The UKs Fiber Goods Tariffs:An Exploration of Incentives and Regulations

Introduction: The textile industry, with its diverse range of products from woven fabric to knitted goods, represents a vital component of the UK's economy. As a global market leader in textiles, the UK has been a significant beneficiary of international trade, particularly through the liberalization of tariffs and the establishment of free trade agreements. Yet, amidst these gains, the British government continues to implement policies aimed at protecting the domestic textile industries and ensuring fair trade practices. This article will delve into the various types of textile import taxes that the UK imposes on foreign goods and their impact on both the domestic and international markets. It will also include an analysis of some of the most notable cases to illustrate how these tariffs are implemented and affect businesses operating in the UK.

Textile Import Taxes in the UK: A Comprehensive Overview

The UK's textile import taxes are a mix of tariff rates, duty rates, and other customs duties imposed on the import of textile products from non-EU countries. These taxes aim to protect domestic industries by setting up barriers against foreign competition and ensuring that imported goods are competitively priced.

Tariffs:

Tariff rates can vary significantly depending on the type of textile product and the country of origin. For example, textiles from China or India may face higher tariffs due to concerns over labor standards and environmental regulations. On the other hand, textiles from the European Union (EU) may have lower tariffs as they adhere to stricter quality and environmental standards.

Duty Rates:

Duty rates represent a percentage of the value of a textile product when it is imported into the UK. High duty rates can significantly increase the cost of imported textiles, making them less attractive for buyers in the UK. However, duty rates can also be reduced if the importing country meets certain criteria such as compliance with EU regulations.

Customs Duties:

Customs duties are additional charges imposed on the import of textile products at the point of entry. While these fees are often minimal compared to tariffs or duty rates, they still represent a cost to importers. Customs duties are often calculated based on the weight or volume of the textile product and can vary depending on the country of origin and the type of product being imported.

Import Quotas:

In addition to tariffs, import quotas are another regulatory tool used by the UK to limit the quantity of imported textiles. These quotas can be set by national governments or imposed by the European Union. Quotas are typically based on the total value of imported textiles and may apply to specific categories of products or regions within the EU.

Case Study: The UK's Tariff on Wool Clothes

One notable case where textile import taxes played a role was the UK's tariff on woolen garments. In 2014, the UK imposed a 25% tariff on woolen clothing imports from China due to concerns over labor practices and environmental regulations. This tariff led to higher prices for consumers and reduced competition in the UK woolen clothing market. However, it also provided an incentive for UK producers to invest in more sustainable and ethical production methods.

Another example is the UK's duty rate on imported cotton fabrics. In 2018, the UK reduced its duty rate on cotton fabrics from 45% to 25%. This move aimed to stimulate demand for domestically produced cotton goods while reducing reliance on imported textiles. The reduction in duty rates was welcomed by many UK manufacturers and helped boost their sales in the domestic market.

Import Quotas: The UK's Wool Import Quota

In addition to tariffs, import quotas are used to regulate the amount of woolen clothing that can be imported into the UK. The UK's wool import quota is currently set at 100,000 metric tons per year. This quota is allocated based on the total value of woolen clothing imported into the UK and is subject to periodic adjustments based on economic and political factors.

Import Quotas: The UK's Cotton Import Quota

Similarly, the UK's cotton import quota is another regulatory tool used to control the amount of cotton fabrics that can be imported into the UK. The current quota is set at 360,000 metric tons per year, which is also allocated based on the total value of cotton fabrics imported into the UK. Like with wool, the quota is subject to periodic adjustments based on economic and political factors.

Conclusion:

The UK's textile import taxes play a crucial role in shaping the domestic textile industry and maintaining fair trade practices. While tariffs and duty rates can create barriers to imported textiles, they also provide an incentive for domestic producers to improve their quality standards and sustainability practices. Additionally, import quotas help regulate the amount of imported textiles entering the UK market, ensuring that competition is fair and that domestic producers are not unfairly disadvantaged. As the global textile industry continues to evolve, it will be interesting to observe how the UK implements new policies and regulations to ensure continued growth and competitiveness in this vital sector.

大家好,今天我们来聊聊英国纺织品进口税率的话题,纺织品作为全球贸易的重要组成部分,其进口税率的变化对于进出口贸易企业来说具有重要意义,本篇文章将通过表格和案例分析的方式,详细介绍英国纺织品进口税率的背景、现状以及影响因素。

英国纺织品进口税率背景

英国作为全球纺织品的重要出口国,其纺织品进口税率受到多种因素的影响,英国政府会根据国际贸易形势和市场需求调整纺织品进口税率,英国的纺织品进口涉及到多个国家和地区,不同国家和地区的纺织品进口税率也会有所不同,英国的纺织品进口还受到政策法规、贸易协定等因素的影响。

英国纺织品进口税率现状

根据最新的数据,英国纺织品进口税率呈现出一定的特点,英国的纺织品进口税率相对较高,这主要是由于其出口市场广阔、贸易伙伴众多以及政策法规等因素的影响,英国的纺织品进口税率在不同国家和地区之间存在一定的差异,这主要是由于不同国家和地区的税收政策、贸易协定等因素的不同所致。

英国进口的纺织品主要包括羊毛、丝绸、棉布等,根据不同的纺织品类型和用途,英国的纺织品进口税率也有所不同,羊毛进口税率相对较高,而丝绸和棉布进口税率则相对较低,英国还与多个国家和地区签订了贸易协定,这些协定也会对英国的纺织品进口税率产生影响。

案例分析

以某纺织企业为例,该企业在英国进口纺织品时所面临的税率情况,该企业在进口羊毛制品时,由于市场需求较大,政府对其进口税率进行了适度调整,该企业在与多个国家和地区签订贸易协定后,其进口税率也受到了相应的优惠,这些案例说明,英国纺织品进口税率的调整和优惠政策对于进出口贸易企业具有重要的意义。

影响因素分析

影响英国纺织品进口税率的因素是多方面的,国际贸易形势和市场需求是影响纺织品进口税率的根本因素,随着全球贸易形势的不断变化,英国政府会根据市场需求调整纺织品进口税率,不同国家和地区的税收政策、贸易协定等因素也会对纺织品进口税率产生影响,政策法规也是影响纺织品进口税率的另一个重要因素,政府会根据政策法规的变化来调整纺织品进口税率。

英国纺织品进口税率受到多种因素的影响,国际贸易形势和市场需求是决定纺织品进口税率的根本因素,不同国家和地区的税收政策、贸易协定等因素也会对纺织品进口税率产生影响,政策法规的变化也会对纺织品进口税率产生重要影响,进出口贸易企业需要密切关注这些因素的变化,以便更好地掌握市场动态和国际贸易形势,从而制定出更加合理的进出口策略。

就是关于英国纺织品进口税率的详细介绍和分析,希望本文能够为大家提供有益的参考和帮助。

Articles related to the knowledge points of this article:

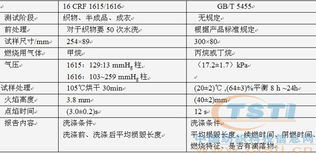

Testing Fabric Content for Fibers in Textile Industry

The Art of Textile Labels and Their Incredible Benefits for Customers