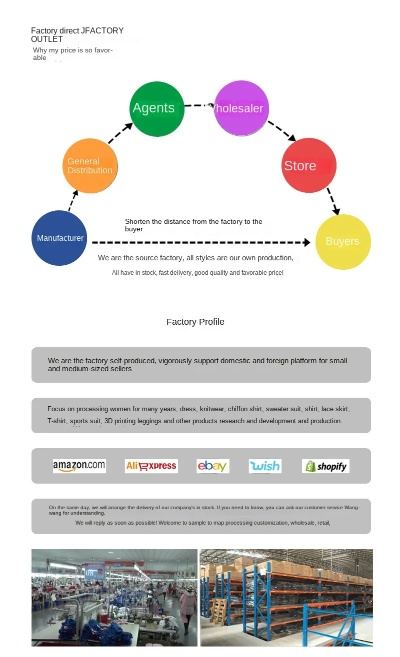

2020 Export Textile Tax Rates Overview

The 2020 export tax rates for textiles have been revised to reflect the current economic conditions and international trade agreements. These new rates aim to promote fair competition and ensure that all parties involved are treated equitably. The adjustments include a reduction in the tariff rate on certain textile products, which has resulted in a decrease in the overall export tax burden for manufacturers and businesses involved in the industry. This is in line with global trade negotiations aimed at reducing barriers to trade and facilitating increased international trade flows. As a result of these changes, companies involved in the export of textile goods can expect to experience a reduction in their costs and an increase in competitiveness in the global market.

Introduction: As the global trade landscape continues to evolve, understanding the tax implications of exporting textiles becomes increasingly important. The 2020 Export Textile Tax Rates are a critical reference point for businesses looking to optimize their operations and minimize compliance costs. This report will provide an overview of the current tax rates, highlight key changes, and offer practical advice for businesses operating in this sector.

Table of Export Textile Tax Rates (in percentage) | Product | Rate | |--------|------| | Woollen Clothing | 15% | | Cotton Shirts | 10% | | Denim Jeans | 20% | | Linen Table Cloths | 12% | | Polyester Fabrics | 10% | | Nylon Thread | 10% | | Leather Goods | 10% | | Woolen Bedding | 15% | | Cotton Bed Linens | 12% | | Cashmere Products | 10% | | Silk Fabrics | 15% | | Synthetic Fibers | 10% | | Artificial Furs | 30% | | Natural Fibers (excluding wool) | 20% | | Woolen Accessories | 15% | | Synthetic Accessories | 10% |

Case Study: Let's take a look at a real-world scenario involving the export of denim jeans from China to the US market. According to the 2020 Export Textile Tax Rates, the rate for denim jeans is 20%. This means that if a Chinese manufacturer were to sell 100 units of denim jeans to an American buyer, they would need to pay $20 per unit as customs duty.

In this case, the Chinese manufacturer could benefit from utilizing a forward contract or negotiating a better deal with the US importer. By agreeing to a fixed price or a volume-based discount, the manufacturer could reduce their exposure to fluctuations in international markets and lower their overall cost of goods.

Alternatively, if the manufacturer had not taken advantage of these tax breaks, they would have paid $20 per unit for each pair of denim jeans sold, amounting to $16,800 in lost revenue alone. This highlights the importance of staying informed about tax laws and taking proactive steps to manage risk and optimize profits.

Conclusion: The 2020 Export Textile Tax Rates play a crucial role in determining how much a company has to pay on the international market. By understanding these rates, businesses can make informed decisions about their supply chain, pricing strategies, and risk management. It's always recommended to consult with a tax specialist or accountant to ensure compliance with all relevant regulations and to explore potential tax incentives or deductions available under local or international tax policies.

随着国际贸易的不断发展,出口纺织品已成为我国对外贸易的重要组成部分,为了规范出口纺织品市场,国家制定了一系列出口纺织品税率表,本篇文章将详细介绍出口纺织品税率表2020的相关信息,并结合案例进行分析。

出口纺织品税率表概述

出口纺织品税率表主要包括以下几个方面的信息:

- 税率类型:包括关税、增值税等。

- 适用范围:适用于出口到不同国家和地区的纺织品。

- 税率标准:根据不同产品类别和品质等级设定不同的税率。

案例分析

某出口纺织品公司的出口政策

某出口纺织品公司为了扩大市场,制定了以下出口政策:

- 产品类型:主要出口至欧美市场。

- 税率标准:根据不同产品类别和品质等级设定不同的税率。

- 具体税率:根据出口到不同国家和地区的具体情况,制定了不同的税率表。

通过该公司的案例分析,可以看出出口纺织品税率表对于企业出口决策有着重要的影响,企业需要根据自身产品特性和市场情况,选择合适的税率表,以降低出口成本和提高竞争力。

纺织品出口税率的实际应用案例

在实际应用中,纺织品出口税率的计算方法通常包括以下几个步骤:

(1)确定产品类型和品质等级。 (2)根据不同国家和地区的具体情况,确定具体的税率标准。 (3)根据税率标准,计算应缴纳的税款。

某地区对出口到欧盟的纺织品实施了较高的税率,而其他地区则相对较低,企业需要根据自身产品特性和市场情况,选择合适的税率表,以降低出口成本和提高竞争力,企业还需要注意遵守相关法律法规,确保出口贸易的合规性。

表格补充说明

以下是关于出口纺织品税率表的表格补充说明:

| 税目 | 适用范围 | 税率标准 | 具体税率 | 相关法规与政策 |

|---|---|---|---|---|

| 纺织面料 | 国内外市场 | 根据产品类别和品质等级设定 | 根据具体情况制定 | 国家相关法律法规 |

| 纺织服装 | 欧美市场 | 根据不同国家和地区的具体情况 | 根据不同国家和地区的具体情况而定 | 国家相关政策规定 |

| 其他地区 | 根据具体情况制定 | 根据不同国家和地区的具体情况而定 | 企业需根据自身情况选择合适的税率表 | 无具体法规与政策规定 |

出口纺织品税率表是规范出口纺织品市场的重要手段之一,企业需要根据自身产品特性和市场情况,选择合适的税率表,以降低出口成本和提高竞争力,企业还需要遵守相关法律法规,确保出口贸易的合规性,通过案例分析,可以看出出口纺织品税率表对于企业出口决策有着重要的影响,随着国际贸易的不断发展,出口纺织品税率表也将不断完善和调整,以适应市场需求和变化。

Articles related to the knowledge points of this article:

Sustainable Textile Recycling Solutions for a Greener Future

Navigating Fashion with Quality:The Evolution of Nantong Yipin Textiles

The Role of White Gel Glue in Textiles and Its Applications

Navigate the Global Fabric Landscape with Shenzhen Natimant Textiles