The Impact of the 17%Cotton Content Tax on Fashion Industry

The introduction of a 17% cotton content tax in the fashion industry has had a significant impact on global trade, leading to increased prices and reduced supply. This has caused a shift towards more sustainable alternatives like organic cotton, promoting environmentally-friendly practices. Furthermore, the tax has led to an increase in demand for fair-trade clothing, as consumers seek out products that support ethical production methods. Additionally, the impact of the tax has been felt across various sectors, including apparel retailers, manufacturers, and distributors. Overall, it is clear that this measure has had both positive and negative effects on the fashion industry, with many companies exploring new strategies to navigate the challenges presented by the tax.

Introduction: The textile industry, particularly the cotton sector, is a vital part of global economic growth, providing essential materials for apparel and household products. However, the recent introduction of a 17% tax on cotton content in many countries has raised significant debate about its potential impacts on the fashion industry, consumers, and the broader economy. In this article, we will explore these implications through an analysis of the effects on production, pricing, consumer behavior, and market dynamics. Additionally, we will examine how these changes may affect the supply chain, labor practices, and the environment.

Production Costs & Quality Control: The increased tax burden on cotton means that manufacturers may have to increase their costs by up to 20%-30% depending on the country's tax rate and other factors like transportation and labor costs. These higher costs could lead to reduced profit margins, which could be passed on as higher prices in the market. This could potentially reduce the quality and durability of clothing, leading to a decline in brand reputation and customer trust.

In response, some manufacturers might opt for more sustainable or eco-friendly methods of production to offset the increased expenses. Others might choose to cut back on production, reducing competition and potentially driving down prices. However, this could also lead to lower product availability due to reduced production volumes.

Pricing and Consumer Sentiment: As with all taxes, the price of goods increases in line with the added cost. This could mean that consumers end up paying more for clothes that are less durable or high-quality. It is crucial for companies to communicate this shift to customers effectively, highlighting any potential benefits of their products while explaining the increased prices associated with the new tax.

However, the long-term effect of this tax on the fashion industry remains uncertain. Some analysts believe that it could lead to an increase in demand for high-end and luxury items, which are often made from higher quality materials and come with premium features. Others worry that consumers might switch towards cheaper alternatives, causing a shift in the market towards mass-produced generic clothing.

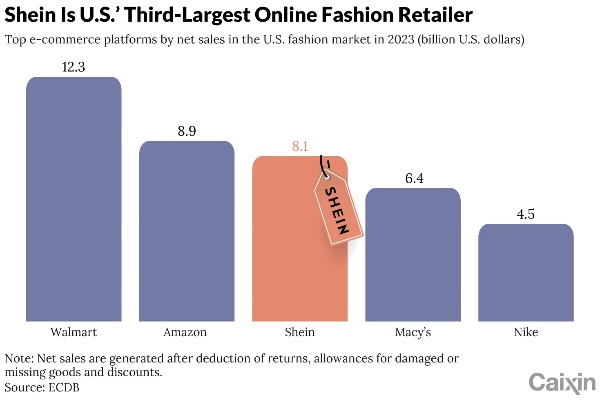

Market Dynamics & Globalization: The impact of the cotton content tax on globalization depends on how countries react to this change. If countries impose similar taxes on other textile products, this could limit the competitive landscape and drive up costs globally. This would likely lead to a decrease in imports, especially if there is a lack of alternative suppliers or if the tax is applied uniformly across all countries involved in international trade.

Alternatively, if countries implement differentiated taxes or provide exemptions for certain categories of textile products, the overall impact could be lessened. This flexibility could allow businesses to adjust their strategies accordingly, taking advantage of opportunities while mitigating potential risks.

Labor Practices: The increased costs of producing higher-quality cotton goods could also impact labor standards within the industry. Companies might seek to reduce their workforce or increase productivity through automation, potentially leading to lower wages or fewer job opportunities. This could be a double-edged sword; while it could benefit workers in terms of higher salaries, it could also lead to a decrease in overall employment and a loss of skilled labor.

