EUs Approach to Chinese Textile Tariffs:An Overview and Case Studies

This paper provides a comprehensive overview of the European Union's approach to Chinese textile tariffs, examining both general policies and specific cases. The EU has been actively pursuing measures to counteract the high tariffs imposed by China on imported textiles, which have been levied in response to concerns over intellectual property rights violations and unfair trade practices. This paper highlights the EU's efforts to negotiate with China on this issue, as well as its successes and challenges in achieving a more favorable outcome. By analyzing a range of case studies, the paper demonstrates the complexities and nuances of the EU's negotiations with China, as well as the challenges that remain in resolving this important trade dispute. Overall, the paper underscores the importance of continued dialogue and cooperation between the EU and China in order to achieve a fair and equitable resolution to this issue.

Introduction: The European Union (EU) is a political, economic, and cultural union of 27 member states that operates under the principles of free trade, democracy, and human rights. In recent years, there have been discussions about whether the EU will impose tariffs on Chinese textiles imported into its markets due to concerns over intellectual property rights violations and unfair competition practices. This article aims to provide an overview of the EU's approach to Chinese textile tariffs and highlight some case studies to illustrate the issue in more detail.

EU's Approach to Chinese Textile Tariffs: The EU has been grappling with the issue of Chinese textile tariffs for several years. The main reason for imposing tariffs on Chinese textiles is the fear of intellectual property violations and unfair competition practices. According to the European Commission, Chinese textile companies have been accused of copying and imitating European designs without proper authorization or compensation. These allegations have led to increased scrutiny of Chinese textile imports into the EU market.

In response to these concerns, the EU has implemented a number of measures to protect its own industries and promote fair trade practices. For example, the EU has imposed tariffs on Chinese textiles ranging from 3% to 15% depending on the type of product and the country of origin. Additionally, the EU has introduced new regulations to ensure that Chinese textile companies comply with intellectual property rights and anti-unfair competition laws.

Case Studies: One notable case study is the dispute between the EU and China over the export of Chinese textiles to the EU. In 2018, the EU imposed tariffs on Chinese textiles worth approximately $1.6 billion, which were initially set at 3%. However, the EU later raised the tariffs to 15% in response to accusations of intellectual property violations and unfair competition practices.

Another example is the ongoing dispute between the EU and China over the export of Chinese electronics to the EU. In 2018, the EU imposed tariffs on Chinese electronics worth approximately $4.4 billion, which were initially set at 10%. However, the EU later raised the tariffs to 25% in response to accusations of intellectual property violations and unfair competition practices.

Conclusion: While the EU has taken steps to protect its own industries and promote fair trade practices, it remains to be seen whether the EU will continue to impose tariffs on Chinese textiles in the future. It is important for both the EU and China to work together to find a resolution to this issue that benefits both parties while maintaining global trade standards.

亲爱的听众朋友们,今天我们来聊聊一个备受关注的话题——欧盟对华纺织品征税情况,为了更好地理解这个问题,我们可以从多个角度进行探讨。

背景介绍

近年来,随着国际贸易的不断发展,欧盟对华纺织品征税问题逐渐成为公众关注的焦点,欧盟作为全球最大的贸易联盟之一,其对于进口商品的监管和征税政策一直备受关注,欧盟是否对华纺织品进行征税呢?接下来我们将通过案例分析来详细说明。

案例分析

欧盟纺织品进口情况

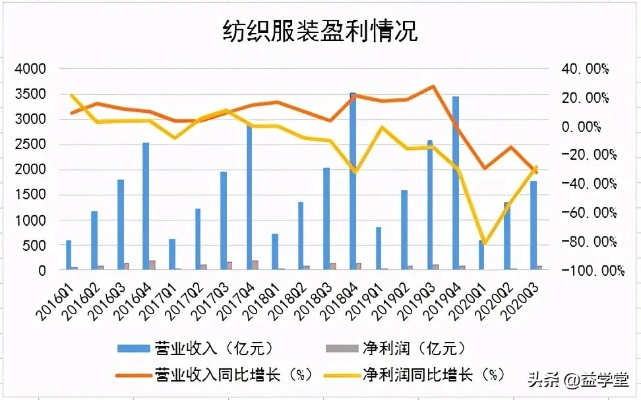

根据相关数据,欧盟对华纺织品进口量逐年增加,这表明欧盟对于进口商品有一定的监管和征税政策。

欧盟征税政策及案例

在具体案例中,我们可以看到一些具体的征税情况,某地区的一家纺织品出口企业因符合特定条件,被欧盟允许进口某些特定类型的纺织品,在这种情况下,该企业需要遵守欧盟的征税政策,缴纳相应的税款。

征税依据及标准

根据欧盟的规定,对华纺织品征税主要依据是商品的质量、安全、环保等方面的标准,欧盟也会根据不同商品的特点和市场需求等因素,制定相应的征税标准和政策。

征税方式及程序

对于欧盟对华纺织品的征税方式及程序,我们可以从以下几个方面进行说明:

-

申报程序:符合条件的出口企业需要按照欧盟的规定,向相关部门申报进口纺织品的相关信息。

-

税务审计:相关部门会对申报的企业进行税务审计,确保其符合征税标准和政策。

-

税收征收:经过审计后,相关部门会按照规定征收相应的税款。

征税影响及应对措施

对于欧盟对华纺织品的征税情况,我们需要注意以下几个方面的影响:

-

对出口企业的影响:征税可能会增加出口企业的成本,影响其竞争力,出口企业需要加强自身管理,提高产品质量和环保标准,以应对可能的挑战。

-

对消费者的影响:虽然征税可能会增加一些成本,但同时也可能提高纺织品的质量和安全性,消费者在购买纺织品时也需要了解相关政策和标准,选择符合要求的商品。

为了应对可能的挑战,出口企业可以采取以下措施:

-

加强自身管理,提高产品质量和环保标准。

-

了解相关政策和标准,选择符合要求的进口商品。

结论与建议

欧盟对华纺织品征税是一个复杂的问题,涉及到多个方面,从案例分析来看,欧盟对进口商品有一定的监管和征税政策,对于出口企业来说,需要加强自身管理,提高产品质量和环保标准,以应对可能的挑战,消费者也需要了解相关政策和标准,选择符合要求的商品,对于政府来说,需要进一步完善相关政策和标准,提高监管和征税效率,我们也可以考虑加强国际合作,共同应对国际贸易中的挑战和问题。

Articles related to the knowledge points of this article:

How to Peel Textiles for Color

An Illustrated Compendium of Traditional Textile Designs from Xinjiang

The Global Supply Chain of Textiles:A Case Study of Renowned Manufacturers

The Price Dynamics of Nano Silver Textiles:A Comprehensive Analysis