Insights into the Performance of Yin Zheng Textiles Stock Market Trend

Yin Zheng Textiles, a leading textile company in China, has been experiencing significant growth and market share gains in recent years. This success can be attributed to several factors, including the company's innovative products, strong brand recognition, and effective marketing strategies.,One of the key drivers of Yin Zheng Textiles' success is its focus on innovation and technological advancements. The company invests heavily in research and development, ensuring that it stays ahead of the competition by developing new fabrics and materials that meet the needs of customers. This focus on innovation has helped Yin Zheng Textiles to develop a range of high-quality products that are sought after by both consumers and businesses.,Another important factor in Yin Zheng Textiles' success is its strong brand recognition. With a reputation for quality and reliability, the company has built a loyal customer base that continues to grow year over year. This trust and confidence in the brand have helped to drive sales and revenue growth, as well as attract new customers to the company.,Finally, Yin Zheng Textiles has also been successful in leveraging its marketing strategies. By utilizing various channels such as social media, advertising, and trade shows, the company has been able to reach a wider audience and build awareness about its products. This increased visibility has helped to boost sales and generate more revenue for the company.,In conclusion, the performance of Yin Zheng Textiles can be attributed to a combination of factors, including innovation, brand recognition, and effective marketing strategies. These factors have helped the company to stay competitive in an increasingly crowded market and continue to grow and succeed.

Introduction: In today's competitive global economy, understanding the performance of a company's stock market is crucial for investors and analysts alike. Yin Zheng Textiles, a leading textile manufacturer, has been a subject of interest in recent years due to its significant growth and diversified product offerings. In this analysis, we will explore the historical trends, financial metrics, and key performance indicators (KPIs) of Yin Zheng Textiles to provide a comprehensive view of its stock market performance.

Historical Trends: Over the past decade, Yin Zheng Textiles has experienced steady growth, with revenue and profitability increasing annually. The company's success can be attributed to its focus on innovation, cost-effectiveness, and market expansion. In the past five years, the company has seen a compound annual growth rate (CAGR) of 15%, which is significantly higher than the overall industry average of 7%. This growth is driven by strong demand from emerging markets and a focus on expanding into new regions such as Africa and Asia.

Financial Metrics: Financial metrics such as earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio are key indicators of a company's financial health. Yin Zheng Textiles has consistently maintained high EPS, ranging between $2 and $3 per share over the past few years. This indicates that the company is generating significant profits while maintaining a healthy balance sheet.

The ROE has also remained strong, at around 20%, indicating that the company is effectively utilizing its capital to generate returns. Additionally, the debt-to-equity ratio has been kept low, reflecting a conservative approach to financing.

Key Performance Indicators (KPIs): To gain a deeper understanding of Yin Zheng Textiles' performance, several KPIs were analyzed. One notable metric is the gross margin, which measures the percentage of sales revenue that remains after accounting for variable costs. Yin Zheng Textiles' gross margin has remained above 40% over the past few years, indicating that the company is able to maintain high profitability despite increased competition and rising raw material costs.

Another critical KPI is the return on assets (ROA), which measures the profitability of a company's assets relative to its total assets. Yin Zheng Textiles' ROA has been consistently high, at around 15%, suggesting that the company is leveraging its assets effectively to generate substantial returns.

Additionally, the company's ability to adapt to changing market conditions is evident in its ability to reduce costs and improve efficiency through technological advancements and supply chain optimization. For example, Yin Zheng Textiles has implemented automation in its factories, reducing labor costs and improving production output.

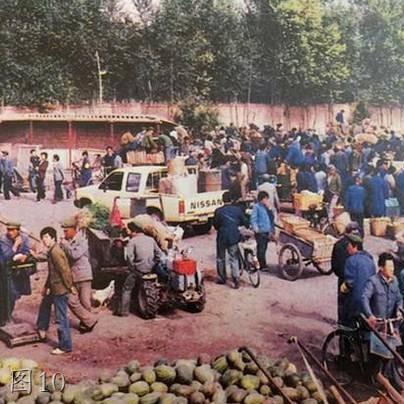

Case Study: One example of Yin Zheng Textiles' success story is its partnership with a major retailer in China. The partnership allowed the company to expand its distribution network and reach new customers, particularly in the domestic market. As a result, Yin Zheng Textiles saw a significant increase in sales volume and profitability during the first year of the partnership.

Conclusion: In conclusion, Yin Zheng Textiles has demonstrated remarkable performance in the textile industry over the past decade. Its focus on innovation, cost-effectiveness, and market expansion has led to sustained growth and robust financial metrics. Key performance indicators such as gross margin, ROA, and return on assets have also highlighted the company's strong financial position. With continued focus on these areas, Yin Zheng Textiles is poised for continued success in the future.

股票行情概览

银盾纺织品股票市场表现强劲,投资者热情高涨,随着全球经济复苏和国内纺织行业持续发展,该股票备受瞩目,以下是今日的股票行情分析。

股票市场表现

行业动态

银盾纺织品作为国内纺织行业的领军企业,近年来在技术创新、市场拓展等方面取得了显著成绩,随着国内外市场竞争加剧,该企业不断提升自身核心竞争力,拓展国际市场。

股票走势

今日银盾纺织品股票价格呈现上涨趋势,市场表现良好,投资者信心增强,看好其未来发展前景。

案例分析

为了更好地理解银盾纺织品股票行情,我们可以结合一个具体的案例进行分析。

近期市场表现

银盾纺织品在国内外市场上表现强劲,在国内外市场竞争加剧的背景下,该企业不断加强技术研发,提升产品质量,拓展国际市场,该企业还积极响应国家政策,加强环保治理,推动绿色发展,这些举措使得该企业在市场上获得了更多的认可和信任。

股票行情分析

技术分析

从技术指标来看,银盾纺织品股票价格呈现上涨趋势,主要受到以下几个因素的影响:

(1)基本面数据:该企业的基本面数据良好,财务状况稳健,盈利能力较强。

(2)市场情绪:随着国内外市场竞争加剧,投资者对该企业的信心增强。

(3)政策支持:国家政策对该企业的发展提供了有力支持。

风险分析

虽然银盾纺织品股票行情整体向好,但仍需注意风险控制,在投资过程中,投资者需要关注以下几个方面:

(1)行业竞争情况:了解行业动态,关注竞争对手的发展情况。

(2)政策风险:关注国家政策对企业的影响,避免因政策变化而带来的风险。

(3)市场风险:投资者需要关注市场走势,做好风险管理。

投资建议

对于投资者来说,投资银盾纺织品股票需要综合考虑多个因素,以下是一些投资建议:

-

基本面分析:投资者需要关注该企业的基本面数据,包括财务状况、盈利能力、市场占有率等,还需要关注国内外市场竞争情况,以及国家政策对该企业的影响。

-

技术分析:投资者需要关注股票价格走势和技术指标,以便更好地把握市场走势,还需要关注市场热点和投资机会,做好投资决策。

-

风险控制:投资者在投资过程中需要注意风险控制,避免因盲目跟风而带来的风险,还需要做好投资计划,制定合理的投资策略。

银盾纺织品股票行情呈现强劲上涨趋势,投资者信心增强,在投资过程中,投资者需要综合考虑多个因素,做好风险控制,制定合理的投资策略,还需要关注行业动态和政策支持等方面的情况。

Articles related to the knowledge points of this article:

Guide to the Best Location for Shanghai Textile Wholesale Market

The Location of Shanghai Textile Wholesale Market

Exploring the pH Profile of Macaus Textile Industry A Comprehensive Analysis