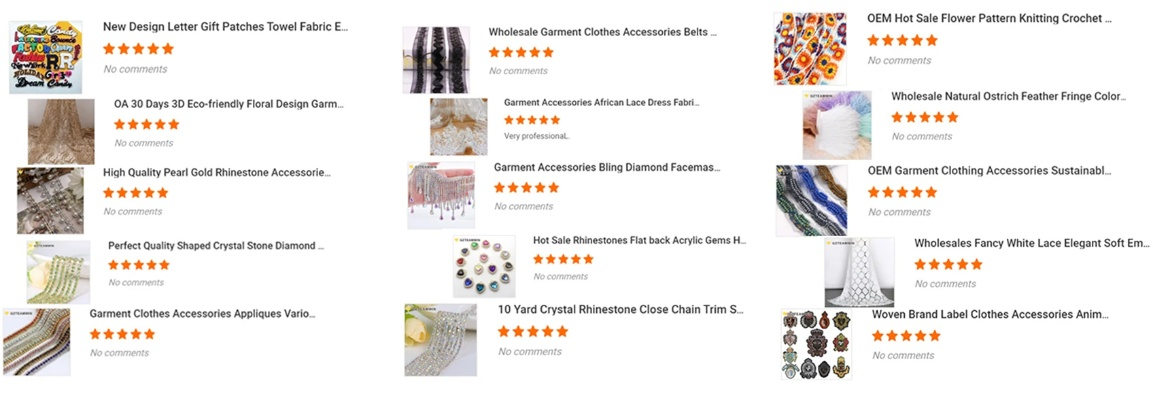

B. Types of Textile Products There are various types of textile products, each with its own unique selling points and pricing structure. Here are some common examples:

-

Clothing: This includes shirts, pants, dresses, jackets, etc. The cost of clothing can vary depending on the material, design, and brand.

-

Home Textiles: These include blankets, curtains, pillows, towels, etc. The cost of home textiles can be influenced by the type of fabric, size, and quality.

-

Industrial Fabrics: These are used in various industries, such as construction, manufacturing, and transportation. The cost of industrial fabrics can be determined by the thickness, density, and durability of the material.

C. Invoicing Process The invoicing process for textile products involves several steps:

-

Determine the Cost: Before invoicing, it's essential to determine the cost of the product based on its materials, production time, and labor costs.

-

Calculate the Price: Once the cost is determined, calculate the final price by adding the cost of materials, labor, and any other applicable taxes or fees.

-

Create the Invoice: Using the calculated price, create an invoice that includes all the necessary information, such as the product description, quantity, price, and payment terms.

-

Send the Invoice: Once the invoice is ready, send it to the buyer or customer for payment.

II. Common Challenges in Textile Product Invoicing

A. Unclear Pricing: One of the most common challenges in textile product invoicing is unclear pricing. This can arise from inaccurately calculating the cost of materials or labor or from using outdated pricing methods. To overcome this challenge, it's essential to use accurate pricing tools and regularly review and update your pricing strategy.

B. Lack of Standardization: Another challenge is the lack of standardization in textile product invoicing. Different manufacturers may use different pricing models and calculation methods, which can make it difficult to compare prices and negotiate terms with buyers. To address this challenge, it's important to establish industry-wide standards and promote best practices for invoicing.

C. Complexity in Documentation: The documentation required for textile product invoicing can be complex, especially when dealing with bulk orders or international transactions. This complexity can lead to errors and delays in processing payments. To simplify this process, it's essential to streamline the documentation process by using electronic invoices, clear labeling, and clear communication with customers about their rights and responsibilities.

III. Practical Solutions for Textile Product Invoicing

A. Use Precise Pricing Tools: To ensure accurate pricing, it's essential to use precise pricing tools that can accurately calculate the cost of materials, labor, and other expenses. These tools can help identify potential discrepancies and provide insights into cost trends over time.

B. Standardize Invoicing Methods: Manufacturers should strive to standardize their invoicing methods to ensure consistency across different regions and countries. This can help reduce confusion and improve the efficiency of the invoicing process.

C. Simplify Documentation: To streamline the documentation process, manufacturers should use clear labels and clear communication with customers about their rights and responsibilities. This can help reduce errors and ensure timely payment processing.