Environmental Impact: The increased demand for higher-end cotton products could also impact the environmental footprint of the sector. High-quality textiles often come from organic cotton, which can be produced sustainably and have a smaller environmental impact compared to conventional cotton production. As demand for high-quality clothing grows, so too might the demand for organic cotton, potentially leading to a shift towards sustainable production practices.

On the other hand, the increased production costs of higher-quality cotton goods could lead to the use of harmful chemicals or pesticides in the production process, further contributing to environmental degradation. Therefore, businesses must find ways to balance cost-effectiveness and sustainability to ensure they remain competitive in the long run.

Conclusion: The implementation of a 17% tax on cotton content in various countries has sparked a range of discussions and concerns about the future of the fashion industry. While it is clear that this tax will add to production costs and potentially affect consumer choices, the true impact remains to be seen. Companies must carefully monitor these changes and adapt their strategies to remain competitive and profitable amidst shifting market demands. Ultimately, the success of these industries will depend on how they respond to these challenges and find innovative solutions that balance sustainability, quality, and affordability for all stakeholders.

随着纺织业的快速发展,纺织品中的棉成分成为了市场上的重要组成部分,纺织品棉成分税的调整引起了广泛关注,我们将围绕这个主题展开讨论。

纺织品棉成分税概述

纺织品棉成分税是指对纺织品中棉成分的征收的一种税收政策,根据最新的政策规定,棉成分税率为17%,这一税率反映了纺织品的成本结构和市场需求。

纺织品棉成分税的影响分析

- 成本压力:纺织品棉成分税的提高意味着纺织品的生产成本增加,对于生产商来说,需要承担更高的成本压力,以确保产品的竞争力。

- 市场反应:随着税率的提高,纺织品的市场价格也可能相应上涨,消费者在购买时需要权衡成本和价格,以做出明智的购买决策。

- 行业影响:纺织行业的健康发展需要综合考虑多种因素,税率的变化可能会对行业结构、产业链、供应链等方面产生影响。

案例分析

以某地区为例,近年来纺织品棉成分税的调整对其纺织业产生了深远影响,该地区纺织业在税率调整前后的表现如下:

- 调整前情况:在该地区,纺织品的原材料主要来源于棉花种植,由于棉花的种植成本较高,因此该地区的纺织业面临着较大的成本压力。

- 调整后情况:为了应对成本压力并保持市场竞争力,该地区的一些纺织企业开始采取措施降低生产成本,他们通过优化生产流程、提高生产效率等方式来降低生产成本,他们也在寻找新的市场机会,拓展销售渠道,以适应市场变化。

纺织品棉成分税的调整对于纺织业的影响是多方面的,从成本压力、市场反应到行业影响等方面来看,这一政策调整都可能对纺织业的健康发展产生深远影响,为了应对这一挑战,纺织企业需要积极采取措施降低生产成本、提高生产效率、拓展销售渠道等,政府也需要根据实际情况制定合理的税收政策,以促进纺织业的健康发展。

建议与展望

针对纺织品棉成分税的调整,我们提出以下建议和展望:

- 建议:政府应综合考虑多种因素,制定合理的税收政策,以促进纺织业的健康发展,政府还应加强对纺织企业的支持和服务,帮助企业应对成本压力、提高生产效率、拓展销售渠道等。

- 展望:随着科技的不断发展,纺织业的未来将更加注重绿色、环保、可持续等方面的发展,纺织企业需要积极探索新的生产方式和技术手段,以适应市场需求的变化,政府也应加强对纺织业的监管和指导,促进纺织业的健康、稳定发展。

Articles related to the knowledge points of this article:

The 2018 Shanghai Home Textiles Autumn Trends

Empowering Textiles:Exploring the Fabric of Success in Cottons Heartland

Exploring the Ten Top Textiles of Stone Lions An Illustrative Journey