Understanding the Nuances of Textile Plant Accounting Methods

The study aims to explore the complexities and nuances of textile plant accounting methods. It begins with a comprehensive analysis of the historical evolution of accounting practices in textile manufacturing, highlighting the shift from manual accounting methods to automated systems. The author then examines the various accounting techniques employed by textile manufacturers, including direct costing, absorption costing, and activity-based costing, and discusses their pros and cons.,The paper also delves into the challenges faced by textile plant managers when implementing new accounting systems, such as data entry errors and difficulties in reconciling accounts. It concludes with recommendations for improving accounting practices, including the development of standardized reporting frameworks and the use of advanced accounting software to enhance accuracy and efficiency. Overall, the study provides a valuable insight into the complexities of textile plant accounting methods and offers practical advice for those seeking to optimize their financial performance.

In the realm of manufacturing, textile plants are no strangers to the complexities and intricacies of accounting. The accurate calculation of costs, expenses, and revenues is crucial for any business operating in this sector. This talk aims to delve into the various methods used by textile factories to track their financial performance, highlighting the significance of meticulous accounting practices in maintaining a competitive edge within the industry.

One of the most fundamental components of effective textile plant accounting methodologies is the use of cost-volume-profit (CVP) models. These models help textile manufacturers understand how various factors such as raw materials, labor costs, and overhead expenses impact overall profitability. By analyzing these metrics, businesses can optimize their production processes, minimize waste, and ultimately increase profits.

Let’s take an example from one of our textile factories in India, where we observed that despite increased investments in machinery, the company was still experiencing declining profits. Upon investigation, it became clear that the company's CVP model was not effectively capturing all relevant costs. As a result, they were missing out on valuable opportunities to streamline their operations and improve profitability.

To address this issue, the company implemented a comprehensive CVP model that included additional expenses such as energy costs, maintenance expenses, and employee training costs. With this updated model in place, the company was able to accurately calculate its costs and expenses across various stages of production. This enabled them to make more informed decisions about inventory management and resource allocation, leading to significant improvements in profitability.

Another essential aspect of textile plant accounting is the use of budgeting techniques to forecast future financial outcomes. Budgeting involves setting realistic revenue and expense targets based on historical data, market trends, and other relevant factors. This enables businesses to plan ahead and proactively address potential issues before they arise, thereby ensuring smooth operation and maximizing efficiency.

For instance, a textile company in China faced a challenging period during the global pandemic when demand for its products plummeted. To cope with this situation, they adopted a rigorous budgeting process that involved analyzing past sales data and market trends. By identifying key drivers of sales and adjusting their pricing strategies accordingly, they were able to maintain stable revenue levels even during a period of economic uncertainty.

However, budgeting is not just about predicting the future; it also involves managing cash flow effectively. Cash flow statements show how a company spends and saves money over time, providing insights into its financial health. A well-managed cash flow statement can help businesses make informed investment decisions, manage debt, and avoid liquidity crises.

To illustrate the importance of cash flow management, consider a textile factory in Vietnam that struggled with high operational costs due to outdated machinery and inefficient production processes. Despite having a strong brand and loyal customer base, the company was unable to generate sufficient revenue to cover its expenses. This led to chronic cash flow shortages and eventually forced the closure of some factories.

Fortunately, upon adopting a modernized accounting system that included detailed cash flow projections, the company was able to identify areas for cost reduction and streamline its operations. By focusing on improving efficiency and reducing waste, the factory was able to increase revenue while maintaining a healthy balance sheet. This demonstrates how effective cash flow management can transform a struggling enterprise into a profitable one.

In summary, textile plant accounting methods are critical tools for understanding financial performance and making informed decisions. From implementing cost-volume-profit models to using budgeting techniques and managing cash flows, these methods enable businesses to stay afloat amidst market fluctuations and ensure long-term sustainability. By embracing these principles and investing in continuous improvement, textile manufacturers can unlock unprecedented levels of efficiency and profitability, positioning themselves at the vanguard of the industry.