IV. Case Study: Successful Textile Product Invoicing

A. Company Name: ABC Textiles Ltd.

B. Problem: Unclear pricing and complex documentation led to delayed payments and decreased customer satisfaction.

C. Solution: ABC Textiles implemented a new pricing system that used accurate data and established clear communication channels with customers to ensure clarity and transparency in pricing. They also adopted electronic invoices and provided clear labeling for easy identification of products and quantities.

D. Results: The new pricing system and improved documentation processes significantly improved the efficiency of the invoicing process and reduced the incidence of errors and delays in payment processing. As a result, customer satisfaction increased and cash flow improved, leading to increased sales and profitability for ABC Textiles Ltd.

Conclusion: In conclusion, textile product invoicing is an essential aspect of running a successful business. By understanding the basics of invoicing, identifying common challenges, and implementing practical solutions, businesses can streamline their invoicing process and improve their bottom line. By following the guidelines outlined in this guide, businesses can effectively invoice textile products and build strong relationships with their customers.

在今天的对话中,我们围绕“纺织品是否需要开票”这一主题展开讨论,下面是一篇英文口语化内容,结合表格和案例说明,以便更好地理解。

背景信息

对话者A:你好,我想了解一下关于纺织品是否需要开票的问题。

对话者B:纺织品销售确实需要开票,这是商业交易的基本要求。

开票原因及流程

开票原因

开票是确保财务记录准确、合规的必要步骤,对于纺织品销售来说,开票可以确保销售数据的完整性和可追溯性,便于财务核算和税务申报。

开票流程

开票流程通常包括以下几个步骤:

(1)客户下单:销售方收到订单后,确认订单信息并开具发票。

(2)发票开具:根据订单信息,销售方开具正式发票,发票应包含产品名称、数量、单价、总价等信息。

(3)提交税务申报:将发票提交给当地税务部门进行申报。

案例说明

小明在某大型商场购买了纺织品,并要求开具发票,商场工作人员根据规定为其开具了发票。

小红在电商平台购买了纺织品,平台提供了便捷的在线开票服务,消费者只需在购买时选择开票选项,平台即可自动生成发票并发送给消费者。

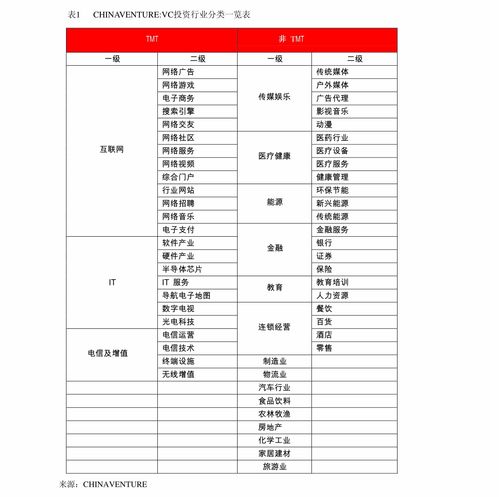

补充说明表格内容

以下是关于纺织品开票的相关表格内容:

| 序号 | 术语解释 | |

|---|---|---|

| 1 | 开票定义 | 开票是商业交易中确保财务记录准确、合规的必要步骤 |

| 2 | 纺织品开票需求 | 纺织品销售需要开票,这是商业交易的基本要求 |

| 3 | 开票流程 | 客户下单→销售方确认订单信息并开具发票→提交税务申报 |

| 4 | 开票案例一 | 小明在大型商场购买纺织品并要求开具发票,商场工作人员根据规定为其开具了发票 |

| 5 | 开票案例二 | 在电商平台购买纺织品,平台提供了便捷的在线开票服务,消费者只需在购买时选择开票选项,平台即可自动生成发票 |

总结与建议

纺织品销售确实需要开票,这是商业交易的基本要求,开票可以确保销售数据的完整性和可追溯性,便于财务核算和税务申报,电商平台提供了便捷的在线开票服务,消费者可以方便快捷地完成开票操作,对于商家来说,应该遵守相关法律法规,确保开票流程的合规性和准确性,对于消费者来说,也应该了解并遵守相关法律法规,确保开票的合法性和有效性,建议商家和消费者加强沟通与合作,共同促进商业交易的健康发展。

Articles related to the knowledge points of this article:

Top 10 Fashionable Needlework and Textile Brands for Home Decor

The Art of Textiles:A Visual Exploration

The Global Fabrics of Shenzhen:A Look at the International Textile Market