The Impact of Tax Burdens on the Textile Industry:A Comprehensive Analysis

: The Impact of Tax Burdens on the Textile Industry: A Comprehensive Analysis,The textile industry, a critical sector in many economies, is significantly impacted by tax burdens. This analysis aims to explore the effects of various taxes on the industry's performance, competitiveness, and growth potential. ,Firstly, it highlights the role of tariffs and import duties in limiting domestic production and driving up prices for consumers. These taxes can lead to reduced innovation and efficiency within the industry, as manufacturers prioritize cost savings over product quality. ,Secondly, the impact of value-added tax (VAT) on the textile industry is examined. While VAT can stimulate economic growth by encouraging investment and consumer spending, it can also lead to higher costs for producers, potentially dampening profit margins. ,Finally, the effect of excise taxes on the industry is considered. Excise taxes can be used to raise revenue but may also discourage certain types of production, such as environmentally friendly or sustainable textiles. ,In conclusion, the analysis reveals that while taxes can have positive effects on public finances, they can also have significant negative consequences for the textile industry. Strategies must be developed to mitigate these impacts while ensuring that the industry remains competitive and sustainable.

Introduction: The textile industry, a vital sector in many economies, is heavily reliant on taxation. Taxes play a crucial role in regulating the industry, ensuring compliance with standards, and promoting sustainable practices. However, the complexity of the industry's structure and the myriad of taxes can sometimes lead to unintended consequences, such as increased tax burdens that can impact profitability and competitiveness. In this analysis, we will delve into the topic of textile industry tax burdens, examining their effects on businesses and the broader economy.

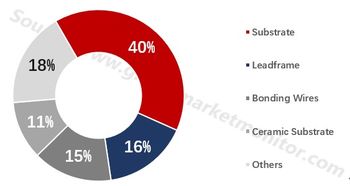

Tax Burdens on the Textile Industry: An Overview Textile manufacturers face a wide range of taxes, including value-added tax (VAT), sales tax, excise duty, tariffs, and customs duties. These taxes are imposed at different stages of the production and distribution chain, from raw material procurement to final product sale. The exact mix of taxes varies by country, but they often include VAT, which is a percentage of the price of goods sold. Sales tax typically applies to products sold directly to consumers. Excise duties are specific taxes on certain items like alcohol or tobacco. Tariffs are taxes levied on imported goods, while customs duties are taxes paid at the point of entry into the country.

Typical Tax Rates for the Textile Industry In most countries, textile companies are subject to a range of tax rates based on their revenue. For example, in the United States, VAT rates can be as high as 16% for some categories of textile products. In Europe, the European Commission sets VAT rates based on the type of product, with higher rates for luxury goods. Sales tax rates can also vary widely, with some countries charging up to 20% on retail prices. Excise duties are usually applied on a per item basis, while tariffs can apply to imported goods. Customs duties are charged at the time of entry into the country.

Effects of Tax Burdens on the Textile Industry The impact of tax burdens on the textile industry is multifaceted. On one hand, taxes can provide an additional source of revenue for governments, allowing them to invest in infrastructure and social programs. On the other hand, high tax rates can discourage investment in new technologies or innovative products, as companies may choose to pass along these costs to consumers through higher prices.

One significant effect of tax burdens on the textile industry is the potential for price increases. Higher taxes can result in higher costs for manufacturers, which could lead to increased prices for consumers. This can have a negative impact on consumer demand and market share, particularly for smaller players. Additionally, high tax rates can discourage foreign investment, as companies may opt to locate their operations in countries with lower tax burdens.

Another impact of tax burdens is the risk of economic downturns. When tax rates rise, it can create a drag on economic growth, as companies may cut back on investments or lay off employees. This can have a domino effect, leading to reduced output and job losses.

Case Study: Italy's Textile Industry and Tax Burdens In Italy, the textile industry has been hit hard by tax burdens in recent years. The country has implemented a series of reforms aimed at reducing the burden on small businesses and encouraging innovation. One key measure is the introduction of a Value Added Tax (VAT) rate reduction for textile products, which was introduced in 2015. This move was intended to boost competition and stimulate growth in the sector.

