纺织品行业会计实务与账务处理

In the textile industry, accounting practices and financial reporting are critical for maintaining accurate and timely financial information. This paper discusses the key aspects of textile industry accounting, including the recognition and measurement of revenues and expenses, as well as the recording of transactions in the accounting system. The paper also highlights the importance of proper bookkeeping and record-keeping procedures to ensure that financial statements are prepared accurately. Additionally, it emphasizes the need for regular audits and compliance with relevant laws and regulations to maintain the integrity of the financial statements. Ultimately, the goal of textile industry accounting is to provide accurate financial information to stakeholders, such as investors, creditors, and regulators, to help them make informed decisions about the company's operations and financial health.

Introduction: The textile industry is a crucial sector in the global economy, producing a wide range of products such as clothing, home textiles, and industrial fabrics. Accounting for this industry involves managing financial transactions, recording revenues and expenses, and ensuring compliance with tax regulations. This guide will provide an overview of the accounting practices commonly used in the textile sector, including the use of accounting standards like the International Accounting Standards (IAS), the United States Generally Accepted Accounting Principles (GAAP), and local regulations. We'll also explore common challenges faced by textile companies and how they are addressed through accounting methods.

Accounting Practices in the Textile Industry:

-

Revenue Recognition: In the textile industry, revenue recognition typically occurs when a customer pays for goods or services rendered. The revenue is recognized when it becomes probable that cash will be received from the sale of goods or services. For example, if a company sells a piece of fabric to a customer, the revenue would be recognized when the payment is received.

-

Cost of Goods Sold (COGS): COGS includes all costs directly related to the production and sale of goods, including raw materials, labor, and overhead costs. It represents the amount of money spent on producing a product before it is sold. For example, if a company manufactures 100 pieces of fabric at a cost of $5 per piece, COGS would be $500.

-

Profit and Loss Accounting: Profit and loss accounts show the company's net income after all expenses have been accounted for. This includes both operating and non-operating expenses. For example, if a company earns $100,000 in revenue and incurs $20,000 in COGS, its profit for the period would be $80,000.

-

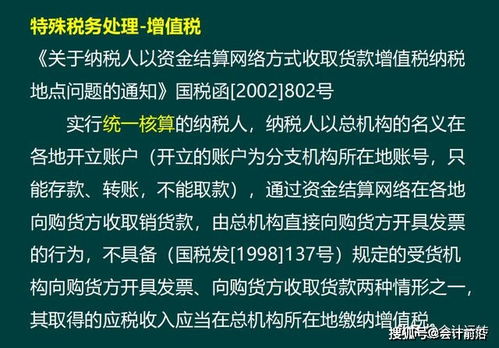

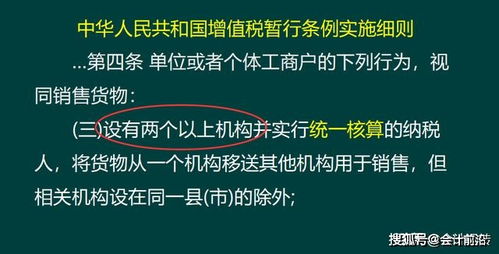

Tax Accounting: Tax accounting involves calculating and paying taxes based on the company's financial statements. In the textile industry, taxes may include sales tax, value-added tax (VAT), and any other applicable taxes. For example, if a company has a tax rate of 10%, its taxable income would be 10% of its total revenue.

Challenges Faced by Textile Companies:

-

Varying Prices: Textile products can vary greatly in price depending on factors such as brand, quality, and design. Companies must accurately record these variations in their financial statements to ensure accurate revenue recognition.

-

Labor Costs: Labor costs can be significant in the textile industry, especially for high-quality products. Companies must accurately track and account for these costs to ensure proper profitability.

-

Material Costs: Raw material costs can fluctuate significantly due to supply chain issues or changes in market demand. Companies must monitor these costs closely to ensure accurate COGS reporting.

-

Intangible Assets: Companies in the textile industry often invest in intangible assets such as trademarks, patents, and copyrights. These assets can generate significant revenue but require careful accounting to ensure proper recognition and valuation.

