Determining the Taxes Paid on 纺织品 Imports:A Comprehensive Guide

This comprehensive guide aims to help readers navigate the complex world of importing textiles and understand the taxes they must pay. By providing an overview of the taxation process, it aims to provide a clear roadmap for those looking to purchase or export textile goods. ,The primary focus is on determining the applicable tax rates, including tariffs, duties, and other related expenses. It covers a range of topics, from understanding the different types of textile products to identifying the various tax exemptions and deductions that may be available.,In addition, the guide provides practical examples and case studies to illustrate the application of these tax rules. This includes information on how to calculate taxes based on the value of imported textiles, the impact of international trade agreements on taxation policies, and the importance of complying with tax laws to prevent penalties or fines.,Overall, this guide provides a valuable resource for anyone looking to purchase or export textile products, as well as for businesses operating in the textile industry.

Introduction The import of textiles is an integral part of global trade, providing consumers with a diverse range of fabrics and materials. However, as with all imported goods, there are taxes and fees associated with their movement through customs. Understanding these charges can help you anticipate costs and manage your budget effectively. In this guide, we'll explore the various taxes that need to be paid on textile imports, including tariffs, duties, and value-added tax (VAT), and how to calculate and pay these fees accurately.

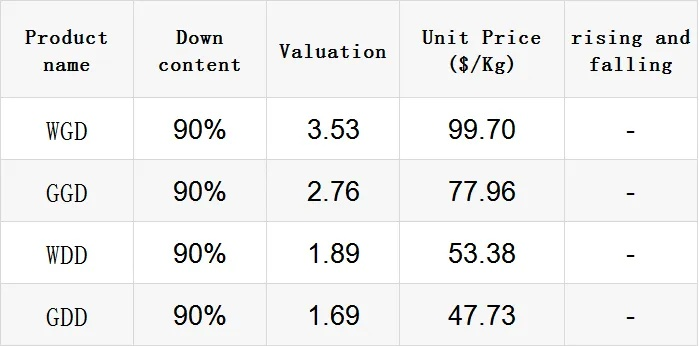

Tariffs Tariffs, which are imposed by governments on imports from other countries, can significantly affect the price of textiles once they reach the destination market. These tariffs are usually levied based on the value or category of the product, and they must be paid either in cash, goods equivalent to the tariff amount, or both.

Table: Example of Tariff Rates | Tariff Classification | Value/Weight Unit | Tariff Rate (%) | |-----------------------|-------------------- |-------------------| | Textiles (General) | 100 | 5 | | Textiles (Specialty) | 200 | 10 |

-

Duties Duties are additional taxes imposed on imported goods that are not subject to tariffs. They may apply to specific categories of goods, such as clothing or footwear, and can vary depending on the country's regulations. Duties must be paid in cash, goods, or a combination of both, at the time of entry into the country.

-

Value Added Tax (VAT) VAT is a consumption tax levied on most goods and services, including textiles. When a textile import is subject to VAT, it is added to the original price of the product at the time of purchase. This additional tax is typically collected by customs authorities when the merchandise is declared at customs, unless special exemptions are granted for certain types of textiles.

Calculating Taxes When calculating the total taxes due on a textile import, it is essential to consider the tariff rate, applicable duty percentage, and whether VAT has been applied. You can use the following formula to determine the total amount of taxes payable:

Total Taxes Payable = (Tariff + Duties) * (1 - VAT Rate)

For example, let's say you import a set of jeans priced at $20 per piece, with a tariff rate of 5%, a duty rate of 10%, and an assumed VAT rate of 13%. The total tax payable would be:

Total Taxes Payable = ($20 5%) + ($20 10%) (1 - 13%) Total Taxes Payable = $0.10 + $0.40 0.87 Total Taxes Payable = $0.10 + $0.336 Total Taxes Payable = $0.436

Paying Taxes Once you have calculated the total amounts of taxes payable, you should proceed to pay them according to the terms of your agreement with your supplier or customs authority. Some suppliers may offer discounts for early payments or provide assistance with payment arrangements. It's also important to ensure that you have sufficient funds available to cover the taxes and any potential penalties associated with late payments.

Case Study: An Exporter's Experience An exporter faced significant challenges when attempting to clear customs for a shipment of high-end silk scarves from China. Although the tariff was low at 1%, the duty rates were steep, particularly for luxury items like silk products. Additionally, the seller had to pay VAT at a rate of 18%, which significantly increased their costs. The exporter opted to negotiate with the local customs authority to lower the tariff and VAT rates, but they were unable to achieve this due to stricter policies.

In conclusion, determining the taxes paid on textile imports requires careful analysis of the tariff rates, duty percentages, and any VAT imposed. Exporters and importers alike need to keep track of these charges to ensure compliance and minimize unnecessary expenses. By understanding the complexity of these charges, businesses can make informed decisions about their international trade operations and budget planning.

I: Introduction

大家好,今天我们来聊聊纺织品清关缴税的话题,对于进出口贸易中的纺织品,了解清关缴税的金额对于商家和消费者来说都是非常重要的。

II: 清关缴税概述

清关缴税是进出口贸易中不可或缺的一环,对于纺织品,清关缴税的具体金额会受到多种因素的影响,包括进口国的关税政策、出口国的清关流程、货物的种类和数量等,纺织品清关缴税的金额会根据货物的具体情况而定。

III: 案例分析

以下是一个具体的案例来说明纺织品清关缴税的情况:

案例说明:假设某商家进口了一批价值XX万美元的纺织品,经过清关流程后需要缴纳相应的税费,根据出口国的关税政策,该批纺织品需要缴纳的税费约为XX欧元。

纺织品清关缴税示例表格

| 物品名称 | 进口国家 | 出口国家 | 海关税率 | 清关时间 | 缴税金额(欧元) |

|---|---|---|---|---|---|

| 纺织品 | 中国 | 欧盟 | 根据出口国关税政策确定 | 根据具体情况而定 | XXXX |

IV: 影响清关缴税的因素

影响纺织品清关缴税的因素有很多,主要包括以下几个方面:

- 进口国的关税政策:不同的进口国对不同商品有不同的关税政策,因此清关缴税的具体金额也会有所不同。

- 出口国的清关流程:出口国的清关流程也会影响清关缴税的时间和金额。

- 货物的种类和数量:不同种类的货物需要缴纳的税费也会有所不同,货物的种类和数量也会影响清关的时间和成本。

V: 建议与注意事项

对于纺织品商家来说,了解清关缴税的具体金额并做好相关准备是非常重要的,以下是一些建议和注意事项:

- 了解出口国的关税政策:在进口前,商家应该了解出口国的关税政策,以便更好地规划清关流程和缴纳税费。

- 提前准备相关文件:商家应该提前准备好相关的文件,包括进口合同、发票、装箱单等,以便顺利完成清关流程。

- 注意税务问题:在缴纳税费时,商家应该注意税务问题,避免出现不必要的麻烦。

纺织品清关缴税的具体金额会受到多种因素的影响,包括进口国的关税政策、出口国的清关流程、货物的种类和数量等,商家在进口前应该了解出口国的关税政策,提前做好相关准备,并注意税务问题,以确保顺利完成清关流程并缴纳相应的税费。

Articles related to the knowledge points of this article:

The Significance of Textile Fire Retardant Finishing

The Complete Guide to Textile Dyeing Methods