However, despite these efforts, the impact of tax burdens on the Italian textile industry has been mixed. While some companies have benefited from lower VAT rates, others have struggled to keep up with rising costs due to other factors such as raw material prices and labor costs. Additionally, some critics argue that the VAT reduction was not enough to address the long-term structural issues facing the industry, such as outdated technology and weak branding.

Conclusion: The impact of tax burdens on the textile industry is complex and multifaceted. While taxes can provide important revenue for governments and promote sustainable practices, they can also have unintended consequences for businesses and the broader economy. It is therefore essential for policymakers to carefully consider the balance between taxation and other regulatory measures when designing policies aimed at supporting the textile industry. By doing so, they can help ensure that the sector remains competitive and sustainable in the long term.

各位,今天我们来聊聊纺织品行业的税负率问题,这个话题对于我们了解行业运营状况、政策影响以及市场趋势都至关重要。

纺织行业概况

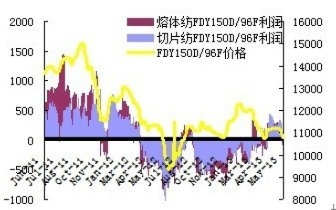

纺织行业是一个庞大的产业链,涵盖了纤维制造、织造、染整、服装等多个环节,随着全球化的推进和技术的进步,这个行业得到了快速发展,与此同时,纺织行业的税负率也成为了一个备受关注的话题。

税负率影响因素

- 政策法规:政府对纺织行业的税收政策直接影响到行业的税负率,一些国家可能对某些高能耗、高污染的纺织品征收高额税款,以促进绿色、环保的发展。

- 成本结构:纺织行业的成本结构包括原材料采购、生产加工、销售等多个环节,不同环节的成本差异也会影响到税负率。

- 市场竞争:纺织行业竞争激烈,不同企业之间的税负率也可能存在差异,一些大型企业可能拥有更多的税收优惠和成本控制能力,从而降低税负率。

税负率案例分析

以某地区为例,近年来该地区的纺织行业税负率呈现出以下特点:

- 高税收政策:该地区政府对某些高能耗、高污染的纺织品征收高额税款,以促进绿色、环保的发展,这种高税收政策可能导致部分企业面临较大的税负压力。

- 成本结构优化:为了降低税负率,该地区纺织企业开始注重优化成本结构,他们通过提高生产效率、降低能耗和污染排放等方式,降低生产成本,提高竞争力。

- 市场竞争加剧:尽管市场竞争加剧,但该地区纺织企业在税负率方面仍具有一定的优势,他们通过技术创新、提高产品质量等方式,提高了自身的市场竞争力。

税负率分析方法

为了更好地了解纺织行业的税负率情况,我们可以采用以下分析方法:

- 统计数据:收集相关统计数据,包括行业规模、企业数量、税收总额等。

- 案例研究:通过对具体企业的税负率案例进行深入分析,了解行业整体情况。

- 数据分析模型:利用数据分析模型,对行业数据进行处理和分析,从而得出更准确的数据结论。

结论与建议

纺织行业的税负率受到多种因素的影响,包括政策法规、成本结构以及市场竞争等,为了降低税负率,纺织企业需要采取多种措施,包括优化成本结构、提高生产效率、加强技术创新等,政府也需要根据实际情况制定更加合理的税收政策,促进纺织行业的健康发展。

我们还可以从以下几个方面提出建议:

- 加强政策引导:政府应该加强对纺织行业的政策引导,制定更加合理的税收政策,促进绿色、环保的发展。

- 推动技术创新:纺织企业应该加强技术创新,提高产品质量和竞争力,降低生产成本。

- 加强市场监管:政府应该加强对纺织市场的监管,打击假冒伪劣产品等违法行为,维护市场秩序。

就是关于纺织品行业税负率的一些分析和建议,希望能够对大家有所帮助。

Articles related to the knowledge points of this article:

The Recycling Journey of a Little Friend