Case Study:

XYZ Textiles, Inc. operates a large factory in China that produces high-end fashion apparel. To manage its accounting practices, XYZ implemented a comprehensive system that included:

- A detailed inventory management system to track the movement of raw materials and finished products.

- An automated system for tracking sales orders and processing invoices.

- A payroll system to accurately calculate and pay employees' salaries.

- A software platform for tracking COGS and generating profit and loss statements.

By implementing these systems, XYZ was able to improve its efficiency and accuracy in accounting for its operations. As a result, it was able to better manage its finances, comply with regulatory requirements, and make informed business decisions.

Conclusion: Accounting in the textile industry is critical for ensuring financial stability and compliance with regulations. Companies must employ effective accounting practices to accurately record revenues, expenses, and profits. By doing so, they can provide accurate financial information to investors, regulators, and stakeholders, enabling them to make informed decisions about the company's future.

在当今全球化的纺织品市场中,做账工作对于企业的运营和发展至关重要,本文将围绕纺织品行业的做账主题,通过英文案例说明和表格补充说明的方式,深入探讨纺织品行业做账的要点和注意事项。

纺织品行业做账概述

纺织品行业涉及原材料采购、生产加工、销售等多个环节,做账工作需要全面考虑这些环节,在纺织品行业中,做账主要包括以下几个方面:

- 采购记录:记录原材料的采购情况,包括供应商、采购数量、采购价格等。

- 生产记录:记录纺织品生产过程中的各项工艺流程、设备使用情况等。

- 销售记录:记录纺织品销售情况,包括销售合同、发货记录等。

纺织品行业做账案例分析

某纺织品公司做账实践

某纺织品公司是一家大型企业,其做账工作严格按照会计准则和行业规范进行,该公司在做账过程中,注重以下几个方面:

- 采购记录:该公司对原材料的采购进行了严格的把关,确保采购的原材料符合质量标准,公司对采购价格进行了严格的审核,确保采购成本合理。

- 生产记录:该公司在纺织品生产过程中,建立了完善的工艺流程和设备使用记录,确保生产过程的规范性和可追溯性,该公司还定期对生产过程进行审计,确保生产质量符合标准。

- 销售记录:该公司在销售过程中,与客户签订了详细的销售合同,并建立了完善的发货记录,公司还定期对销售数据进行分析,及时掌握市场动态和客户需求。

纺织品行业做账表格补充说明

以下是纺织品行业做账的一些表格补充说明:

- 采购明细表:记录原材料的名称、规格、数量、采购单价等信息。

- 生产流程表:记录纺织品生产过程中的各项工艺流程、设备使用情况等,表格应包含日期、工序、设备型号等信息。

- 销售合同表:记录与客户的销售合同信息,包括合同编号、客户名称、交易日期等,表格应包含合同金额、发货日期等信息。

纺织品行业做账注意事项

在纺织品行业中,做账工作需要注意以下几个方面:

- 遵守会计准则和行业规范:企业应严格按照会计准则和行业规范进行做账工作,确保做账的准确性和可靠性。

- 确保采购成本合理:企业应注重采购成本的审核和控制,确保采购成本符合企业实际需求和标准。

- 保证生产过程规范性和可追溯性:企业应建立完善的工艺流程和设备使用记录,确保生产过程的规范性和可追溯性,企业还应定期对生产过程进行审计和检查,确保生产质量符合标准。

- 及时掌握市场动态和客户需求:企业应定期对市场动态和客户需求进行分析,及时掌握市场变化和客户需求变化,为企业的发展提供参考和支持。

纺织品行业做账工作是企业运营和发展中的重要环节,企业应注重做账工作的全面性和准确性,通过以上案例分析和表格补充说明,我们可以更好地了解纺织品行业做账的要点和注意事项,企业还应加强与客户的沟通和合作,及时掌握市场动态和客户需求变化,为企业的发展提供更好的支持。

Articles related to the knowledge points of this article:

Navigating the Global Market with Nantong Jinmen Textiles

Export Tax Rates in Korea A Guide to Ensure Compliance and Maximize Profits