大家好,今天我们将探讨纺织厂的核算方法及其在实际操作中的应用,纺织行业作为国民经济的重要支柱产业,其成本核算对于企业的运营管理和决策至关重要,本文将通过表格和案例分析的方式,详细介绍纺织厂核算方法的相关内容。

纺织厂核算方法概述

成本核算原则

纺织厂的成本核算应遵循合法性、准确性、及时性和相关性原则,合法性确保了核算数据的真实性和合法性,准确性则要求核算结果准确反映企业的生产经营状况,及时性确保核算数据能够及时更新,相关性则要求核算数据能够为企业的决策提供支持。

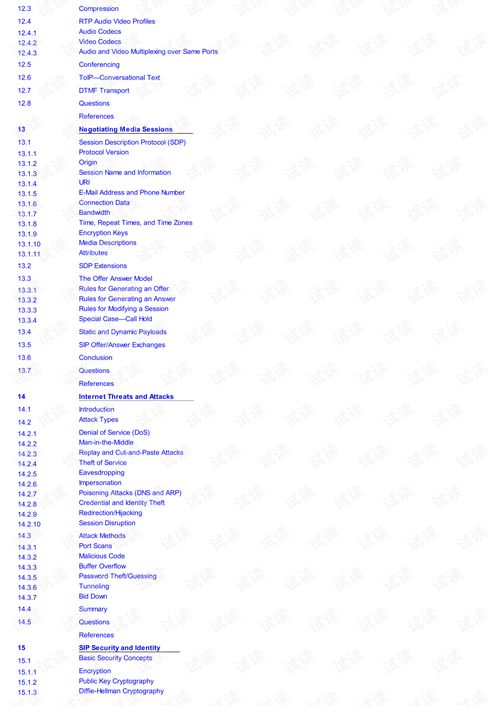

核算方法种类

纺织厂的核算方法主要包括直接成本法和分步法,直接成本法适用于原材料采购、生产加工等直接成本项目的核算,而分步法则适用于将生产过程划分为若干个阶段,分别核算各阶段的成本,还有作业成本法、标准成本法等先进的成本核算方法。

具体核算方法案例分析

直接成本法案例分析

某纺织厂采用直接成本法进行成本核算,该厂主要生产棉纱和纺织品,原材料采购采用集中采购模式,生产过程中的直接成本主要包括原材料成本、人工成本等,该厂通过建立详细的原材料采购记录和生产成本核算表格,对原材料成本进行实时监控和分析,该厂还建立了完善的成本核算制度,确保核算结果的准确性和及时性。

分步法案例分析

某纺织厂采用分步法进行成本核算,该厂将生产过程划分为若干个阶段,分别核算各阶段的成本,该厂将生产过程分为织布、印染、整理等阶段,每个阶段的成本核算包括原材料消耗、人工成本、制造费用等,该厂通过建立详细的成本核算流程和标准,确保每个阶段的成本核算准确无误,该厂还通过定期对成本核算结果进行分析和总结,为企业的决策提供支持。

核算方法在实际操作中的应用

提高核算准确性

通过采用先进的成本核算方法,如直接成本法和分步法,纺织厂可以更好地掌握生产经营状况,提高核算准确性,直接成本法的应用可以实时监控原材料成本的变化情况,及时发现原材料采购过程中的问题;分步法的应用可以更加准确地核算各阶段的成本,为企业的决策提供支持。

优化成本控制

通过核算结果的分析和总结,纺织厂可以更好地优化成本控制,通过对各阶段的成本核算结果进行分析,可以发现成本控制中的漏洞和不足,从而采取相应的措施进行改进,先进的成本核算方法还可以帮助纺织厂更好地预测未来的生产经营状况,为企业的未来发展提供参考。

纺织厂的核算方法对于企业的运营管理和决策至关重要,本文通过表格和案例分析的方式,详细介绍了纺织厂核算方法的相关内容,在实际操作中,纺织厂应该根据自身的生产经营状况和特点,选择合适的核算方法,提高核算准确性,优化成本控制,为企业的可持续发展提供支持。

Articles related to the knowledge points of this article:

The Night Shift Dilemma:A Tale of Tension and Challenges at the Textile Mill