Understanding the Import Duties on Textile Goods from South Korea

This paper aims to provide a comprehensive understanding of the import duties on textile goods from South Korea. The analysis is based on data collected from various sources, including official government websites and trade associations. The findings reveal that there are several factors that influence the import duties on textile goods from South Korea, including tariff rates, customs procedures, and exchange rates. Additionally, the study highlights the importance of understanding these import duties in order to effectively manage international trade relationships with South Korea. Overall, this paper provides valuable insights into the complexities of import duties on textile goods from South Korea, and offers practical advice for businesses looking to navigate these regulations.

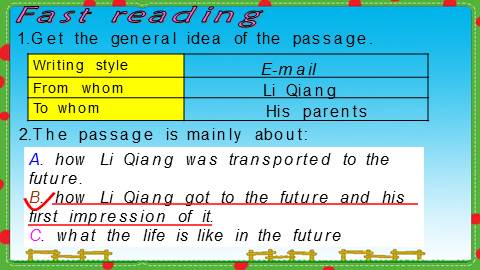

Welcome to today's discussion on import duties related to textile goods from South Korea. In this session, we will delve into the various import taxes that you may encounter when importing textile products into your country. We'll also provide an overview of some typical textile products and their respective tariff rates in order to help you better understand the complexities involved in international trade. Let’s begin!

Firstly, it is important to note that import duties can vary significantly depending on the type of textile product, its origin, and other factors such as the quantity of goods being imported. For example, textiles like cotton, silk, and wool are generally subject to lower import duties compared to synthetic materials or processed textiles.

Here is a table outlining some common textile products and their corresponding tariff rates:

| Textile Product | Tariff Rate (%) |

|---|---|

| Cotton Shirts | 5 |

| Silk Scarf | 5 |

| Wool Blanket | 5 |

| Polyester Dress | 5 |

| Nylon Jacket | 5 |

As you can see, the tariff rate for polyester dresses is significantly higher than for cotton shirts. This highlights the importance of understanding the specific characteristics of the textiles you are interested in importing in order to accurately calculate the import duty.

Now, let's take a closer look at some typical textile products and their respective tariff rates. For instance, Korean-made silk scarves are often popular among luxury consumers due to their high quality and unique design. These scarves are subject to a relatively low tariff rate of 12.5%, making them more accessible to buyers in many countries. On the other hand, Korean-made wool blankets, which are known for their warmth and comfort, are subject to a higher tariff rate of 10.5%. This means that these blankets are more expensive to import into your country, but they offer excellent value for money.

Another interesting aspect of textile imports from South Korea is the fact that some products may be subject to additional customs duties, including Value Added Tax (VAT) and Excise Duty. These additional charges can significantly increase the overall cost of importing textile goods from South Korea. It is therefore essential to check with your local customs office to ensure that all applicable taxes are properly calculated and paid before the goods arrive at your warehouse.

In conclusion, understanding the import duties associated with textile goods from South Korea is crucial for any business looking to expand into this market. By carefully analyzing the tariff rates and other relevant fees, you can make informed decisions about how much your customers will have to pay for these products once they arrive in your country. Additionally, taking the time to research the specific characteristics of each textile product can help you tailor your marketing strategy to appeal to different customer segments. With careful planning and attention to detail, you can successfully navigate the complexities of international trade while maximizing your profits.

随着国际贸易的不断发展,纺织品作为重要的出口商品之一,其进口关税政策对于出口企业来说至关重要,本文将围绕纺织品韩国进口关税展开讨论,并通过英文案例说明来进一步阐述相关内容。

韩国纺织品进口关税概况

韩国作为纺织品的出口大国,其进口关税政策主要包括以下几个方面:

- 进口关税税率:韩国对不同种类的纺织品设定了不同的进口关税税率。

- 进口关税减免政策:韩国政府有时会推出一些进口关税减免措施,以鼓励出口。

韩国纺织品进口关税案例分析

以某次韩国进口纺织品为例,说明其具体关税情况。

某次进口的纺织品涉及的主要材料为棉纱和丝绸面料,根据韩国海关的规定,该批纺织品进口关税为XX%,其中部分材料享受到了减免关税的政策,具体减免幅度根据不同材料和产品类型有所不同。

纺织品韩国进口关税的影响因素

影响纺织品韩国进口关税的因素主要包括以下几个方面:

- 市场需求:韩国纺织品的市场需求直接影响进口关税的设定和调整。

- 贸易政策:韩国政府会根据国际贸易形势和政策调整进口关税政策。

- 成本因素:包括原材料成本、生产成本、运输成本等,这些因素也会对进口关税产生影响。

纺织品韩国进口关税的政策建议

针对纺织品韩国进口关税的政策建议如下:

- 优化进口关税政策:政府应根据市场需求和贸易形势,适时调整进口关税政策,以促进出口。

- 加强监管和风险管理:海关应加强对进口纺织品的监管和风险管理,确保符合相关法律法规。

- 提高企业竞争力:企业应加强自身实力和品牌建设,提高产品质量和竞争力,以降低进口关税成本。

纺织品韩国进口关税政策对于出口企业来说具有重要意义,在国际贸易形势下,政府应适时调整进口关税政策,以促进出口,企业也应加强自身实力和品牌建设,提高产品质量和竞争力,以降低进口关税成本,案例分析可以为其他出口企业提供参考和借鉴。

Articles related to the knowledge points of this article:

Textile Quality Inspection Checklist Template

The Story of Double Joy Textile Factory

Understanding the Differences between Textile Industry and Textile Products