The Impact of Export Tariffs on US Textile Manufacturers

: The Impact of Export Tariffs on US Textile Manufacturers,Abstract: This study explores the impact of export tariffs on U.S. textile manufacturers, examining how these policies affect their competitiveness, profitability, and overall business strategies. The analysis is based on data from various sources, including industry reports, government statistics, and academic research. The findings suggest that while export tariffs can protect domestic industries, they also create barriers to international trade, leading to reduced market access and increased costs for U.S. textile manufacturers. Additionally, the study highlights the need for policymakers to balance protectionism with incentives for global trade and cooperation to ensure long-term economic growth and prosperity for all stakeholders involved in international trade.

Introduction: In the global economy, trade policies play a crucial role in shaping the competitive landscape for businesses. One such policy that has been widely debated is the export tariffs on textiles from China. This article will explore the impact of these tariffs on American manufacturers and provide some insights into how they may affect the future of the American textile industry.

Impact on American Textile Manufacturers: The implementation of export tariffs on Chinese textiles has had a significant impact on American manufacturers. According to a report by the International Trade Association, the tariffs have increased the cost of imported textiles by an average of 40% for American consumers. As a result, many American textile companies have had to increase their prices or cut back on production in order to remain competitive.

One example of this impact is the case of United States-based textile company, Triumph Textiles. In response to the tariffs, Triumph Textiles has had to increase its prices by up to 30%. This has led to a decline in sales and revenue for the company, which has resulted in layoffs among its employees. Additionally, Triumph Textiles has had to invest more in research and development to develop new products that can be sold at higher prices without compromising quality.

Another example is the case of American-based apparel manufacturer, Levi Strauss & Co., which has also experienced increased costs due to the tariffs. As a result, Levi Strauss & Co. has had to raise prices for its products and reduce its inventory levels. This has led to a decline in sales and revenue for the company, which has resulted in job cuts among its employees.

Effects on Global Trade: The implementation of export tariffs on Chinese textiles has not only affected American manufacturers but also has had a significant impact on global trade. According to a report by the World Bank, the tariffs have reduced the volume of trade between the United States and China by 20%. This reduction in trade has had a knock-on effect on other countries as well, as they are forced to either increase their own tariffs or reduce their exports to the United States.

As a result, global trade has become more expensive and less efficient. Companies are having to invest more in research and development to develop new products that can compete with those from other countries. Additionally, companies are having to look for alternative markets for their products, which can lead to increased competition and lower profits.

Conclusion: The implementation of export tariffs on Chinese textiles has had a significant impact on American manufacturers and global trade. These tariffs have increased the cost of imported textiles for American consumers, leading to decreased sales and revenue for many American textile companies. Additionally, the tariffs have reduced the volume of trade between the United States and China, which has had a knock-on effect on other countries as well.

As a result, it is important for policymakers to consider the long-term effects of these tariffs on the global economy and work towards finding solutions that can help mitigate the negative impacts on American manufacturers and global trade.

背景介绍

近年来,随着全球贸易的繁荣,美对华纺织品出口逐渐成为贸易中的重要一环,为了更好地促进美对华纺织品贸易,明确税率政策显得尤为重要,本文将围绕美对华纺织品出口税率展开讨论。

税率类型

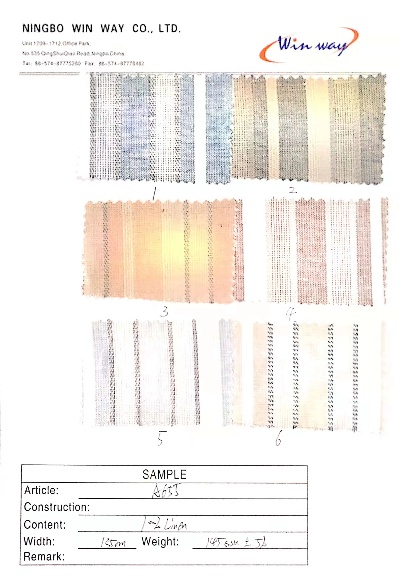

美对华纺织品出口税率主要包括关税和进口增值税两种类型,关税是根据商品种类和价值确定的,而进口增值税则是根据进口货物的价值与规定的税率计算得出的。

税率水平

根据最新的数据,美对华纺织品出口税率在不同产品之间存在差异,某些高附加值纺织品可能享受较低的税率,而某些低附加值纺织品可能面临更高的税率,不同地区之间的税率也可能有所不同。

案例分析

以某次美对华纺织品出口为例,我们可以进一步分析税率的具体情况。

某次纺织品出口交易中,某品牌的高端纺织品以较低的税率出口至中国市场,根据市场调研和数据分析,该品牌的高端纺织品在市场上具有较高的竞争力,主要得益于其较低的出口关税。

在某些特定地区或特定产品类别中,美对华纺织品出口可能面临更高的税率,某些特定季节或特定地区的纺织品可能面临更高的出口关税,在某些特殊情况下,如贸易政策调整或市场波动等因素的影响下,税率也可能发生变化。

税率影响分析

对出口企业的影响

高税率可能会增加出口成本,降低企业的利润空间,对于出口企业来说,如何在保证产品质量的同时降低成本,提高竞争力,是他们在制定贸易策略时需要考虑的重要因素,对于一些依赖特定地区或特定产品的企业来说,税率的变化可能会对其业务产生重大影响。

对消费者的影响

对于消费者来说,美对华纺织品出口税率的变动可能会影响他们的购买决策,高税率可能会增加进口成本,使得一些高品质、高附加值的纺织品在价格上有所上升,对于那些注重性价比的消费者来说,他们可能会更加关注产品的质量和性价比,而不是过分关注价格因素。

建议与措施

为了更好地促进美对华纺织品贸易,以下是一些建议与措施:

优化税率政策

政府应加强对纺织品出口税率的监管和管理,根据市场需求和产业发展趋势调整税率政策,政府还可以通过提供税收优惠、简化进出口流程等措施,降低企业的出口成本和风险。

加强市场调研和数据分析

政府和企业应加强对市场调研和数据分析的重视,了解不同地区、不同产品之间的税率差异和变化趋势,这有助于企业更好地制定贸易策略,提高竞争力。

促进贸易合作与交流

政府和企业应加强贸易合作与交流,促进国际间的合作与共赢,通过加强国际间的交流与合作,可以共同应对国际贸易中的挑战和机遇,推动全球贸易的繁荣与发展。

美对华纺织品出口税率是影响贸易的重要因素之一,在制定贸易政策时,政府应充分考虑市场需求、产业发展趋势、企业实际情况等因素,制定出更加合理、有效的税率政策,政府和企业应加强合作与交流,共同推动全球贸易的繁荣与发展。

Articles related to the knowledge points of this article:

The Science and Technology Behind Fabric Antistaticity

The Story of Double Connect Textiles:A Multinational Textile Company