Investment Strategies for Textile Firms:An Overview

Investment strategies for textile firms have undergone significant changes in the last few years, with a shift towards more sustainable and eco-friendly practices. This has led to an increased focus on using recycled materials, implementing energy-efficient technologies, and adopting ethical production processes. Additionally, the rise of digital technologies has also impacted investment strategies, with companies investing heavily in digital platforms to enhance their supply chain management and customer experience. As such, textile firms must adapt quickly to these changing market demands to remain competitive in the global marketplace.Navigating the World of Textile Investments: A Comprehensive Guide for Beginners and Experts

Introduction: Textile industries have been an integral part of human civilization for centuries, providing essential materials for clothing, shelter, and trade. In recent years, the textile industry has witnessed significant growth, driven by increased demand from emerging markets and technological advancements in manufacturing processes. As a result, investing in the textile sector can be a lucrative opportunity for both individual investors and multinational corporations alike. However, with numerous factors to consider, it is crucial for investors to adopt a thoughtful and strategic approach to navigate the world of textile investment.

-

Market Research: The first step in any investment strategy is thorough market research. This involves analyzing trends in consumer behavior, global trade policies, and technological developments that impact the textile industry. For instance, the rise in popularity of eco-friendly fabrics is driving innovation in sustainable manufacturing methods, which can provide opportunities for firms willing to adapt quickly.

-

Financial Analysis: Investors should conduct a comprehensive financial analysis of potential textile companies. This includes examining profit margins, cash flow, liquidity, and debt levels. For example, comparing the financial health of two textile firms may reveal one that is more stable than another due to its lower debt burden or higher revenue streams.

-

Supply Chain Management: Effective supply chain management plays a critical role in maintaining competitiveness in the textile industry. Investors should assess how well a company can manage its raw material procurement, production, distribution, and sales processes. For instance, companies that leverage technology-driven supply chain solutions like blockchain or artificial intelligence may offer a competitive edge over their peers.

-

Regulatory Impact: Regulatory changes can significantly impact a textile company's operations and profitability. Investors must stay informed about new laws and regulations that could affect their investments. For example, the European Union's General Data Protection Regulation (GDPR) has made it mandatory for companies to obtain explicit consent from their customers before sharing personal data.

-

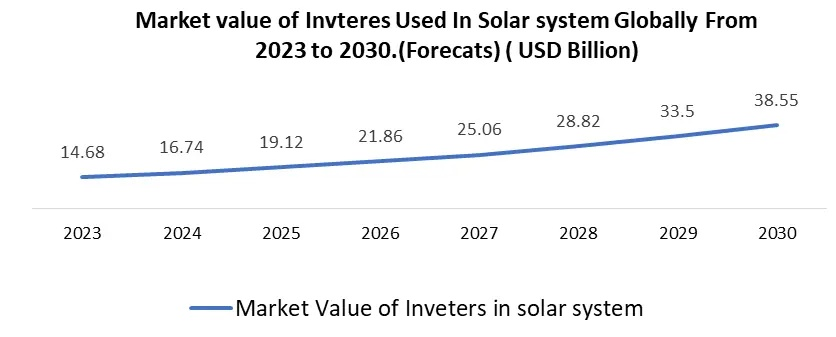

Technological Advancements: Advancements in textile technologies such as automation, machine learning, and digital printing are transforming the industry. Investors who recognize these trends early and invest in companies at the forefront of technological innovation stand to reap significant rewards. For example, a company investing in the development of AI-powered fabric quality control systems could potentially increase its product's value in the market.

-

Geopolitical Risk Analysis: Political unrest, geo-political tensions, and trade agreements can all impact a textile firm's operations. Investors need to assess these risks and adjust their portfolios accordingly. For instance, investing in textile companies located in regions prone to conflict may not be advisable if those areas are under political turmoil.

-

Diversification: Diversification is key to reducing risk exposure in the textile sector. Investors can spread their investments across different types of textile products, geographical regions, and even across multiple industries within the textile sector itself. For example, investing in a company that produces both cotton and polyester fabrics can diversify the portfolio while still benefiting from the growing demand for these materials.

-

Cultural Adaptation: Globalization has led to a greater interconnectedness between different cultures and markets. Investors must understand the cultural nuances and preferences of different markets to tailor their investment strategies effectively. For example, some markets might prefer softer fabrics, while others may favor stronger ones based on their cultural norms.

-

Exit Planning: Finally, it is important for investors to consider exit planning for their portfolios, including potential acquisition targets, mergers and acquisitions, and strategic divestitures. By having a clear exit strategy in place, investors can ensure that they can maximize returns or minimize losses when it comes time to sell their shares.

Conclusion: The textile industry offers ample opportunities for investment, but success lies not only in identifying promising companies but also in understanding the complexities of the market and implementing a strategic approach. By employing the insights presented here, investors can navigate the challenges and seize the rewards that come with investing in textile firms. Remember, like any investment, patience, research, and a willingness to adapt are crucial for long-term success in the textile sector.

随着经济的不断发展和人们生活水平的提高,纺织行业逐渐成为投资热点,纺织厂作为纺织产业链的重要环节,其投资策略对于企业的发展至关重要,本文将围绕纺织厂投资策略展开讨论,并结合案例分析,为您提供参考。

纺织厂投资策略

市场调研与分析

在投资纺织厂之前,首先需要对市场进行深入调研和分析,了解当地纺织行业的发展趋势、市场需求、竞争格局等,以便确定投资方向和目标,还需要关注政策法规、技术标准等因素,确保投资符合国家产业政策和发展方向。

投资类型选择

根据市场需求和自身资源条件,选择合适的投资类型,常见的投资类型包括新建纺织厂、扩建纺织厂、技术改造等,新建纺织厂需要充分考虑选址、设备采购、生产流程设计等因素;扩建纺织厂则需要根据现有产能和市场需求进行合理布局;技术改造则更注重提高生产效率、降低生产成本等。

投资风险控制

在投资纺织厂过程中,风险控制是至关重要的,需要关注市场风险,确保投资项目符合市场需求;需要关注技术风险,确保投资项目的技术先进性和稳定性;还需要关注管理风险,确保投资企业具备完善的管理体系和良好的运营能力。

投资案例分析

以某知名纺织厂为例,该纺织厂在投资过程中采用了多种策略,该纺织厂进行了深入的市场调研和分析,明确了市场需求和竞争格局;该纺织厂选择了新建或扩建的方式,结合自身资源和条件进行了合理布局;该纺织厂注重技术创新和环保理念,提高了生产效率和产品质量。

案例说明

在某地区,某知名纺织厂成功投资了一家新型纤维材料生产工厂,该工厂采用了先进的生产技术和环保理念,提高了生产效率和产品质量,该工厂还注重市场调研和分析,明确了新型纤维材料的市场需求和竞争格局,在投资过程中,该工厂采取了多种策略,包括选址、设备采购、生产流程设计等,该工厂还注重风险控制和管理风险,确保了企业的稳定发展。

纺织厂投资策略对于企业的发展至关重要,在投资过程中,需要充分考虑市场调研和分析、投资类型选择、投资风险控制等因素,还需要注重技术创新和环保理念,提高生产效率和产品质量,还需要关注政策法规、技术标准等因素,确保投资符合国家产业政策和发展方向,还需要注重企业管理和运营能力提升,确保企业的稳定发展。

纺织厂投资需要综合考虑多个因素,包括市场调研、投资类型选择、风险控制、技术创新和环保理念等,还需要注重企业管理和运营能力提升,以确保企业的长期稳定发展。

Articles related to the knowledge points of this article:

The Evolution of Tianzhuang East Textile Factory